INSIGHT by Jennifer Morris, Chief Executive Officer, Nature Conservancy. This article was originally published on the World Economic Forum.

〉Restoring coastal ecosystems could result in a return of $11.8 billion in carbon finance by 2040.

〉While private sector actors increasingly demand carbon credit investments, the blue carbon credit supply is still lacking.

〉The World Economic Forum launched the Blue Carbon Action Partnership to support national ambitions and drive the blue carbon market.

Coastal wetlands – consisting of mangroves, seagrasses, and salt marshes – play a critical role in climate change mitigation and adaptation. These are estimated to sequester 4 to 10 tons of carbon dioxide per hectare annually and up to 10 times faster than tropical rainforests.

Globally, coastal ecosystems contribute over $ 190 billion annually to blue carbon wealth. Financing their restoration could result in 380 million TCO2 of sequestration and a return of $11.8 billion in carbon finance by 2040. This is equivalent to the annual emissions of nearly 82 million gasoline-powered passenger vehicles.

It is unsurprising then that blue carbon is reaching the attention of leaders at the highest level, with the UN Secretary-General Executive Office flagging it as a top priority for ocean work in 2023 and G20 leaders visiting a mangrove forest during their summit in Bali.

While private sector actors increasingly demand carbon credit investments to protect or restore blue ecosystems, the supply of these credits is lacking, leaving the opportunities for blue carbon untapped. Additionally, current policy frameworks around carbon markets lack clarity which has slowed down the development of blue carbon projects.

Beyond market opportunities, governments can use blue carbon to achieve their mitigation and adaptation goals under the Paris Agreement, but the commitments for conservation investment have not materialised at scale.

As blue carbon gains more attention, only partnerships will produce progress. To fully realise its potential, the world must unite blue carbon actors at all levels to develop the science, policy, and financial mechanisms for scaling blue carbon ecosystem restoration and conservation.

Here are four ways local, national, and global stakeholders can work together for the future of blue carbon:

1) Invest in high-quality carbon projects

Corporations are increasingly committing to net-zero objectives and even considering carbon offsets, substantially boosting the demand for blue carbon credits. Current carbon credit inventories are shrinking, and competition among corporate offset purchasers is high. On that account, new blue carbon projects can generate hundreds of thousands of credits to meet this growing demand.

Nevertheless, we must ensure that the credits are grounded in credible science and that there are safeguards with equitable benefit sharing for communities.

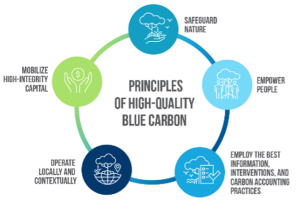

New frameworks are emerging to help both buyers and suppliers understand what projects ensure benefits for people and the planet. The High-Quality Blue Carbon Principles and Guidance released at UNFCCC COP 27, for example, provide a consistent and accepted approach to these objectives.

2) Give local leaders and communities access to the international market

Many communities may already value their blue carbon ecosystems for fishing, livelihood, shoreline protection, and other benefits. Carbon, as an additional benefit, can unlock external finance opportunities for these ecosystems on top of their daily lived benefits. We can unlock high-integrity capital investment in blue carbon ecosystems by providing local communities access to the voluntary carbon market. This requires collaboration across communities, support organizations, and policy-makers to make access to markets easier for projects.

3) Equip governments to achieve their Paris Agreement climate goals

As countries begin to renew their Nationally Determined Contributions (NDCs) outlining how they will achieve their goals under the Paris Agreement, many are including blue carbon in their NDCs for adaptation and mitigation.

Deliberate national policies, regulations, and accounting approaches are needed to help these governments and those who have yet to include blue carbon in their NDCs to achieve such ambitions. Because blue carbon ecosystems span land and ocean, jurisdiction over these ecosystems can be confusing and policies challenging. Government support to clarify land tenure will streamline approaches to mainstreaming blue carbon.

4) Global partnerships

Significant ambitions to achieve investment goals in blue carbon are also building, including the newly launched Mangrove Breakthrough. This partnership between the UN Climate Change High-Level Champions and the Global Mangrove Alliance aims to uncover $4 billion to secure the future of 15 million hectares of mangroves globally by 2030. Through collective action, the Mangrove Breakthrough project seeks to halt mangrove loss, restore half of the recent losses, double the protection globally, and ensure sustainable long-term finance for all existing mangroves.

The International Partnership for Blue Carbon is another prime example. As a group of governments, non-governmental organizations, and research organizations, they aim to connect efforts across all members and leverage the great work already happening to support one another.

In parallel, using the High-Quality Blue Carbon Principles and Guidance as a foundational document, the World Economic Forum will soon launch (3rd May 2023, project already launched – investESG) the Blue Carbon Action Partnership (BCAP). BCAP supports national blue carbon ambitions and convenes partners to help tackle international challenges and drive the blue carbon market forward.

Partnerships at all levels – from local to global, across all sectors – will allow us to unlock blue carbon ecosystems’ potential to benefit people, biodiversity, and the planet.

| All opinions expressed are those of the author and/or quoted sources. investESG.eu is an independent and neutral platform dedicated to generating debate around ESG investing topics.