INSIGHT by Julia Anna Bingler (ETH Zurich) and Chiara Colesanti Senni (CEP) | Updated on September 24, 2020

It is time for joint assessment principles, standardised disclosure templates, and harmonized tool documentation.

| Navigating your way through climate risk analysis is challenging. Yet, it is indispensable. It is challenging due to the multitude of tools and approaches, which continue to pop up in academia, by financial service providers, and NGOs. It is also challenging since tools are often not well reported. And it is challenging because understanding the tools requires knowledge of multiple disciplines: The complexity of financial climate risks means to translate insights from climate science and climate modelling into micro-and macroeconomic impacts, and eventually into financially decision-relevant indicators. These challenges need to be overcome. The good news is: They can be overcome.

Taking action is urgent: Climate-related financial risks are of increasing concern to investors and financial supervision. They might even have the potential to trigger the next systemic financial crisis, as recently stated by the Bank for International Settlements. Understanding the so-called Green Swan risks should be a key priority in financial decision-making and supervision.

In practice, when trying to understand and assess these risks, most actors use one of the climate risk analysis tools available. This means that these tools have considerable influence on firms’ climate risk assessment and management. Until today, there is no commonly agreed standard on how to ensure high quality, comparable, and meaningful results. Regulators have insofar been hesitant in regulating this new field. On the one hand, thiscontributed to the lack of standardization, which also implies higher information and search costs for firms. On the other hand, this fosters innovation.

It is indeed not useful to prescribe specific methodologies and approaches. Climate risk analysis is an inherently uncertain endeavour, and the multiple approaches and methodologies simply account for this fact. However, to ensure that climate risk disclosures are of high quality, comparable and decision-relevant for investors and financial supervision, and to enable properly informed internal climate risk management, climate risk analysis needs common standards. This is one of the main findings of our recently published working paper (Bingler, Colesanti Senni 2020: Taming the Green Swan: How to improve climate-related financial risk assessments. CER-ETH Economics Working Paper Series 20/340), where we analyse 16 climate transition risk tools by aid of descriptive and criteria-based analysis.

Descriptive analysis: The big picture

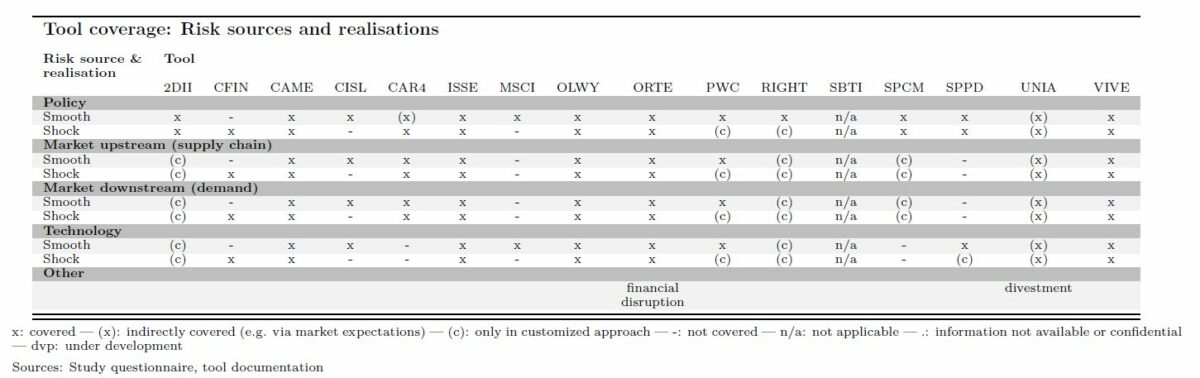

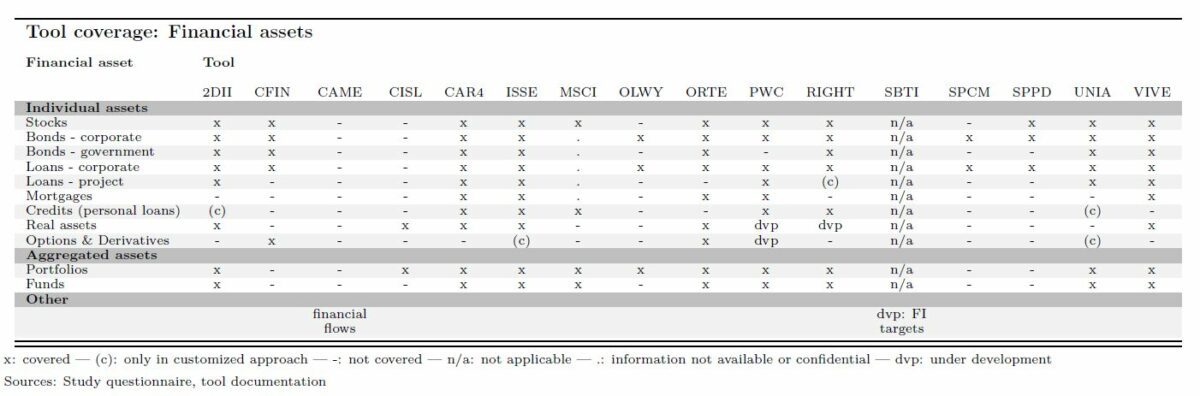

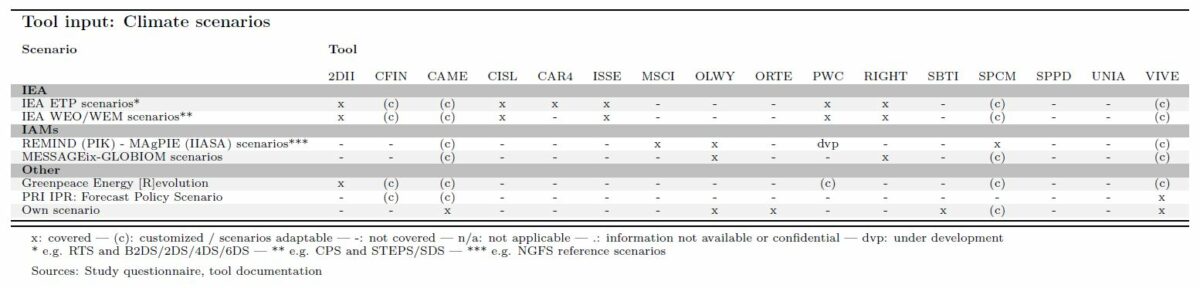

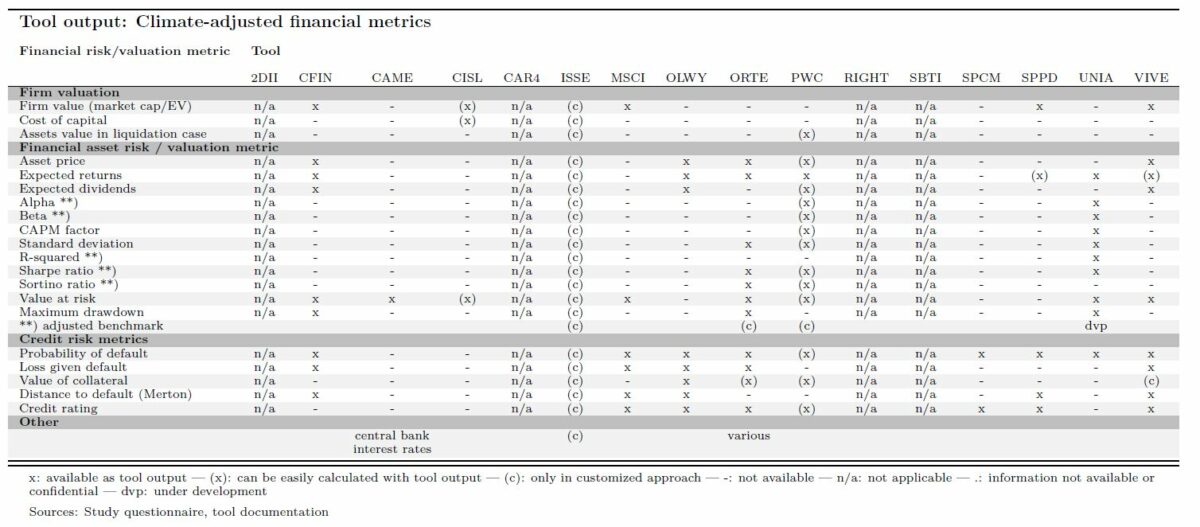

In the descriptive analysis, we look at the tool’s coverage of risk sources and risk realisations, their coverage of asset classes, the tool input (i.e. climate scenarios) and the tool output (i.e. the climate-adjusted financial risk metrics).

| Various transition risk analyses are feasible, yet risk interactions are usually not covered

We focus on the tools’ coverage of various transition risk sources, namely policy risks, technology risks, market upstream risks (i.e. supply chain) and market downstream risks (i.e. demand). The risks materialise either smoothly (ordered transition) or as a shock (disruptive/immediate transition).We find that policy risk is best covered, and that there is always at least one tool available to analyse one of the specific risk sources and realisations. However, few tools cover all analysed risk sources and the interaction among them – despite the fact that the risk sources could mutually reinforce each other. Tool providers should therefore further develop their tools further in this area.

| Project loans, mortgages and real assets need better coverage

With regards to the coverage of financial assets, we find that, in our tool sample, publicly traded asset classes are significantly better covered than other asset classes. This is thanks to much more standardised data reporting and data availability. On the opposite, project loans, mortgages and real assets are not well covered across the sample, yet – despite the fact that many transition policies have an impact on the payoff structure of individual projects, or target specifically the buildings sector. A broad coverage of various assets within the same methodological framework would enhance comparability of the risk analysis of various asset classes within the same portfolio.

| Tool users should aim for scenario-neutral tools and use the NGFS reference scenarios

Most tools use either the scenarios of various IAMs (Integrated Assessment Models), or the scenarios provided by the WEO (World Energy Outlook) and the ETP (Energy Technology Perspectives) models of the IEA. The IEA models provide relatively granular data, yet come at transparency shortcomings and systematically underestimated the growth of renewable energy sources in the past. The IAMs are in turn criticized with regards to their modelling assumptions, and their generalising approach. However, there are ongoing efforts in the climate modelling community to overcome these issues. The NGFS reference scenarios are an important step into the right direction to ensure higher comparability of results of the various tools. In addition, we find that in any case, scenario neutrality of tools is an important feature. This allows tool providers to keep their tools up to date with the ongoing developments in climate transition risk modelling, and to better account for users’ own assumptions.

| Financially relevant metrics are in most cases well covered

The tools in our sample were selected based on their ability to provide financially relevant metrics. The metrics considered determine for example credit risk, the value of a specific financial asset, or the value of the underlying issuer. We find that most tools provide climate-adjusted financial asset metrics (value at risk and expected returns) and credit risk metrics (probability of default and credit rating). Challenges related to calculating a forward-looking climate-adjusted alpha, beta or Sharpe ratio need to be acknowledged. Yet, we also argue that further tool developments should try to find a way to cover these important financial metrics, too.

Criteria-based analysis: Inside the box

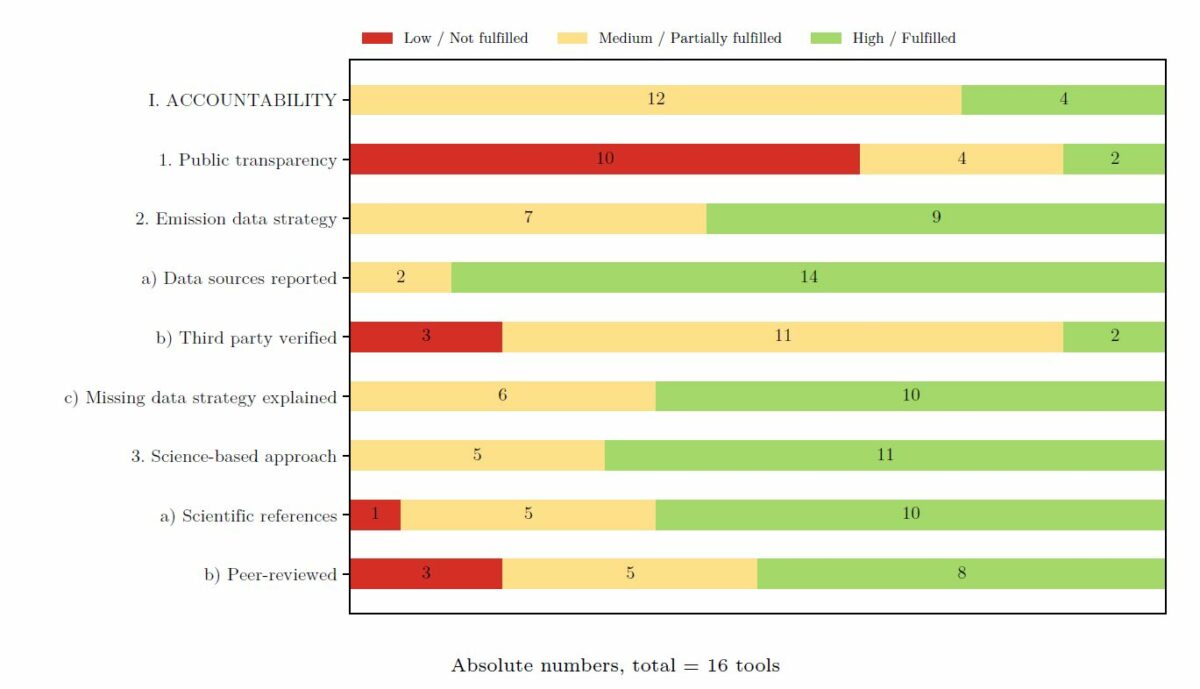

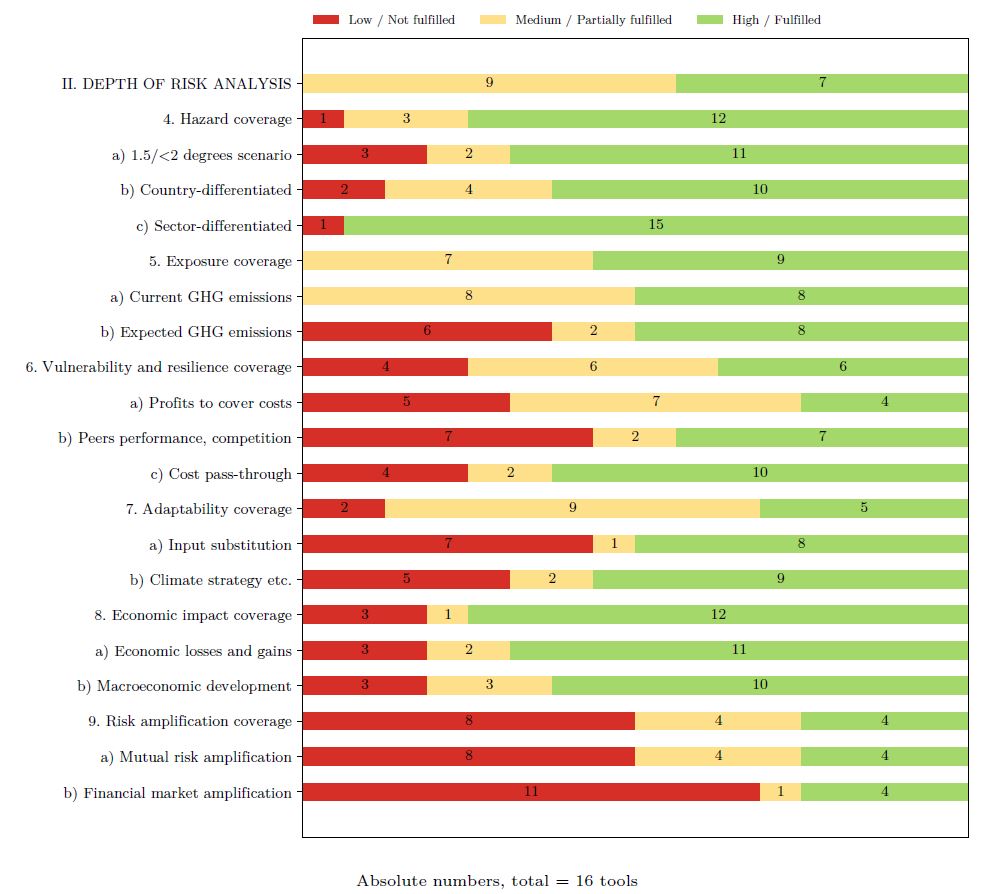

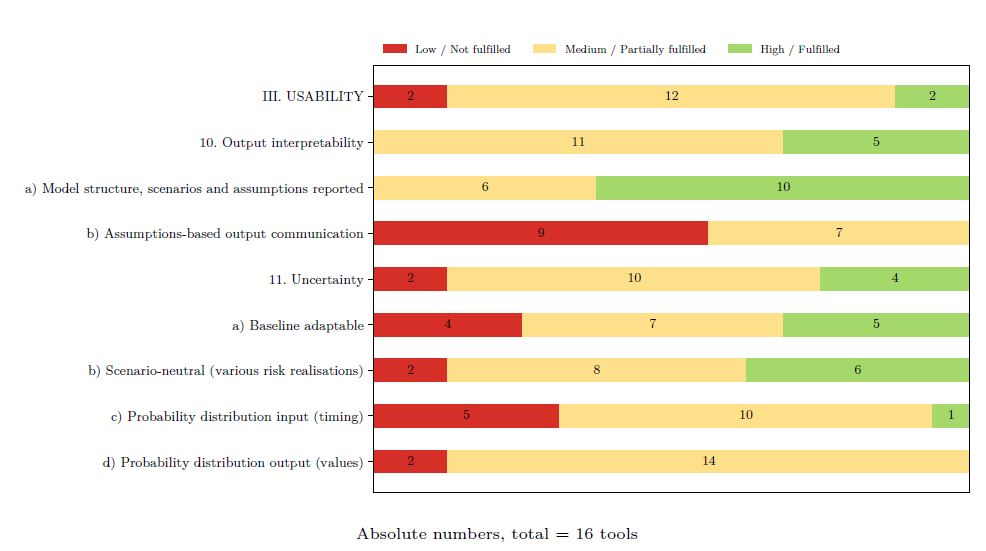

In order to assess quality, comparability and decision-relevance of the tools, we analyse three dimensions: accountability, depth of risk analysis, and usability, by aid of 11 assessment criteria. The set of criteria can also be used to ease the tool selection process for potential tool users. We show the results for each dimension in the figures below. The results are produced by assigning a score of 0 (low/ not fulfilled), 0.5 (medium / partially fulfilled) and 1 (high/ fulfilled) to each element of each of the 11 criteria (see our paper for more details about the method).

| Most tools lack accountability

Acountability ensures that the data input, the tool setup and the output are verifiable and can be critically evaluated by users and external experts in the field. It covers three criteria: Public transparency, emission data strategy, and science-based approach. We find that accountability is an issue for most tools, due to the combination of low transparency of the tools’ specific setup, with the lack of peer-reviewed publications of the tool approaches. In combination with our findings from the usability analysis (see below), we find that standardised publicly available tool documentation templates would be an important step to improve accountability.

| Depth of risk analysis varies considerably

With regards to the depth of risk analysis, tool approaches vary considerably. We argue that – based on current risk understandings in climate science – tool users need to be aware that risk can be decomposed in the following elements: hazard, exposure, vulnerability and resilience, adaptability, and impact. In addition, we look at the consideration of risk amplification mechanisms. Most tools in the sample cover hazard and exposure – yet other risk aspects are only partially covered. Tool users need to be aware of the significant variation in the depth of risk analysis, since this has important implications on the correct interpretation of the tool output. We also find that most tools in our sample are not able to assess mutual risk amplification and financial amplification mechanisms. Yet, these would be two very important aspects for risk assessments of financial institutions, given their relatively high exposure to other financial actors, and for micro- and macroprudential financial supervision.

| Usability requires standardised reporting and probability distribution-based output

Usability relates to interpretability of results, and how tools reflect the climate analysis-inherent uncertainty. We find that it would be highly beneficial if supervisory authorities asked for standardised publicly available tool documentation, to ease the understanding of assumptions and key characteristics of scenarios and the modelling steps. Furthermore, we find that uncertainty would be better reflected in the tool output if all tools generated a probability distribution of various output values based on different input assumptions, instead of a point estimate. In addition, providers should be asked to report the tool output in direct link with the key assumptions in a standardised sentence or template. Furthermore, scenario neutrality is a desirable feature of tools. As argued above, scenario-neutrality ensures that tool users do not need to rely on a given (set of) specifications and scenarios, and that analyses could always reflect the latest state of the art of climate science and climate modelling approaches.

Act now: How to improve quality, comparability and decision-relevance

| Our analysis shows: There is still room to improve the tools and climate risk analyses in general. Yet, we also acknowledge that most likely, there won’t be the one and only tool, fulfilling all criteria, since modelling choices always imply trade-offs between complexity and feasibility or interpretability. This is why we conclude that principles on tool usage, climate risk disclosure templates, tool documentation requirements, and tool output reporting frameworks should be the top priority to improve climate risk analyses. This requires joint action from tool users, tool providers, and supervisory authorities.

| Tool usage – Agree on joint climate risk assessment principles

Tool users, providers and supervisory authorities would ideally convene a task force to agree on climate risk assessment principles. For example, in order to reduce the impact of a single tools’ modelling setup, actors could agree that climate risk analyses should be done using at least two different tools per use case, and that probability distributions of various risk estimates are reported alongside potential point estimates. To inform such decisions, we will conduct further research on the degree of divergence or convergence of various tools for the same firms and assets. Furthermore, users are recommended to agree to employ forward-looking analyses (be aware of market-based approaches in this context), ask tool providers to use third party verified data, and conduct analyses with most up to date publicly available transition scenarios, e.g. the recently launched NGFS reference scenarios, for better quality and comparability of results. Actors might also agree to conduct analyses at least once a year, and report past results in annual disclosures, to show developments over time.

| Risk disclosures – Develop human interpretable and machine-readable TCFD metrics and targets templates

Tool user are at the same time data provider for further climate risk analyses by other financial institutions and supervisory authorities. If risk analysis results were reported alongside standardised TCFD-related metrics and targets templates, where the tool(s) employed, key modelling choices, scenario assumptions, depth of risk analysis, and corresponding results are clearly indicated, the interpretability and comparability of data would be significantly enhanced. Ideally, these templates would be machine-readable, to ease data access and speed-up market uptake. Supervisory authorities might want to develop such templates together with financial institutions, real economy firms and tool providers, to ensure that corporate disclosures and financial reporting requirements are streamlined and useful for relevant actors.

| Tool setup and output reporting – Ask for harmonized documentation

To date, most tools are black boxes. Transparency is low, especially when it comes to publicly available information of the tools’ specific setup. This not only hinders critical reviews of the tools, it also makes the correct interpretation of the tool outputs extremely challenging for third parties. Regulators should consider to establish joint tool setup documentation frameworks, where the tools’ structure,key assumptions and driving factors are well documented and can be critically reviewed. Furthermore, a standardised way on how to communicate tool output, e.g. in a standardised sentence, referring to the key assumptions, would be an important contribution to enhance the correct interpretation of the tools’ output.

| Most important: Get started

These relatively small steps for financial supervisors, tool users and tool provider would enable giant leaps towards improved quality, comparability and decision-relevance of the tools. First movers could be the NGFS together with the IIF, UNEP-FI, TCFD working groups, and initiatives like the Net-Zero Asset Owner Alliance. In parallel, tool provider, researcher, regulators, real economy firms and financial market actors will strongly benefit if they join forces to improve data availability (especially for capex, geospatial and asset-level data), develop scenarios at the granularity required for investment decisions, and improve modelling to cover all most important risk sources and their mutual reinforcement dynamics.

Still, using the tools for climate risk analyses and disclosing the results is beneficial, even if tools are not perfect. Providers would learn from users’ needs and improve tools further. Users start to get their head around the analysis of climate-related risks, and how they want to approach this issue in the future. Risk disclosures allow constructive dialogues about data formats and interpretability between disclosing parties and data users. All of this would significantly improve the quality, comparability and decision-relevance of climate risk analysis and disclosures.

| brief bio

Chiara Colesanti Senni is a fellow with the Council on Economic Policies in Zurich (CEP) where she focuses on the integration of environmental risks in monetary policy. Prior to that she has been doing her PhD in Resource Economics at ETH Zurich. During this time she focused on the transition to a low-carbon economy, including the possibility for central banks to adopt emission-based interest rates in their lending facilities.

Julia Anna Bingler is a Doctoral Researcher at the Center of Economic Research at ETH Zurich. Her research focuses on climate transition risk analyses and TCFD-related disclosures. Prior to joining ETH, she worked for various academic institutions and think tanks on sustainable finance regulatory approaches and market-based climate policy. Besides her research, Julia Anna Bingler monitors national and international climate policy processes and participated in various UNFCCC climate conferences as advisor and observer on finance-related topics.

| about

ETH Zurich in Switzerland has been founded in 1855 as Swiss center of innovation and knowledge in science and technology. It regularly ranks as one of the world’s top universities in international league tables. The Center of Economic Research at ETH Zurich (CER-ETH) conducts high-quality scientific research in economics. It specializes in public economics, energy and resource economics, macroeconomics, international economics, innovation and risk analysis, and other fields of micro- and macroeconomics.

The Council on Economic Policies (CEP) is a non-profit economic policy think tank for sustainability, focused on fiscal, monetary and trade policy. Based in Zurich, Switzerland, CEP’s goal is to leverage existing analysis, fill research gaps and translate findings into policy recommendations on a national and international scale. CEP also collaborates closely with third parties and supports the launch of new organizations to build alliances and increase impact.

| All opinions expressed are those of the author. investESG.eu is an independent and neutral platform dedicated to generating debate around ESG investing topics.