INSIGHT by the The Natural Capital Finance Alliance (NCFA)

| The world’s first comprehensive tool linking environmental change with its consequences for the economy has been developed by the Natural Capital Finance Alliance (NCFA). The web-based tool, called ENCORE (Exploring Natural Capital Opportunities, Risks and Exposure), helps global banks, investors and insurance firms assess the risks that environmental degradation, such as the pollution of oceans or destruction of forests, causes for financial institutions.

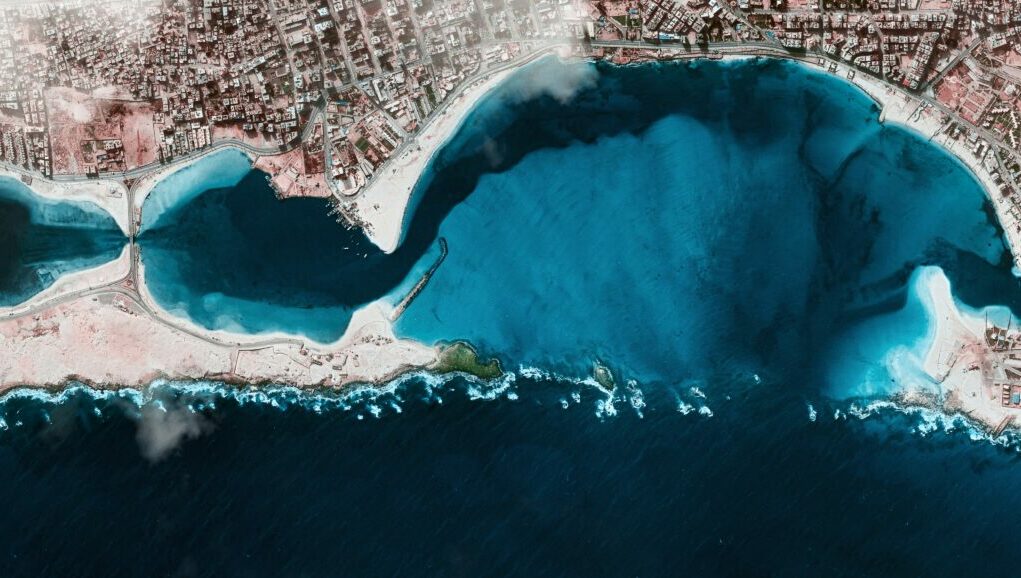

The tool enables users to visualise how the economy depends on nature and how environmental change creates risks for businesses. Starting from a business sector, ecosystem service, or natural capital asset, ENCORE can be used to start exploring natural capital risks. These risks can be explored further to understand location-specific risks with maps of natural capital assets and drivers of environmental change.

ENCORE’s comprehensive database covers 167 economic sectors and 21 ‘ecosystem services’, i.e. the benefits that nature provides that enable or facilitate business production. The tool is managed by the NCFA, a collaboration between the UN Environment Finance Initiative (UNEP FI) and Global Canopy, in partnership with UN Environment World Conservation Monitoring Centre.

The ENCORE tool is freely-accessible in English here and in Spanish here. This project has been made possible with funding from the Swiss State Secretariat for Economic Affairs (SECO) and the MAVA foundation. Work to support the development of ENCORE has also been undertaken by PricewaterhouseCoopers LLC and the Norwegian University of Science and Technology (NTNU).

| Reports to assist financial institutions as they apply the tool to their portfolios:

Find out more about the tool and its applications in a report which outlines the main findings of the first phase of the project to develop the tool and provides a practical guide for financial institutions to help them understand, assess, and integrate natural capital risk in their operations. Download the report, ‘Exploring Natural Capital Opportunities, Risks and Exposure: A practical guide for financial institutions’ here.

A second report, ‘Integrating Natural Capital in Risk Assessments’ is a step-by-step guide to help financial institutions conduct a rapid natural capital risk assessment. The guide has already been piloted by five banks, and complements the recently launched ENCORE tool (Exploring Natural Capital Opportunities, Risks and Exposure), which enables financial institutions to understand and assess their exposure to natural capital risks. The guide helps banks to better understand how environmental change such as ocean pollution or deforestation may affect their portfolios. Produced by the Natural Capital Finance Alliance (NCFA) in collaboration with PwC, the guide is the second phase of the project. Download the report here.

Find out more about the ENCORE tool here on the NCFA website.

What were the experiences of one of UNEP FI’s member banks, FirstRand, when they applied the ENCORE tool to their portfolios? Read here.

| about

The Natural Capital Finance Alliance (NCFA) is a finance sector-led initiative, providing expertise, information and tools on material aspects of natural capital for financial institutions. It works to support these institutions in integrating natural capital considerations into their risk management processes and products as well as helping them to discover new opportunities. The NCFA secretariat is run jointly by UNEP FI and Global Canopy.