The last few weeks and months were dominated by regulatory issues on disclosure and non-financial reporting data. A number of technical indicators were developed and advanced disclosure regimes were finalized. On the ground – on the level of investee companies and their business – the challenge is identifying the data points, capturing and measuring the data and compile them in a form and format which can be used for corporate reporting.

In developing countries the issue of forced labour and other human rights violations is not uncommon. Investors should research the business and supply chains of their raw materials and supplies. A report published by PRI in 2020 is a valuable guide for institutional investors: “WHY AND HOW INVESTORS SHOULD ACT ON HUMAN RIGHTS”.

Institutional investors have a three-part responsibility to respect human rights.

(1) Policy Commitment: Adopt a policy commitment to respect internationally recognised human rights.

(2) Due Diligence Processes: Identify actual and potential negative outcomes for people, arising from investees. Prevent and mitigate the actual and potential negative outcomes identified. Track ongoing management of human rights outcomes. Communicate to clients, beneficiaries, affected stakeholders and publicly about outcomes, and the actions taken.

(3) Enabling or providing access to remedy: Enable or provide access to remedy.

The report outlines how PRI would assist investors along the way:

– support institutional investors with their implementation of the UN Guiding Principles on Business and Human Rights (UNGPs) through knowledge-sharing, examples and other practical materials;

– increase accountability among signatories, by introducing human rights questions into the PRI Reporting Framework – initially on a voluntary basis;

– facilitate investor collaboration to address industry challenges to implementing respect for human rights;

– promote policy measures that enable investors and investees to anage human rights issues;

– drive meaningful data that allows investors to manage risks to people.

The financial industry must play a critical role

in facilitating sustainable development and growth,

and in ensuring that people’s fundamental

dignity and rights are upheld (PRI).

PRI: “RESPECT FOR HUMAN RIGHTS IS FUNDAMENTAL TO ADVANCING THE SDGS”

The Sustainable Development Goals (SDGs) set the global goals for societies and all its stakeholders – including investors – and are explicitly grounded in the Universal Declaration of Human Rights.

The UN Office of the High Commissioner for Human Rights has explicitly mapped the overlap between the SDGs and human rights. The implementation of the UNGPs across business and investment activities has the potential to deliver a transformational contribution towards achieving the SDGs.

By addressing the full range of human rights, corporates and investors could, amongst other things:

(1) address gender-related issues connected to business activities, helping achieve up to eleven SDGs;

(2) provide workers with a living wage, advancing eleven of the SDGs;

(3) eradicate forced labour from the value chain, contributing to the advancement of six SDGs.

This overlap between the SDGs and human rights does not detract from the inalienable nature of human rights themselves: the potential failure of companies or investors to prevent or mitigate harm to people cannot be offset by targeted initiatives to contribute to one or multiple SDGs.

Some important implications for Due Diligence and Asset Manager Selection

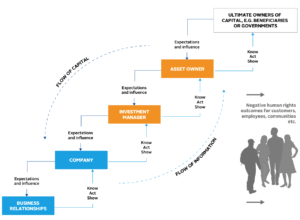

To understand their exposure and the actions required, investors need to request information from throughout the value chain: from their investment managers, other service providers and/or investees.

The management of actual and potential negative human rights outcomes should be reflected in the investment decision-making process, including in portfolio construction, security selection and asset allocation, and/or in selecting.

Pre-investment: Investors should assess negative human rights outcomes of potential investees and set clear expectations about implementing the UNGPs, including with third-party investment managers. This is particularly important for illiquid assets as the investor will have limited opportunities to exit investments without experiencing financial loss and for index investing due to inability to sell specific shares.

Post-investment: Investors should regularly identify actual and potential negative human rights outcomes associated with their investments, using and building influence to ensure that investees address them and track effectiveness. Where investment management is outsourced, appropriate monitoring and reporting should be in place.

In practice the value chain – and the flow of information and capital – is often further complicated through the use of investment consultants, fund-of-funds, benchmark administrators, engagement providers, stock exchanges or other financial intermediaries.

Nevertheless, asset owners are in the position to set expectations and influence the practices of third-party investment managers, service providers and investees (who all have an independent responsibility to respect human rights).

More articles on Human Rights on investESG.eu

PRI

| investESG.eu is an independent and neutral platform dedicated to generating debate around ESG investing topics.