| Insights from the 2021 Annual ESG Manager Survey, published by Russell Investments, November 2021

The broadening of ESG-related information available in the marketplace is highlighting the materiality risks associated with ESG, enabling further adoption of the integration of ESG. However, despite the increase, the extent of the role that ESG assessments play in actual investment decisions remains unclear – especially around environmental and social considerations.

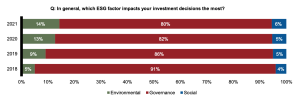

To gain further clarity, we first asked which ESG considerations impact the investment decisions the most. Each year, governance remains the dominant factor.

This is no surprise, given that company management is a critical component in generating long-term enterprise value. When asset managers are considering each of the ESG elements, they need to consider the materiality of each consideration, and materiality differs by industry.

For example, environmental aspects might be important for the energy or utility sectors but less important for the banking sector.

However, overall corporate governance – how companies are managed – applies to all companies, regardless of industry. That being said, we have noticed a reasonable increase in environmental considerations, when compared to previous years’ responses. This is likely due to the increased awareness and desire among market participants to tackle climate risk, which could impact asset prices over time.

Source: Russell Investments

About the survey

Russell Investments conducted its 2021 annual ESG survey across equity, fixed income, real assets and private markets asset managers from around the globe. The survey aims to assess their attitudes toward responsible investing and how managers integrate ESG considerations into their investment processes. This year’s survey covered a wide range of topics, including the following:

- Commitment to net zero by 2050

- ESG data sources

- The importance of ESG-specific considerations

- How ESG insights were formed

- Climate risk: the greatest issue flagged by asset managers’ clients

- The rise in dedicated responsible investing resources

- Engagement activities

- Product offerings

- Reporting and data

This year marks our seventh annual ESG manager survey. The annual survey has evolved over the years, enabling deeper insights into trends and into how attitudes toward responsible investing have changed since it launched in 2015.

Russell Investments incorporates ESG considerations into the investment process. As a component of the manager research process, analysts assign an ESG rank to individual strategies, based on rigorous analysis of a number of key determinants of expertise and effectiveness in the area. The ESG manager survey results provide a rich source of information about how each asset manager approaches ESG. As such, the survey results may serve as significant reference points for evaluating investment strategies.

In order to provide the most accurate representation, we tried to consolidate assets under management for single firms which provided more than one regional response. The survey participants have a broad representation by asset size, region and investment strategy offerings. Of the 369 participants, 293 offer equity strategies, 208 offer fixed income strategies, 113 offer private markets strategies and 94 offer real assets strategies. 56% of the respondents are headquartered in the U.S., 15% are based in the United Kingdom, 9% are based in Continental Europe, with the remainder located in other regions. 34% of the respondents have assets under management of less than US$10 billion while 30% of the participants have over US$100 billion in assets. We have observed that the level of ESG efforts have a high correlation to the firm’s assets under management – the larger firms can afford greater resourcing – resulting in seemingly better ESG-related infrastructure. When comparing the survey results, we were mindful of the underlying composition difference, such as region and asset base.

| investESG.eu is an independent and neutral platform dedicated to generating debate around ESG investing topics. All opinions expressed are those of the author or contributing source.