INSIGHT by ShareAction

Voting laggards BlackRock and Vanguard Group among those holding back investor support for shareholder resolutions on climate and social issues.

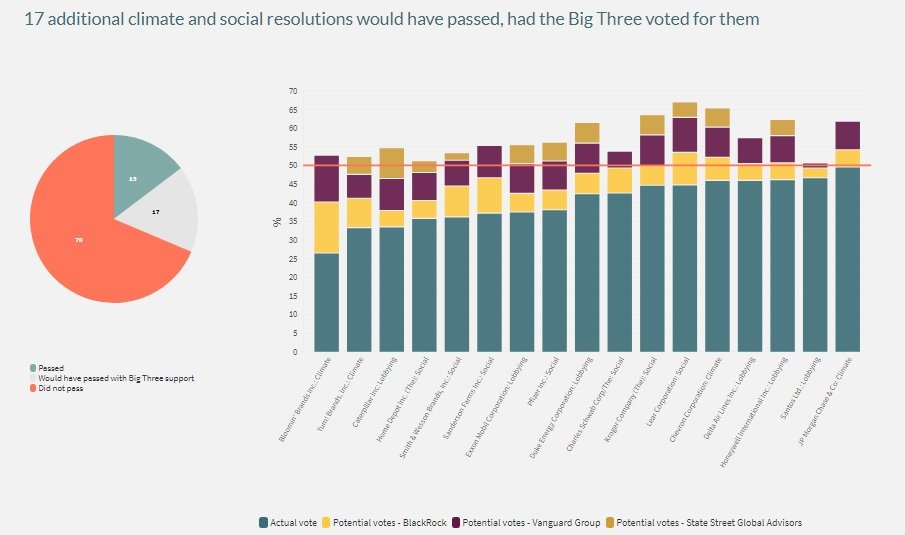

〉Just 15 out of 102 shareholder resolutions on climate and social issues received majority support from asset managers in the past year

〉A further 17 resolutions would have passed the 50% threshold but for a lack of support from one or more of the Big Three (BlackRock, Vanguard Group, State Street Global Advisors)

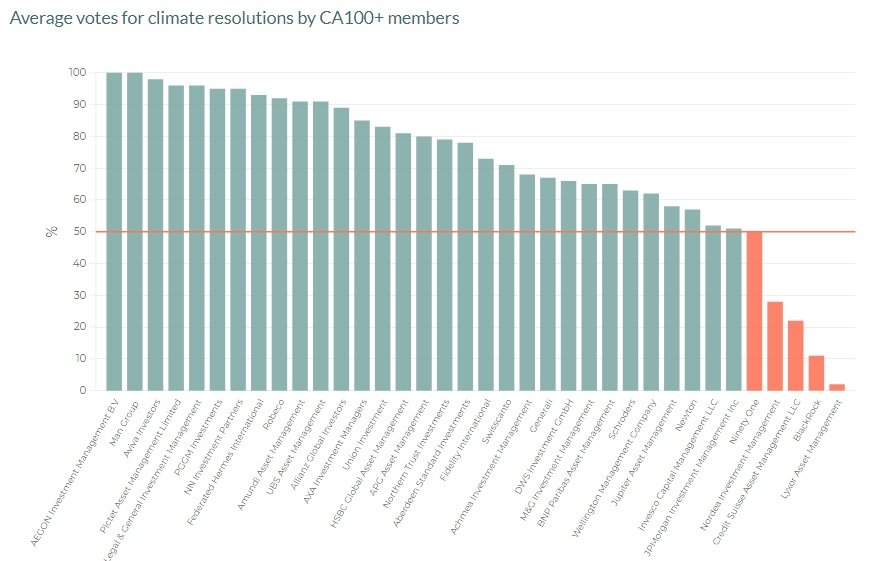

〉CA100+ members range from climate leaders to laggards. AEGON Investment Management and Man Group supported 100% of climate resolutions, in contrast with Credit Suisse Asset Management (22%), BlackRock (11%), and Lyxor Asset Management (2%)

〉No increase in support for human rights resolutions post-COVID-19, despite rhetoric of increased ESG attention on ‘S’ issues

| Despite publicly committing to responsible investment, some of the world’s largest asset managers are still failing to use their proxy voting rights to support sustainable progress in their investee companies.

Responsible investment NGO ShareAction analysed the voting decisions of 60 of the world’s largest asset managers on 102 shareholder resolutions on climate change and social issues from September 2019 to August 2020.

Smaller European fund managers top the rankings, with the 17 best performers all based in Europe. Impax Asset Management, Aviva Investors and PGGM Investments all supported more than 95% of the resolutions analysed.

Several US investors improved their scores: JP Morgan Investment Management supported 51% of climate resolutions, up from 7% in 2018/19, Wellington Management International voted for 62% (up from 10%) while Northern Trust Asset Management supported 79% (up from 21% last year).

| Crucial laggards

But there was little change from crucial laggards BlackRock (12%) and Vanguard, (14%), who each supported fewer than 15% of the climate and social resolutions analysed by ShareAction this year.

As a result, just 15 out of 102 resolutions were supported by a majority of investors. ShareAction found that an additional 17 resolutions would have reached the 50% threshold if one or more of the Big Three had changed their vote. BlackRock and Vanguard voted against all these resolutions, while State Street voted against 11 of the 17 resolutions.

For example, a June 2020 resolution calling for US supermarket chain Kroger to report on its human rights due diligence process narrowly failed, with 48% support from shareholders. This was despite the US Department of Labor having identified dozens of products stocked by Kroger which were produced with child or forced labour. The resolution would have passed if any of the Big Three had voted in favour, but all voted against.

| ShareAction Chief Executive Catherine Howarth said, “As responsible investment strategies surge in popularity, voting on shareholder resolutions is a key test of authenticity and commitment. We applaud asset managers who voted with conviction in 2020’s proxy season on social and environmental resolutions. Pension fund clients of asset managers exposed as having a weak voting record must urgently challenge the gap between rhetoric and action on behalf of their beneficiaries.”

| Empty engagement

Many asset managers justified their refusal to support climate resolutions on the basis that they preferred to engage privately, or that the company was already doing more than its peers.

For example, eight asset managers referred to Total’s positive engagement with CA100+ as a reason for voting against a resolution calling for the company to set greenhouse gas targets aligned with the goals of the Paris Agreement.

| Jeanne Martin, report co-author, described this as a disappointing trend, arguing that: “Engagement through private meetings is important to gather information and build relationships but its effectiveness to enact change can be limited. Given the scale of the climate crisis, it is concerning that some investors shy away from voting on critical resolutions at high carbon companies on the basis of engaging with them privately.” She added that, “Regardless of the company’s progress compared to its peers, if its strategy remains inadequate, investors need to support resolutions pushing for greater ambition.”

| CA100+ range from climate leaders to laggards

Thirty-seven of the asset managers studied are members of the Climate Action 100+ initiative. On average these investors had better record than their peers, with members supporting 69% of climate resolutions, compared with 39% for non-members. But the group also includes climate laggards, with Credit Suisse Asset Management (22%), BlackRock (11%), and Lyxor Asset Management (2%) supporting few climate resolutions.

ShareAction said this divergence should remind asset owner clients that membership of collaborative engagement groups is no guarantee of commitment to responsible investment.

| Contrasting fortunes for social resolutions

While Covid-19 has brought attention to the ‘S’ of ESG, ShareAction said there remained a lack of engagement activity through voting on social issues and that asset owners should engage with their managers to ensure that due attention is being paid to the filing of social resolutions.

Report co-author Martin Buttle said, “ESG funds are increasingly commonly used by asset owners, but the methodology behind these funds often fails to screen out some of the worst offenders on social factors. For ‘S’-conscious asset owners, this makes engagement with these companies – and specifically robust stewardship such as voting – even more important.”

On social issues, the research found that investors tend to support resolutions requiring companies to disclose diversity statistics but oppose those requiring disclosure of pay gaps. The only social resolutions that passed were all in the diversity category.

Within this category, investors showed clear preference for gender-based disclosures over ethnicity-related reporting. On average 48% of investors supported gender disclosures, compared with just 29% who voted in favour of resolutions asking companies to disclose both gender and racial pay gaps.

The report also found that, despite the rhetoric on Covid-19 increasing the focus on the ‘S’ of ESG, there was no change in voting behaviour on human rights resolutions before and after the WHO pandemic declaration, in March 2020. Furthermore, no voting rationales referenced the pandemic.

| Other findings

〉One sixth of asset managers chose not to vote on at least 10% of resolutions, despite holding the relevant stocks. ShareAction said “Voting across all holdings should be considered a base level of stewardship activity. Asset managers who fail to do so are delivering a sub-standard level of stewardship.”

〉During the 2020 AGM season, eight out 12 resolutions filed by CA100+ leads at focus companies targeted corporate lobbying, but a number of asset managers published voting policies that do not support lobbying proposals. For example, Goldman Sachs Asset Management’s voting policy state that, “GSAM generally will vote AGAINST proposals asking for detailed disclosure of political contributions or trade association or lobbying expenditure.”

〉The 2020 AGM season saw a slight increase in action-oriented resolutions, but disclosure resolutions continue to dominate. Sixty-seven of the 102 resolutions focused on disclosure, while almost all of the ‘social’ resolutions examined concerned policy development or disclosure. Report co-author Martin Buttle said, “Resolutions themselves also need to become more ambitious if they are to have impact. Disclosure will always be a focus of stewardship but it needs to be combined with resolutions which encourage positive real-world impact.”

〉ShareAction recommended that asset managers should vote at all AGMs and strengthen their voting policies to support ESG-related resolutions on a ‘comply or explain’ basis.

Aviva Investors placed 2nd in ShareAction’s ranking, having supported 98% of resolutions. Mirza Baig, Head of Governance and Stewardship at Aviva, said:

| “Aviva Investors welcomes the ShareAction report scrutinising our engagement and voting activities during the year. We have a responsibility to press companies to adopt progressive climate and human rights practices, and to use our voting power to hold management accountable when they fall short. We are pleased that the survey results evidence our commitment to take decisive voting action on behalf of our clients.”

| about

ShareAction is a research and campaigning organisation pushing the global investment system to take responsibility for its impacts on people and planet, and to use its power to create a green, fair, and healthy society.

We want a future where all finance powers social progress. For 15 years ShareAction has driven responsibility into the heart of mainstream investment through research, campaigning, policy advocacy and public mobilisation. Using our tools and expertise, we influence major investors and the companies they invest in to improve labour standards, tackle the climate crisis and address inequality and public health issues.

| All opinions expressed are those of the author. investESG.eu is an independent and neutral platform dedicated to generating debate around ESG investing topics.