NEWSLETTER by Alessia Falsarone

The circular economy is at a turning point in the world of architecture, and the broader field of construction. The uncertain future of work, the stressed macroeconomic environment, and the impacts of the climate crisis all contribute to ongoing fears in the real estate industry. To combat these challenges, architects, engineers, and RICS professionals are collaborating to embed circular principles and rethink material consumption. This will create new value for longer periods, as the business case for circular real estate strengthens alongside its environmental and social benefits.

| The Science of Impact

It all starts with a simple question:

“Do I need the product or the service it provides me?”

This is the question that Professor Lucas Rosse Caldas from the Federal University of Rio de Janeiro encourages the participants in the architecture and civil engineering programs to start off with. As one of the expert contributors to the sixth report of the Intergovernmental Panel on Climate Change (IPCC) on buildings, Prof. Caldas understands that closing material loops to reuse waste and resources, and slowing down material cycles to develop durable products, not only has environmental and economic benefits but can also positively impact society.

In his view, in the built environment, it is necessary to shift from a mindset that focuses on product acquisition to one that prioritizes the services that products provide.

The next question for investors and companies alike is:

“Is it economical to deploy the principles of circular economy in smaller sized construction projects?”

The answer is Yes. Circular solutions can be designed across a variety of scales and uses.

| Circularity Roadmaps Explained

Circular real estate is not just about the materials used for construction. Circularity principles can alleviate ongoing challenges in real estate, such as underused space, changes in tenant appeal, and costly renovations, ultimately leading to increased value and profitability.

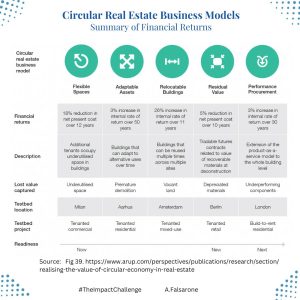

The teams at Arup and the Ellen MacArthur Foundation in partnership with the architects at 3XN/GXN have provided a foundational review of the emerging circular business models for real estate, with an emphasis on dynamic models that adapt to changing functionality and tenant preferences.

Traditionally, the built environment has applied circular economy principles by promoting sustainable material and waste management during design and construction. However, this approach is no longer adequate. With workplaces becoming more employee-focused, retail outlets struggling with multi-channel distribution models, and the pressing climate crisis, maintaining a linear perspective on real estate poses risks for developers, investors, tenants, and municipalities.

Among the circular operating models laid out in the Arup review, two features seem to have found their way in the thinking behind new urban construction:

〉Flexibility – the emergence of co-working spaces has unlocked the potential for underutilized spaces in buildings and balanced the risks associated with short-term tenants. In Milan, Italy, the research teams at Arup and 3XN/GXN found a revenue potential of 18% of the net cost of the lease over a 12-year period.

〉Adaptability – adaptable assets keep buildings in favor for longer when it comes to market dynamics and changing social expectations. In Aarhus, Denmark, this strategy has resulted in a 3% increase in IRR of a 5-story development over 50 years.

By delivering more flexible and adaptable buildings, real estate developers open the door for investors to own circular assets with the option to add new revenue streams over longer periods and generate greater residual value for the property.

| Investing in the Circular Economy

Carol Lemmens from Arup makes it clear. By designing-in flexibility of operating an asset from the very beginning start, we can expect better returns on an investment for longer. In fact, circular economy (CE) ideas are already leading to better real estate investments. They help generate new value from real estate portfolios while also keeping the assets at their highest value for longer by recovering sources of value that would otherwise be go lost.

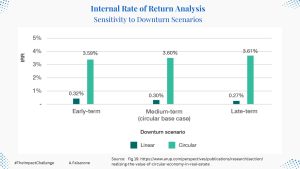

One way to analyze the impact of circularity on the financial performance of a real estate asset is to look at potential downturn scenarios (mostly based on historical parameters) and conduct a sensitivity on the income generated from a linear model vs. that of a circular alternative.

Let’s take for example the Adaptable Assets as the reference operating model. As a reminder that means that buildings are designed and developed to accommodate for more than one use during their lifetime by employing retrofitting as opposed to demolition.

The sensitivity of the Internal Rate of Return (IRR) to different downturns offers a good representation on the need for investors to define all the assumptions that underpin the circular operating model over time to fully appreciate its benefits. In this case, the design for adaptability will generate an additional upfront cost on the IRR, including the cost of converting the building from one to another.

In the example offered, a residential building would be either demolished and rebuilt into a micro-logistics center (linear case) vs. choose to design the building for conversion from residential to a micro-logistics use case one floor at the time and spacing out the annual rental income of the added second use over time.

>>click to zoom in | Source: Realizing the Value of Circular Economy in Real Estate (2020), Fig.19

>>click to zoom in | Source: Realizing the Value of Circular Economy in Real Estate (2020), Fig.19

As investors start modeling and pricing the business case for circular real estate asset, they are able to rethink the financial value generated by each property beyond a linear use model.

>>click to zoom in | Source: Realizing the Value of Circular Economy in Real Estate (2020), Fig.39

>>click to zoom in | Source: Realizing the Value of Circular Economy in Real Estate (2020), Fig.39

By adding flexibility to underutilized spaces in new and existing construction, adapting layouts to alternative uses over time, and providing modular solutions for buildings, investors are on their way to building stronger risk-adjusted performance for their portfolios and develop operating models that are much more resilient to a traditional linear mindset.

| You don’t want to miss this week

From Orlando to Brussels, and Zurich, this week offers new opportunities to connect with fellow circularity practitioners both in person and in hybrid mode.

Discover, grow and leave your mark!

〉May 9th–11th: RFID Journal Live! (Orlando, Florida). This is the world’s largest conference and exhibition focused on radio frequency identification (RFID) and related technologies through industry-specific and how-to tracks, as well as general education for those new to the RFID market. On May 10th, Edson Perin, the IoP Journal editor, will lead the discussion on Digital Product Passports (DPPs) and how the upcoming DPP legislation in the EU reinforces the power of Smart Packaging. His introductory article is a a valuable introduction to the changes in the traceability and interoperability of supply chain information that await businesses.

〉May 10th: Financing Local Circular Economy Initiatives (Brussels, Belgium). The DECISO project and HOOP Project – both part of the Horizon Europe programming – are hosting a session for investors and project developers in the circular economy ecosystem to share insights with the aim of creating a diverse overview of pilots addressing different thematic areas and challenges faced by cities and regions. The event is an opportunity to address existing funding opportunities for circular economy initiatives and how to engage with private investors to bridge the public funding gap.

〉May 10th-11th: Biomaterials 2023 (Zurich, Switzerland). The theme of this year’s forum, gain critical insights in the research of advanced biomaterials, underpins the work of pharmaceutical companies, biomedical research organizations and other R&D businesses. Expert talks will also explore a powerful human side to Biomaterials that considers Ethics, Law and the role of Healthcare delivery systems around the world.

Off to another impactful week!

| about

Alessia Falsarone is executive in residence, practitioner faculty at the University of Chicago, where she leads the Circular Economy and Sustainable Business program. The article is based on the author’s newsletter A Week of Circularity from the innovation knowledge hub.

| All opinions expressed are those of the author and/or quoted sources. investESG.eu is an independent and neutral platform dedicated to generating debate around ESG investing topics.