INSIGHT by Climate Action 100+

Climate Action 100+, a global initiative involving over 500 signatories responsible for more than USD 47 trillion assets under management, has expanded the focus list of companies it is engaging with to deliver Paris Agreement-aligned emissions cuts, implement strong climate governance frameworks and improve climate-related disclosures.

| The changes to the Climate Action 100+ focus list follows a periodic review by the initiative to ensure the companies engaged remain relevant to confronting the global climate change crisis.

Overall, nine companies have been added to the list, while two have been removed. The net rise in companies engaged globally through Climate Action 100+ takes the total to 167.

| Specific company additions to the focus list and the rationale include:

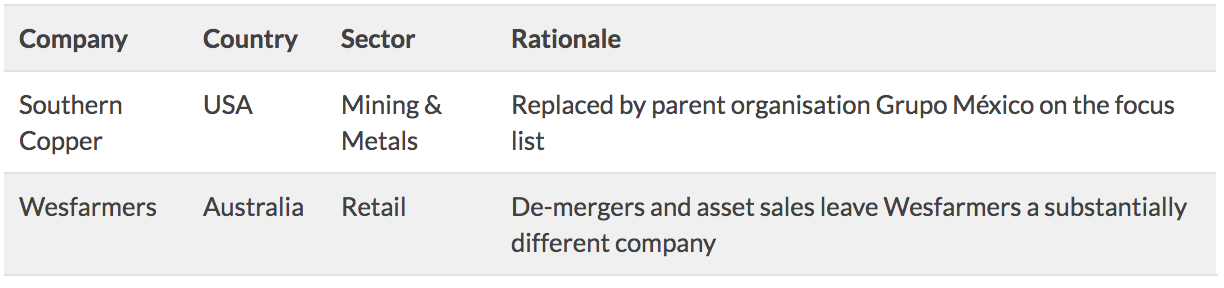

| Companies removed from the focus list and the rationale include:

The recent additions are based on the same criteria for earlier inclusions on the focus list: that a company be a globally significant emitter of greenhouse gases and/or they can play a strategically important role in the transition to net-zero emissions by 2050 or before.

The additional companies are in sectors already being engaged through Climate Action 100+ so as not to overly stretch the focus of the initiative in its first five-year period and to build on practice that has been developed to date.

All additions to the focus list have had lead investors assigned to them to spearhead engagement. These lead investors will be assisted by a team of collaborating investors.

Given the early stages of these engagements, the nine companies added to the focus list will not be subject to the initial round of assessment under the Climate Action 100+ Net-Zero Company Benchmark, to be released next year, but will be included in future assessments.

| Climate Action 100+ Chair and Adviser to Ircantec President Jean-Pierre Costes, Groupe Caisse des dépôts, Laetitia Tankwe, said: “Climate Action 100+ is an investor-driven global collaboration that in a short time has accelerated the capacity for engagement among hundreds of investors, with impressive results. These additions present a strategic opportunity to further curb emissions and enable the transition to a net-zero future by 2050. We welcome the opportunity to support signatories in these new engagements. Our teams are working with focus companies to identify a pathway to, and design a just transition for, a sustainable future.”

A full list of Climate Action 100+ focus companies can be found here.

| about

Climate Action 100+ is an investor initiative to ensure the world’s largest corporate greenhouse gas emitters take necessary action on climate change. Over 500 investors, responsible for more than USD47 trillion assets under management, are engaging companies on improving governance, curbing emissions and strengthening climate-related financial disclosures. The companies include 100 ‘systemically important emitters’, accounting for two-thirds of annual global industrial emissions, alongside more than 60 others with significant opportunity to drive the clean energy transition.

Launched in December 2017, Climate Action 100+ is coordinated by five partner organisations: Asia Investor Group on Climate Change (AIGCC); Ceres (Ceres); Investor Group on Climate Change (IGCC); Institutional Investors Group on Climate Change (IIGCC) and Principles for Responsible Investment (PRI). These organisations, along with five investor representatives from AustralianSuper, California Public Employees’ Retirement System (CalPERS), HSBC Global Asset Management, Ircantec and Sumitomo Mitsui Trust Asset Management, form the global Steering Committee for the initiative. Follow Climate Action 100+ on Twitter: @ActOnClimate100.

| All opinions expressed are those of the author. investESG.eu is an independent and neutral platform dedicated to generating debate around ESG investing topics.