INSIGHT by Natalie Ambrosio Preudhomme, Director, Communications at Four Twenty Seven

| The results from the U.S. presidential elections signal an impending radical shift in U.S. climate policy. President-elect Biden’s transition team identified climate change as one of four top priorities, promptly followed with the appointment of John Kerry as special envoy for climate. As part of his transition plan, Biden announced ten executive actions related to climate change that he intends to take on his first day in office. One of these measures is the requirement for public companies to disclose climate risks and greenhouse gas emissions in their operations and supply chains.

This disclosure requirement aligns with a global trend, following similar announcements in the UK and in New Zealand, with other financial regulators across Europe and the Asia-Pacific also actively considering such measures.

Disclosures are but one of many policy measures the new Administration may implement to address potential risks from climate change on financial markets and the economy. The report published by the US Commodity and Futures Trading Commission (CFTC) in September 2020 provided an extensive list of policy recommendations for financial regulatory agencies and the government at large to regulate climate risk.

A number of these policy recommendations overlapped with the September 2020 report from the Business Roundtable (BRT)1, where large corporations employing over 15 million in total and representing $7.5 trillion in assets(revenues) called on bold policy action to address the looming climate crisis.

Our analysis examines recommendation from the BRT and CFTC, alongside data on corporate risk disclosure, to provide an indication of how US firms are currently standing against the recommendations, and to provide a comparison to other markets.

| Methodology

We use the TCFD Climate Strategy Assessment dataset from V.E, an affiliate of Moody’s, which provides a granular view of how 2,855 companies report in line with the TCFD recommendations. This data is based on a comprehensive analysis of companies’ risk disclosures, across sectors and regions. For the purpose of this analysis, we grouped firms based on the region in which they’re listed, comparing the progress of firms in the US (498 companies), Canada (109), Japan (399) and the European Union (EU) (840). Each of these regions have different approaches to climate policy, with the EU leading the way in terms of regulatory developments for assessing and disclosing climate risk, while Japan expects markets to address financial risks from climate change through emerging best practices and market pressure. Comparing recommendations from the BRT and CFTC to companies’ risk disclosures, we grouped our analysis into two sections, first looking at recommendations around emissions reductions efforts and then discussing recommendations around risk management.

| Emissions Reductions

〉Carbon price

Both the CFTC and BRT recommend imposing a carbon price to develop a clear price signal associated with greenhouse gas (GHG) emissions. Firms sometimes use internal carbon pricing as a management tool, which suggests that they are more prepared to adjust to a nationwide carbon price.

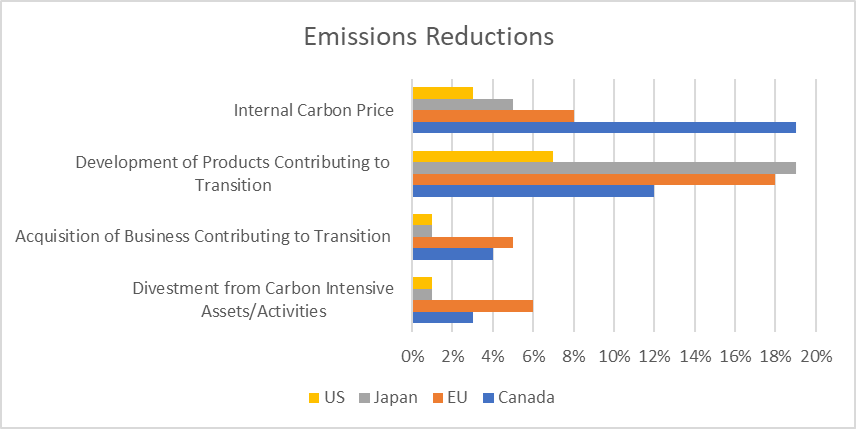

We find that only 3% of assessed US firms report using an internal carbon price, which is fewer than Canada, the EU and Japan. Alongside Canada, US firms also have the highest average carbon footprint of the assessed regions, based on carbon footprint data from V.E. However, Canada shows the largest proportion of firms reporting an internal carbon price, at 19% of firms. The data shows that US firms are behind their peers and have not leveraged the use of an internal carbon price as a management tool to incentivize carbon reductions and price the externalities associated with carbon emissions.

However, we find that many firms that disclose internal carbon prices in the US are from the automobile, energy, mining and pharmaceutical sectors. These sectors are among those with the largest dependencies on energy consumption or fossil fuels, which are expected to be most exposed to transition risks. The overall low numbers are therefore balanced by the fact that the firms in these sectors that do use internal carbon prices are also those that most need to prepare for shifting climate policy.

〉Low-Carbon Technology

The BRT emphasizes the significant opportunity for the U.S. to continue to lead in development and commercialization of energy efficiency and renewable energy to support the transition to a low-carbon economy. It underscores the need to invest in low-carbon and emissions reduction technology to allow us to capitalize on this opportunity.

In the US, 7% of assessed firms disclose the development of products that contribute to the transition to a low-carbon economy, which is less than firms of other regions. Japan and the EU lead the way with 19% and 18% of firms respectively reporting investments in low carbon technology. Only 1% of US firms report acquisition of businesses contributing to the transition; although all regions assessed show low uptake of this indicator. In the US, 35% of the companies in industrials, 33% in electrics and 30% in the automobile sector disclose development of products contributing to the energy transition. This demonstrates the opportunities for firms in sectors with high exposure to transition risk, such as electrics and automobiles, to invest in developing new products which would be in higher demand if climate policy increased.

The EU’s Sustainable Finance Taxonomy helps investors identify which activities contribute to climate adaptation and mitigation which in turn informs portfolio alignment with the Paris Agreement or other emissions reduction goals. The Taxonomy puts additional pressure and incentive for corporations to develop activities that directly contribute to the transition. This may explain why EU companies have made among the most progress to date, although it also may be an indication of further pressure growing outside of the EU as global investors aim to align with the taxonomy.

〉GHG Reduction Targets

The BRT recommends aligning policy and greenhouse gas reduction targets with scientific evidence around the need to reduce emissions. While few firms have disclosed divestment from or decommissioning of carbon intensive assets, those in the US and Japan show the least progress with only 1% of the assessed firms disclosing this indicator, while the EU shows the highest with 6%. Similar to the developments described above, as investors increasingly strive to align their portfolios with emissions reductions targets, companies will experience increased pressure to align their activities with such targets. While the US has experienced less regulatory activity to date in this regard than the other regions, this is likely to change going forward and companies prepared for those change are likely to be better positioned than others.

| Risk Management

〉Governance

The CFTC recommends that financial firms define oversight responsibilities for climate risks for the board of directors. While this recommendation is particularly directed at financial firms, it also aligns directly with one of the TCFD recommendations, and as such will be increasingly relevant as companies are increasingly asked to disclose their climate risks and opportunities in line with the TCFD. The BRT also recommends voluntary and transparent climate risk disclosure by corporations in line with existing frameworks.

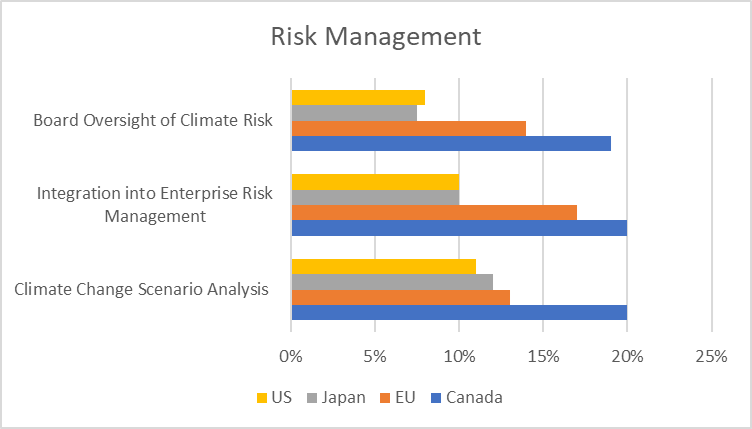

Only 8% of US firms disclose integration of climate risk into board oversight and Japan and Europe show similar progress. Canada stands out with 19% of firms disclosing processes used by the board to monitor and oversee climate progress.

〉Integration into Risk Management

The CFTC report recommends that financial firms integrate climate risk monitoring and management into their governance. However, only 10% of US firms disclose integration of climate risks into their enterprise risk management. While this is similar to progress in Japan, 17% and 20% of firms in the EU and Canada respectively report integration of climate risks into their management, indicating that they are likely more well prepared both for an increase in extreme events or transition risks and for regulations around assessing and disclosing risk.

The CFTC recommends that financial firms conduct scenario analysis aligned with international efforts, In the US, 11% of firms have disclosed use of scenario analysis, which is similar to Japan and the EU. Canada stands out with 20% disclosing use of scenario analysis. There has been a rapid uptick in both the pressure to conduct scenario analysis and stress tests, particularly for banks, as well as the resources available to support these assessments, such as the reference scenarios released by the Network for Greening the Financial system in June 2020.

| Conclusion

Our analysis shows that the largest US corporations tend to be slightly behind in terms of disclosing key indicators compared to their international peers. However, among all assessed regions, only a small percentage of firms disclose the indicators highlighted in this analysis, which demonstrates that there is significant room for progress. Increasing firms’ capacity to assess and disclose climate risks in an informative manner remains a global challenge.

Our analysis focused on the largest publicly trading companies, which are the first that have to comply with upcoming regulations around climate risk disclosure. The picture of progress likely looks different for mid-market firms where integration of emerging best practices for ESG and climate risk is not yet as deep.

1 Moody’s Corporation, Four Twenty Seven’s parent company, is a BRT member.

| All opinions expressed are those of the author. investESG.eu is an independent and neutral platform dedicated to generating debate around ESG investing topics.