INSIGHT by Martha Oberndorfer

| Impact of COVID on voting at shareholder meetings underlines the importance of electronic voting and proxy voting services

Shareholders‘ Meetings without the presence of shareholders has become the norm in 2020. Many European Regulators imposed rules permitting meetings behind closed doors only or so-called virtual meetings, due to the pandemic situation.

How did this impact the execution of voting rights? Markets, which are used to proxy voters and electronic voting platforms, were less affected than the more traditional ones.

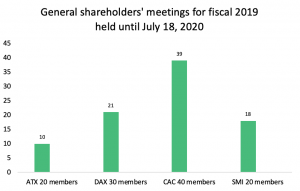

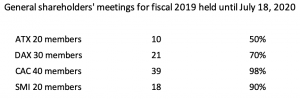

A comparison of major listed companies in France, Switzerland, Germany and Austria shows the differences across markets:

In France and Switzerland, more than 90% of the shareholders‘ meetings for fiscal 2019 were held, although in different formats than in the years before. 70% of the DAX members are done as well. Half of the Austrian companies, composing the ATX, will follow suit in the coming weeks or months.

Only a few companies, which held their meetings in February, enjoyed the physical presence of shareholders, e.g. Siemens, Infineon, and Novartis.

The meetings in „behind closed door format“ required shareholders to use a proxy voting provider, and to ask questions in writing well in advance. As a consequence, the lengths of the meetings declined significantly. Some companies closed the meetings within less than two hours.

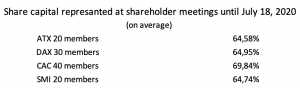

Interestingly, the number of shares represented at the meetings, did not change much compared to previous „normal“ years. Some companies even showed a higher percentage than last year.

A comparison of the percentage of share capital represented at shareholder meetings held until July 18, 2020 shows similar results for Austria, Germany, France and Switzerland:

As in previous years, the lowest rate of approval came in for issues related to executive compensation policy, to changes in the share capital, to the appointment of board members, and related to the appointment of the statutory auditors.

Overall, the executing of voting rights went very well, and the shareholder rights did not suffer too much. It is expected that the use of proxy voting services and of platforms for electronic voting will increase. This would also facilitate the implementation of new regulatory features relating to voting disclosures. The outlook on what to expect here will be discussed in the next issue of VOTING MATTERS.

| brief bio

Martha Oberndorfer has been involved in many areas of the international capital markets, work- ing in institutional fund management, asset management for private clients, M&A advisory, cor- porate treasury and sovereign debt management. During the past 15 years, she served the Austrian taxpayers in various functions – as head of BPK, the government owned pension fund, as head of OEBFA, the sovereign debt management office, and as head of OEBIB, the state entity where the equity participations in strategically important companies are held. Along with navigating the debt management office during the crisis period, she supported the set-up of EFSF and ESM with technical experience and contributed to working groups at OECD and IMF. She holds various supervisory and advisory board positions, including the Austrian Shareholder Association, and is a registered verifier for ecolabels for financial products.

Martha has a deep interest for ethics and financial market integrity and wrote her PHD thesis on business ethics. She holds a PHD in social and economic sciences from University of Linz, Austria, an MBA from University of Toronto, Canada, and she is a Chartered Financial Analyst.

Within SMSG, Martha Oberndorfer represents the stakeholder group consumers.

| All opinions expressed are those of the author. investESG.eu is an independent and neutral platform dedicated to generating debate around ESG investing topics.