INSIGHT by

Karim Tadjeddine, Partner, McKinsey

Ruchi Sharma, Associate Partner, McKinsey

Zdravko Mladenov, Partner, McKinsey

Jonathan Dimson, Senior Partner, McKinsey

This article was first published by the World Economic Forum in collaboration with McKinsey and Company, and on McKinsey.com.

〉New research by McKinsey show’s the devastating affect coronavirus is having on Europe’s small and medium-size enterprises (SMEs).

〉SMEs employ more than two-thirds of Europe’s workforce and contribute substantially to Europe’s economy.

〉But due to the pandemic, one fifth of businesses now expect to default on loans and lay off staff.

〉If revenues were to remain steady, 55% of SMEs could shut down by September 2021, a figure that rises to 77% if revenues worsen.

| Small and medium-size enterprises (SMEs) have been the lifeblood of the European economy, accounting for more than two-thirds of the workforce and more than half of the economic value added.1 Yet the results of a recent McKinsey survey, conducted in August, 2020, of more than 2,200 SMEs in five European countries—France, Germany, Italy, Spain and the United Kingdom—indicate just how hard their prosperity has been hit by the COVID-19 crisis.

Some 70 percent said their revenues had declined as a result of the pandemic, with severe knock-on effects. One in five was concerned they might default on loans and have to lay off employees, while 28 percent feared they would have to cancel growth projects. In aggregate, more than half felt their businesses may not survive longer than 12 months—despite the fact that 20 percent of those surveyed had already taken advantage of the various forms of government assistance aimed at easing their financial distress, such as tax breaks or payments to furlough staff.

Here are more details of the survey.

| Lower revenues and a bleak outlook

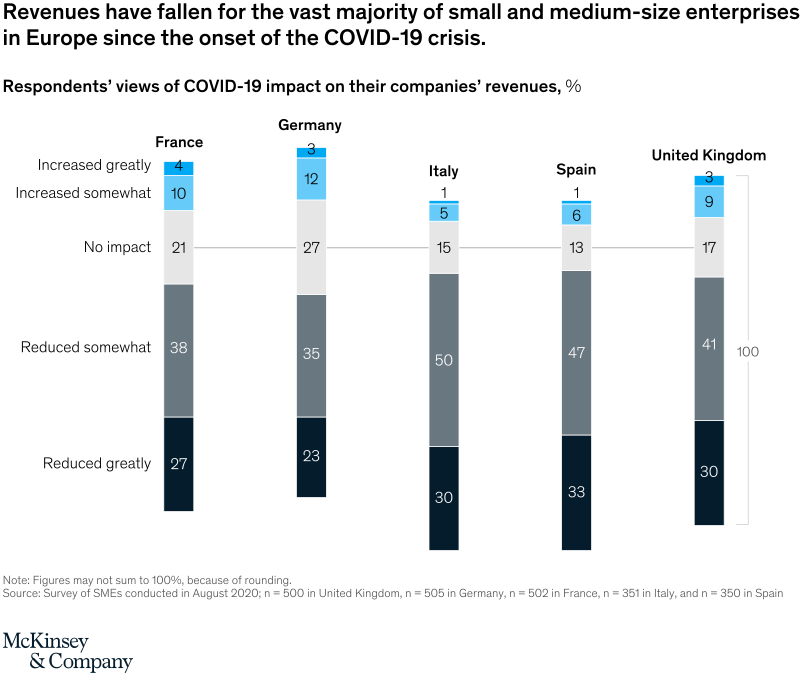

The vast majority of SMEs surveyed have seen revenues fall; although, as one might expect, the picture differs by country, reflecting the severity of measures to control the virus and their impact on business activity. Italian and Spanish SMEs have been hardest hit: 30 percent and 33 percent, respectively, said their revenues had been greatly reduced. That compares with 23 percent in Germany (Exhibit 1).

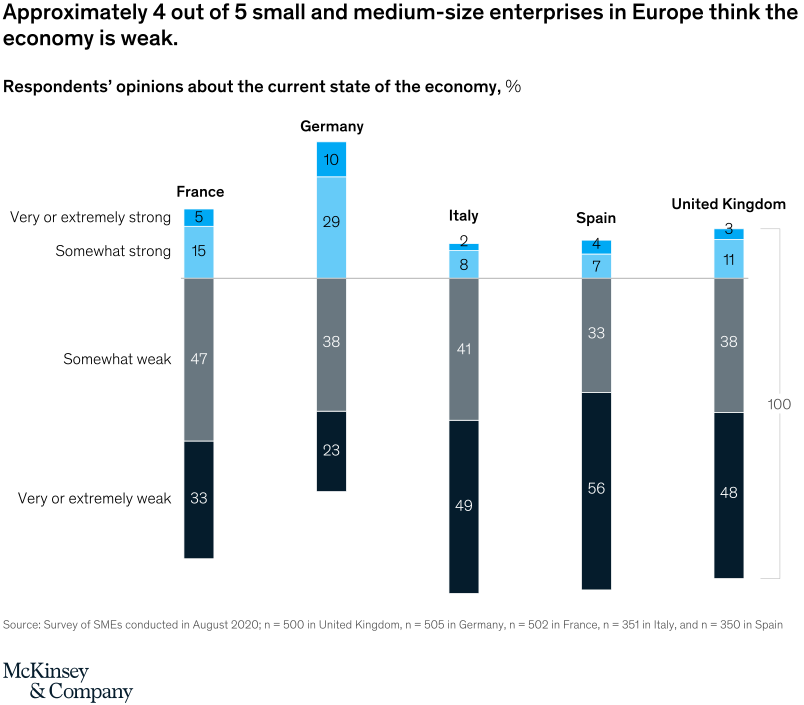

Few SMEs appear optimistic about the prospects for improvement anytime soon given their views on the state of the economy. Overall, 80 percent weighed the economy as somewhat weak to extremely weak. But here, too, we see material country variations. In Germany, where the economy is forecast to contract less than elsewhere, 39 percent of SMEs weighed the economy as somewhat strong to extremely strong. By comparison, in Italy the figure was just 10 percent (Exhibit 2).

© McKinsey & Company

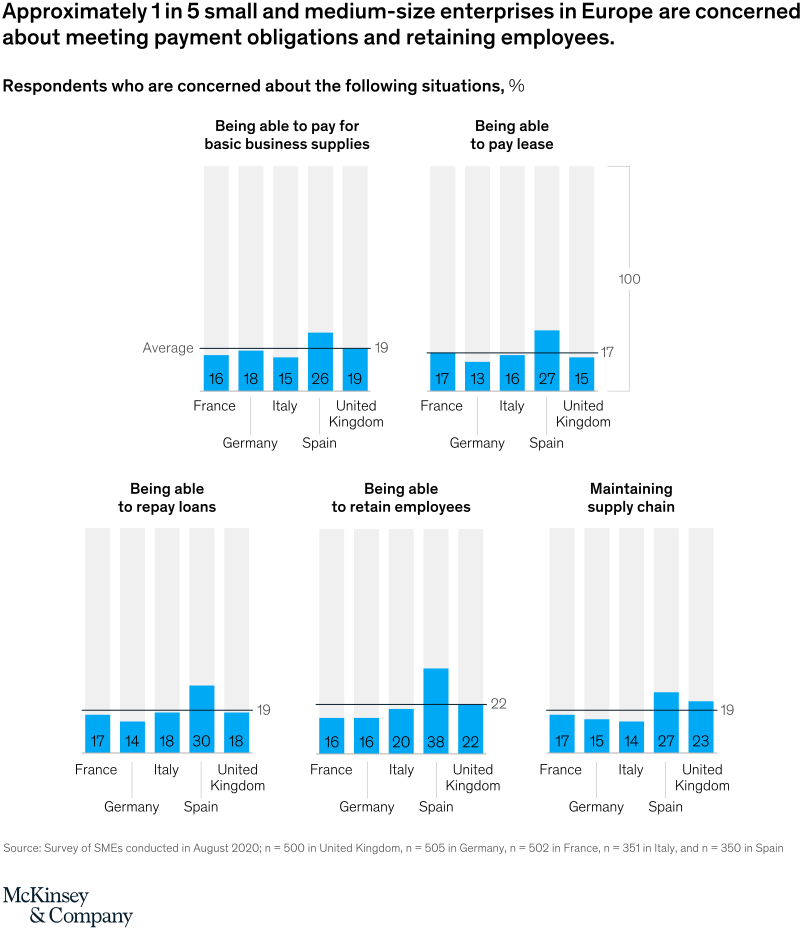

There were also differences across countries on the extent to which the pandemic is impacting SME financial positions, challenging the ability to retain staff or pay loans and leases. For example, Spanish SMEs are consistently among the more pessimistic (Exhibit 3). Thirty percent of Spanish SMEs were concerned about being able to pay back loans, compared with 14 percent in Germany. Similarly, 38 percent of Spanish SMEs feared they might not be able to retain their employees—a figure that drops to only 16 percent in Germany and France. Noteworthy, too, is that on average across Europe, 14 percent of SMEs said they were struggling to staff their operations due in part to so many people being on sick leave or having to quarantine.

© McKinsey&Company

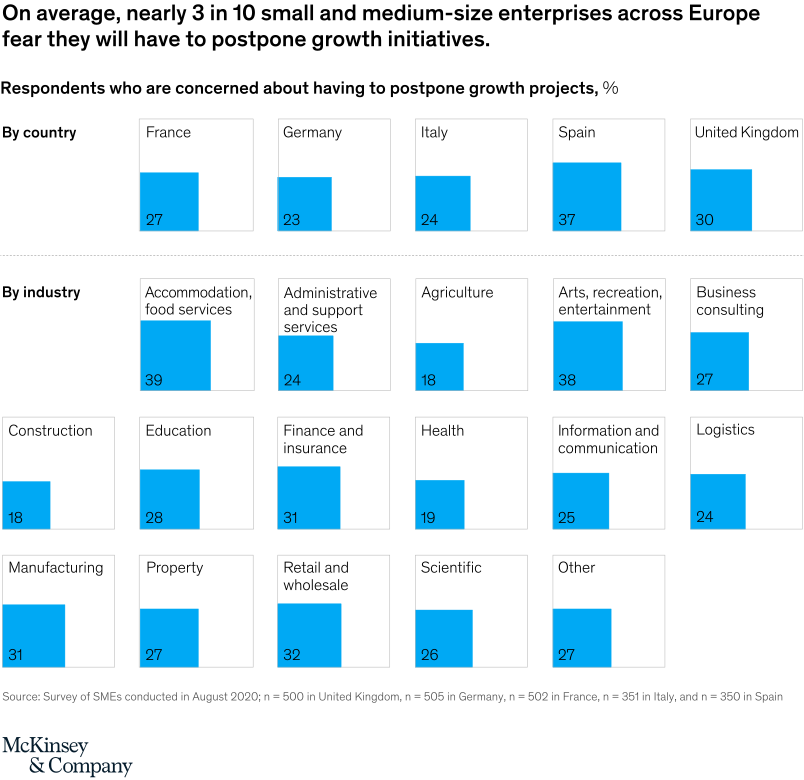

Growth projects are also at risk. Overall, 28 percent of those surveyed said they were concerned they might have to postpone them, though the figure rose to 37 percent among Spanish SMEs and 30 percent among UK ones. Hardest hit will be the accommodation, food services, arts, entertainment, and recreation sectors, according to the survey. Nearly 40 percent of SMEs in these sectors said projects might have to be put on hold, compared with 20 percent of SMEs in sectors at the other end of the scale, namely health, agriculture, and construction (Exhibit 4).

| SME survival

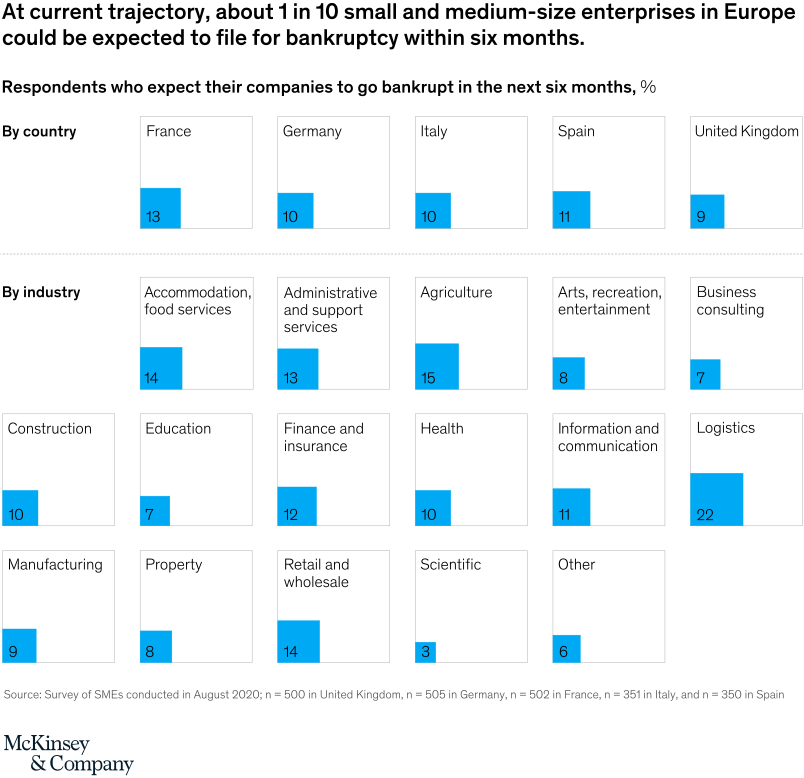

Exhibit 5 shows how all this influences SMEs’ concerns about their survival by country, sector, and company size. Overall, 11 percent said they expected to file for bankruptcy within six months. Concern was highest among the largest companies (those with 50 to 249 employees) in Italy and France, where 21 percent—almost double the average—expected to file for bankruptcy in the next six months. By comparison, sole traders in Spain were most concerned, with 19 percent expecting imminent bankruptcy compared to only 6 percent of companies with 50 to 249 employees. Among industrial sectors, logistics had by far the highest number of expected bankruptcies (22 percent). Agriculture, accommodation, food services, retail, and wholesale followed, though at a considerably lower rate (13–15 percent).

© McKinsey & Company

| Government support

The number of SMEs that ultimately fail to survive will depend in large measure on the uncertain future course of the pandemic and the toll it takes on company revenues. We, therefore, asked survey participants to consider how their businesses would fare under three different scenarios, where revenue held steady, decreased, or increased. They reported the following:

〉If revenues were to remain steady, 55 percent of SMEs worry they may shut down by September 2021.

〉If the situation were to worsen and revenues decreased by a further 10 to 30 percent, 77 percent of SMEs said they may be out of business by September 2021.

〉If the situation were to improve and revenues increased by 10 to 30 percent, 39 percent of SMEs said they may nevertheless be out of business by September 2021.

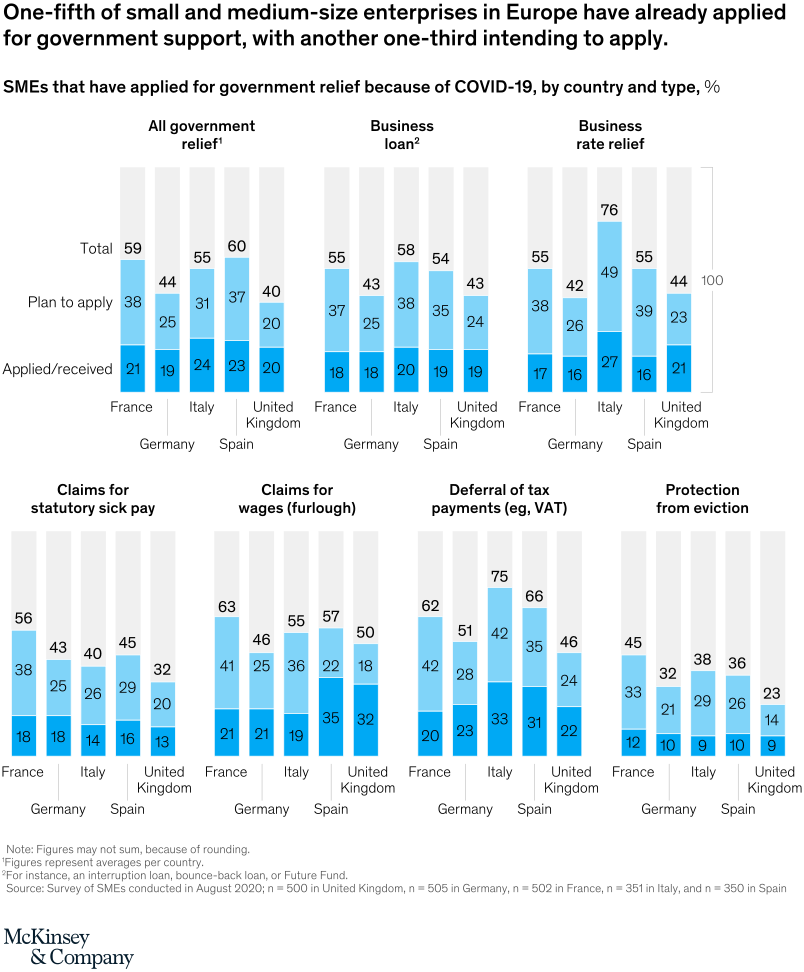

Those scenarios could be influenced by the extent to which SMEs continue to receive government support. Governments across the European Union have previously introduced measures, largely aimed at giving SMEs liquidity to withstand the immediate crisis, but now the Organisation for Economic Co-operation and Development (OECD) reports that policies are beginning to shift from those aimed at helping SMEs survive to those helping them recover.2 Yet the survey data shows a large proportion of SMEs still plan to apply for the liquidity support measures on offer. Exhibit 6 shows that while nearly 20 percent of SMEs had already applied for some form of government assistance, an additional 30 percent planned to do so. Again, there are material differences between the large EU economies: in France and Italy, more than 35 percent were still planning to apply, while in the United Kingdom and Germany the figure stood at 20 percent and 25 percent, respectively.

Different governments will take different approaches to supporting their SMEs from hereon. The extent of their support will also differ, with much depending upon local market conditions. But the survey underscores the need to consider both the immediate survival of SMEs as well their longer-term strength. Research has shown that around the world, the productivity of SMEs is well below that of larger companies. As and when the crisis fades, governments might therefore choose to help SMEs strengthen their resilience by, for example, helping them to find new markets or digitize more rapidly. SMEs have the potential to be an economic and employment engine after the crisis, but governments’ responses could prove critical.

| The views expressed in this article are those of the author alone and not the World Economic Forum.

| All opinions expressed are those of the author. investESG.eu is an independent and neutral platform dedicated to generating debate around ESG investing topics.