INSIGHT by Jerome Lavigne-Delville, Senior Consultant at the International Finance Corporation, Senior Advisor on Sustainable Finance at United Nations Global Compact, and Co-lead of the CFO Taskforce for the SDGs.

| A growing pool of global financial capital is invested in companies with a sustainability lens. According to a 2019 estimate, about $30 trillion of institutional investments in corporate bonds and equity was actively managed for sustainability.1 On the lending side, 67% of global banks report screening their loan portfolios for environmental, social and governance (ESG) risks.2

While this is impressive – and growing – it only represents a fraction of the more than $200 trillion invested globally in corporate bonds, equity and loans.3 In addition, investors with the mandate to invest sustainably are stifled by a lack of scalable and credible investment opportunities.

Progress has been made with the emergence of investment funds composed of more sustainable companies and financial products tied to sustainability, such as green, social and sustainability bonds and loans. However, this market is still tiny in comparison to the overall size of the market and the demand for sustainable investments, with the corporate potion of the market only recently passing the $500 billion mark.4 Meeting the rising demand from impact-seeking investors would require a significant increase in the number and diversity of investment opportunities in sustainable development.

An answer can be provided by companies themselves – building the supply of sustainable finance – if they are able to measurably invest in sustainable development and finance those investments through mainstream financial products tied to sustainability performance. Over time, a systematic integration of sustainability in corporate investments and finance could qualify the largest asset classes in the capital markets – corporate bonds and equity – for sustainable finance.

| Introducing Sustainable Corporate Investments and Finance

As a result, recent efforts to increase the flow of sustainable finance have focused on integrating sustainability in corporate finance and tapping Chief Financial Officers (CFOs) to adopt a more integrated model to finance sustainable development. This is consistent with long-standing efforts – including by the United Nations (UN) Global Compact – to integrate sustainability in the core management and governance practices of companies, including integrated reporting.

This new approach looks at sustainable finance from a corporate perspective, complementing existing approaches focused on investors and financial products. It focuses on the opportunity for companies to finance their sustainability investments as part of an integrated corporate strategy, under the oversight of existing corporate governance structures and leveraging companies’ main medium of investor communication.

While the approach supports further growth of use-of-proceed sustainability bonds and loans, it also opens the full suite of corporate finance products to support sustainability investments, including traditional bonds and loans, credit facilities, derivatives, securitization, structured finance, leasing, insurance, and equity. In addition, it addresses the financing needs of a wide range of companies from different industries, size, and geographies.

The integration of sustainability in corporate finance will likely be gradual, based on companies’ and investors’ own journey to integrate sustainability. Initially, companies can finance specific sustainable assets or activities with more impact-oriented investors by issuing use-of-proceed bonds and loans, with strict monitoring of how the funds are used. As companies start to fully integrate sustainability in their strategy, and investors become more sophisticated in assessing corporate sustainability holistically, the market can expand to other corporate finance instruments that can be tied to performance on material sustainability issues, such as sustainability-linked bonds and loans. Eventually, a company’s sustainability impact can be communicated to a broader set of investors who typically invest in general-purpose bonds and equity, promoting the overall company as a sustainable investment, and reaching the broadest spectrum of the market.

The growth of sustainable corporate finance depends on key developments in corporate management and governance, financial products and financial markets, to ensure credibility beyond a strict use-of-proceed model. These developments include:

〉Ability of companies to set strategic targets on their most material contribution to sustainable development.

〉Evolution in corporate governance practices to ensure board oversight, internal controls, and verification and disclosure of sustainability performance.

〉Introduction of performance-based covenants or terms in financial products, including bonds, loans and possibly equity around material sustainability topics.

〉Active participation of financial market intermediaries to leverage the transparency and credibility mechanisms of broad capital markets.

A model for integrated corporate finance is promotedby the CFO Taskforce for the SDGs, a UN Global Compact initiative to support companies in the transition to sustainable development and to leverage corporate finance and investments for the SDGs. The Taskforce issued a set of CFO Principles on Integrated SDG Investments and Finance, articulating four main areas to integrate sustainability in corporate finance (see Figure 1 below). The principles suggest that companies should create a credible impact thesis and measurements and integrate sustainability in strategic goals and investments. They further suggest the development of an overarching corporate finance approach that leverages different types of financial instruments based on the nature of SDG investments and that drives integrated investor communication on SDG investments.

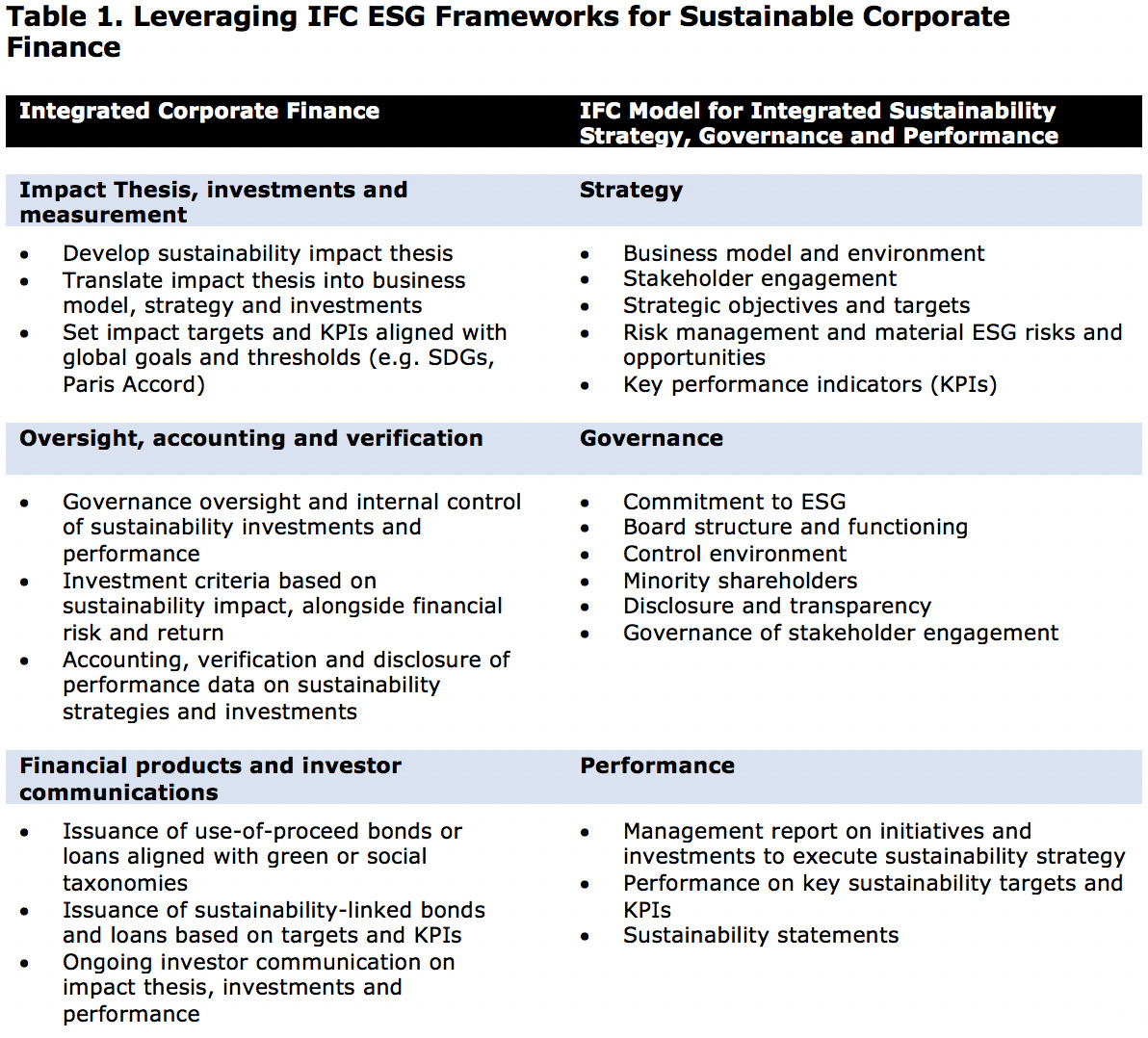

Another model is provided by IFC’s Corporate Governance Methodology and ESG Disclosure and Transparency Toolkit and Program, which were designed to support the development of sustainable capital markets in emerging economies. IFC’s Corporate Governance Methodology provides an approach to evaluate and improve corporate governance of companies— including the governance attributes of key environmental and social policies and procedures—to identify, reduce, and manage risk.5 The ESG Disclosure and Transparency Program provides a comprehensive model for integrating sustainability in strategy, governance and performance, based on the dual concept of sustainability and financial materiality and building on the IFC Performance Standards for Environmental and Social Sustainability. Together, these tools support companies in setting up targets on material ESG issues, monitoring progress and reporting on performance, as contemplated in emerging models for integrated corporate finance (see Table 1 below).

| The Promise of Sustainability-linked Finance

Sustainability-linked finance refers to a range of corporate debt instruments – bonds, loans, credit lines – that are linked structurally to the issuer’s performance on predetermined sustainability goals and targets, allowing general-purpose uses of proceeds and supporting an integrated management and governance of sustainability.

Sustainability-linked finance is a promising application of integrated corporate finance, gaining traction with both corporate issuers and investors who are looking beyond green bonds to broaden the scope of sustainable finance. For corporate issuers, it is aligned with efforts to integrate sustainability in core management and governance processes and provides an alternative credibility mechanism to the use-of-proceed model. For investors, it opens the market to a wide range of corporate issuers that cannot finance their sustainability strategies through separately financed projects or activities, as is required by the use-of-proceed model.

Sustainability-linked finance started in the corporate loan market, where the performance-based loans were developed and nurtured as part of the trusted relationship between companies and their commercial banks. The practice has grown substantially over the past few years, with the market reaching $137 billion in 2019,6 and principles for sustainability-linked loans introduced in 2020.7 A parallel evolution occurred in the corporate bond market with the introduction of sustainability-linked bonds, opening the door for sustainable finance in one of the largest investment asset classes.

Sustainability-linked bonds have grown rapidly in popularity since their introduction by Italian electric utility ENEL in 2019. They gained further legitimacy with the introduction of Sustainability-Linked Bond Principles8, and a decision by the European Central Bank that they would become eligible for asset-purchase programs and as collateral starting in January 2021.

Since then, a number of companies have entered the market from different industries and geographies, helping to expanding the scope and potential size of the market for sustainable finance. This includes Chanel (fashion, France), Hulic (real estate, Japan), LafargeHolcim (materials, Switzerland), Novartis (pharmaceuticals, Switzerland), NRG Energy (energy, USA), Schneider Electric (engineering, France) and Suzano (pulp and paper, Brazil).

Whether it is in the corporate loan or bond market, sustainability-linked finance offers a number of benefits, including:

〉Broadens the market to sectors without an objective definition of sustainable activities, or where it is impractical to allocate proceeds to specific sustainability projects.

〉Allows companies to develop their own unique impact thesis and strategy based on capability, footprint, and operating context.

〉Promotes innovation and competition for the most effective sustainability solutions.

〉Provides a holistic impact assessment of companies, beyond specific assets or projects.

〉Leverages corporate governance mechanisms in place at most companies to provide investors with assurance that funds are used toward impactful activities.

〉Supports the evolution of impact measurement from process-based (allocation of proceeds) to performance-based (KPIs on corporate performance).

According to ICMA, “Sustainability-Linked Bonds incentivise the issuer’s achievement of material, quantitative, pre-determined, ambitious, regularly monitored and externally verified sustainability (ESG) objectives through Key Performance Indicators “KPIs” and Sustainability Performance Targets (“SPT”).”9

| A Path Forward to Bridge the Financing Gap for Sustainable Development

When nested in a broader corporate finance approach, the concept of sustainability-linked finance can be applied to any financial instrument in a CFO’s toolkit. Recently, a number of sustainability-linked credit lines have been issued, as well as an SDG-linked cross currency swap.10 The next frontier is equity, where models could be developed to link economic rights of shareholders, such as dividends or distributions, to sustainability performance. Taken together, these innovations could create a quantum leap for sustainable finance – potentially reaching hundreds of trillions of dollars and redirecting corporate investment towards sustainable development on a global scale.

Integrated corporate finance also holds the promise of injecting much needed capital for economic and sustainable development in emerging markets, supporting the World Bank’s twin goals of eliminating poverty and promoting shared prosperity and contributing to the achievement of the UN Sustainable Development Goals. Companies can leverage their access to capital markets, commercial banks and development banks to invest in riskier sustainability solutions and in emerging economies where access to capital is lacking. Direct investments by companies – especially foreign direct investments – represent a critical form financial intermediation for sustainable development. This was recognized by UN Member States in the 2030 Agenda for Sustainable Development and the Addis Ababa Action Agenda on Financing for Development.

| “[We] encourage official development assistance and financial flows, including foreign direct investment, to States where the need is greatest, in particular least developed countries, African countries, small island developing States and landlocked developing countries, in accordance with their national plans and programmes.”11

| “We recognize the important contribution that direct investment, including foreign direct investment, can make to sustainable development, particularly when projects are aligned with national and regional sustainable development strategies.”12

Ultimately, integrated corporate finance can help put financial capital to use in a most productive capacity towards long-term sustainable development and bring finance back closer to its original ethos and greatest potential contribution to society.

| brief bio

Jerome Lavigne-Delville is an expert in global corporate sustainability and responsible investment, with 20 years of experience in sustainability, finance and law. Jerome currently serves as a Senior Advisor for the UN Global Compact, focusing on Sustainable Finance and is a Co-lead for the CFO Taskforce for the SDGs. He is also a Senior Consultant for the IFC, working with the Corporate Governance Group to promote environmental, social and governance (ESG) standards in emerging markets. Prior to that, Jerome was the Chief of Standards Development at SASB, heading the development of the SASB standards for material sustainability disclosure. Jerome also served as a Programme Officer at the UN Global Compact overseeing transparency and disclosure efforts and coordinating a number of critical investor-company initiatives including ESG Investor Briefings and the Sustainable Stock Exchange Initiative.

| Endnotes

1 Based on data from the Global Sustainable Investment Alliance.

2 Survey published by Fitch Ratings, January 2020.

3 Based on data from the Bank of International Settlement, OECD, and SIFMA.

4 Based on data from Refinitiv and the Climate Bond Initiative.

5 The IFC Corporate Governance Methodology include the assessment of six key parameters: Commitment to ESG, Structure and Functioning of the Board, Control Environment, Disclosure and Transparency, Treatment of Minority Shareholders and Governance of Stakeholder Engagement.

6 Refinitiv Annual Report.

7 The Sustainability Linked Loan Principles were developed in May 2020 by APLMA, LMA, LSTA.

8 ICMA, Sustainability-Linked Bond Principles Voluntary Process Guidelines, June 2020.

9 Id.

10 In 2019, ENEL issued an SDG Linked Cross Currency Swap alongside its SDG-linked bonds.

11 2030 Agenda for Sustainable Development, Section 10(b).

12 Addis Ababa Action Agenda on Financing for Development, Paragraph 45.

| All opinions expressed are those of the author. investESG.eu is an independent and neutral platform dedicated to generating debate around ESG investing topics.

> zoom image

> zoom image