INSIGHT by Douglas Broom, The World Economic Forum, Senior Writer

This article is part of the and was first published by The World Economic Forum.

〉Carbon credits allow companies to compensate for their greenhouse gas emissions.

〉Now a new blueprint offers a route to create a universally comparable standard for much carbon they save.

〉And lays down the ground rules for transparent carbon credit trading.

〉The plan will boost funding to developing countries where many projects are located.

| To limit global warming to 1.5°C, in line with the Paris Agreement, we need to cut current greenhouse-gas-emission levels in half by 2030 and reduce them to “net zero” by 2050.

But what about activities that can’t be made carbon-free? One answer is carbon credits.

By paying someone else to either reduce their emissions or capture their carbon, companies can compensate for their environmental footprint and even, in the most ambitious cases, use carbon credits to get to carbon-neutral status.

| So what are carbon credits and how do they work?

The underlying theory is simple. If one party can’t stop emitting CO2, it can ask another to emit less so that, even as the first carries on producing CO2, the total amount of carbon in the atmosphere is reduced.

There are three basic types of carbon credit:

〉Those from reduced emissions (typically energy efficiency measures)

〉Removed emissions (carbon capture and planting forests)

〉And avoided emissions (for example refraining from cutting down rainforests).

Companies can meet their climate targets by purchasing credits for their current emissions although some, like Microsoft, have committed to going further and using credits to compensate for all their historic emissions – in Microsoft’s case, going back 45 years.

Other organizations have cut the bulk of their emissions and used credits to compensate for those they cannot avoid. Credits are generally traded in units of 1 tonne of CO2, and it’s estimated that credits worth 2 billion tonnes of CO2 will be needed to get to the 2030 target.

| Building transparency

Until now, there has been no standardized way to trade carbon credits and no way to verify the compensating activity behind them. Environmental groups say the process has been “fraught with scandals”, accusing some countries of having increased emissions just to get paid for cutting them.

These and other allegations prompted the Financial Times to declare: “Carbon offsetting is shaping up to be the greatest mis-selling scandal since the Dominican friar Johann Tetzel sold pardons to redeem the dead.”

But a new report from an international task force led by UN Special Envoy for Climate Action and Finance Mark Carney and chaired by Bill Winters, CEO of Standard Chartered Bank, has devised a draft blueprint for creating large-scale transparent carbon credit trading markets based on independent verification that the claimed reductions in CO2 are valid. The World Economic Forum is observing the effort.

“While an important tool, offsetting cannot be considered as a substitute for direct emissions reductions by corporates,” they say. “It’s important that any offsetting that forms part of climate commitments is done through high integrity projects.”

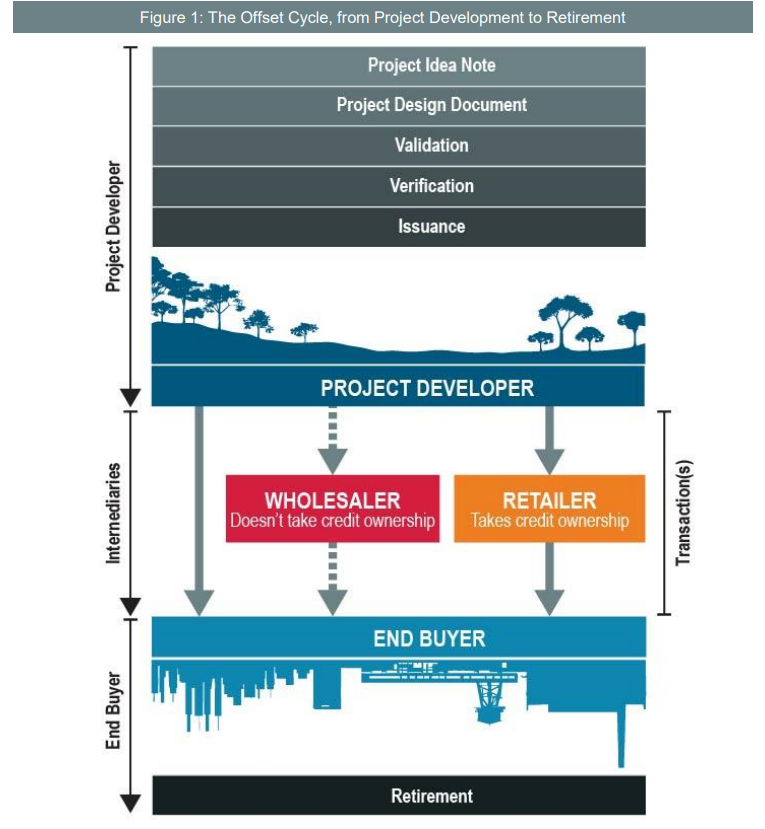

To be eligible to be traded, the report says credits must be based on projects that have been independently validated and monitored throughout their lifecycle. Data should be held securely to avoid tampering and it proposes using blockchain technology to create an unalterable record.

The report also says verifiable carbon credit trading will help developing countries access global funding “as activities and projects in these countries can provide a cost-effective source of these carbon emission reductions.”

| Carbon credits in action

The Katingan Project in Indonesia is one such scheme. In 2007, two environmental entrepreneurs began persuading local farmers to abstain from clearing virgin forest in return for selling carbon credits from their land.

Today, it’s the world’s largest forest-based avoided-emissions project. The project says it has prevented the release of more than 37 million tonnes of CO2 and saved 200,000 hectares of rare peat swamp forest, which is home to five critically endangered species including the Borneo orangutan.

Europe’s most energy-intensive industries, including airlines operating flights between EU member countries, can already use carbon credits to meet mandatory limits on their emissions under the EU Emissions Trading Scheme (EU ETS) which has been operating since 2005.

In Colombia, companies can pay their carbon taxes using carbon credits, and in May 2020, the US Treasury issued new rules requiring companies claiming carbon-capture tax credits to verify the amount of carbon captured by the schemes they invest in.

| The views expressed in this article are those of the author alone and not the World Economic Forum.

| All opinions expressed are those of the author. investESG.eu is an independent and neutral platform dedicated to generating debate around ESG investing topics.