NEWSLETTER by Alessia Falsarone. The author acknowledges the team at The University of Chicago Circular Economy and Sustainable Business Management Program and all participants of the innovation knowledge hub for their insights and collaboration.

“As my mother used to say: you can only give it your utmost best.”

These words from Jan te Bos, Director General of the Eurima (European Insulation Manufacturers Association), during a recent interview, have been on my mind since I first heard them. In this case, Jan was making a reference to the task of decarbonizing the building stock in the EU, balancing the endless dialogue of who will ultimately pick up the bill with the need to engage stakeholders in a way that the opportunities (to deliver societal and financial returns) as much as the risks of inaction are clear to all. Acknowledging and dealing with biases that may emerge in these conversations is a key factor in creating impactful solutions.

| The Science of Impact

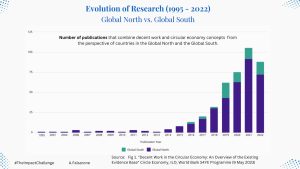

A recent report by Hatty Cooper and the team at Circle Economy highlights an important problem in the deployment of circularity policies. A bias for developed world economies, the Global North.

The pace of research activities and their publications, spanning nearly 20 years, has occurred in developed world countries over 80% of the time. In addition, its focus has disproportionately focused on job creation while disregarding job quality — such as working conditions and wages, for example – all vital factors to ensure that the development of national policies on a circular economy align with sustainable growth in emerging economies.

>>click to zoom in | Source: “Decent Work in the Circular Economy: An Overview of the Existing Evidence Base” Circle Economy, ILO, and World Bank S4YE Program (9 May 2023)

>>click to zoom in | Source: “Decent Work in the Circular Economy: An Overview of the Existing Evidence Base” Circle Economy, ILO, and World Bank S4YE Program (9 May 2023)

In addition, the research findings directed to the Global South appear to be predominantly focused on the waste management sector and much less on the role that developing economies play in global value chains.

As a result, limited analysis of circular economy implementation in the Global South compared to the Global North is most likely to hinder deeper collaboration leveraging the global trade relationship between regions of the world that could reshape production and consumption practices.

| Circularity Roadmaps Explained

Vietnam offers a direct example of the opportunities in a circular transition between Global North and Global South. The circular economy has been often referred to as an inevitable path for the country, given its limited natural resources, high population, and the growing pressure of environmental pollution.

At the end of 2022, Vietnam announced its plan to release a national roadmap for the implementation of a circular economy by 2030 as a way to promote the efficient use and management of natural resources and reduce environmental degradation. The release of the country’s action plan by the end of 2023 is a key priority for the Institute of Strategy and Policy on Natural Resources and Environment (IPONRE) under the Ministry of Natural Resources and Environment.

International cooperation has been helping IPONRE establish a country-specific vision, including access to expert opinions from the Japan International Cooperation Agency (JICA), and from engineering consultancy firm Nippon Koei Vietnam International Co., Ltd. Moreover, Vietnam’s ties with the Nordics have created a network for shared experiences and policy recommendations which are likely to favor a public-private partnership model in building and developing a national plan for a circularity. The recent invitation to join the European Circular Economy Stakeholder Platform and leverage Europe’s extensive initiatives and experience in the field is the latest example of the appetite for international cooperation when incorporating circularity in country-level roadmaps. Strategic trade considerations can contribute directly to aligning socio-economic incentives with policy development and capacity building.

According to Vietnam’s Central Institute for Economic Management (CIEM), the national institute under the direct authority of the Ministry of Planning and Investment, involving the private sector in the design of a circularity roadmap will be essential. The Institute has found that:

〉Only 3-6% of Vietnamese firms are fully aware of circularity as a concept, whereas those partly aware account for 20 to 30%

〉Less than 10% think that the existing legal framework is adequate for circular businesses (nearly 20% of Vietnamese firms believe there is no applicable legal framework)

〉Less than 15% of companies have received governmental support including training and workforce development opportunities.

There’s a pivotal stakeholder that needs attention: Vietnamese SMEs. SMEs account for nearly 96% of all companies operating in the country, employing 47% of the workforce and contributing 36% to national GDP. Yet, their involvement so far has been minimal.

The expected release of the national circularity roadmap in December 2023 will be a testing ground for Vietnam’s sustainable development. It is viewed as a key variable for the country to remain a relevant player as a manufacturing hub in its free trade agreements with the US, China and the UK. Moreover, it will provide the first implementation strategy for circularity where representatives of Global North countries have actively engaged with the Global South as a way to rethink trade agreements and as a way to more formally engage the private sector.

| Investing in the Circular Economy

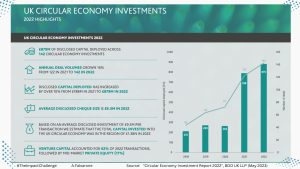

Circular economy investing has been on the rise. Rory McPherson and Todd Mills from global consultancy BDOestimate that, in the UK alone, approximately £1.3 billion of private capital have been allocated to circularity assets in 2022.

The latest update by their team highlights how circular economy investments made up a quarter of total private sector M&A transactions for the year – a 10% increase in capital allocation vs. the prior year.

>>click to zoom in | Source: “Circular Economy Investment Report 2022”, BDO UK LLP

>>click to zoom in | Source: “Circular Economy Investment Report 2022”, BDO UK LLP

While deal volumes see industrial and manufacturing sectors benefiting the most from the circular economy, technology, media and telecommunication investments follow the trend closely.

Private equity investors are recognizing the potential of circular business models to achieve environmental impact and more efficient operational costs in the medium term. It is likely that larger publicly traded companies will follow suit in due time.

| You don’t want to miss this week

From Vlissingen (the Netherlands) to Murcia (Spain), and London, this week offers new opportunities to connect with fellow circularity practitioners both in person and in hybrid mode.

Discover, grow and leave your mark!

〉May 16th: Circular Industry Day (Vlissingen, The Netherlands)*. Hosted by North Sea Port and Smart Delta Resources, the event will have circular cross-border chain collaborations as the central themes of the afternoon, with a focus on the raw materials transition and its associated challenges in and around the North Sea Port – an area with an economic added value of 12.5 billion euros and direct and indirect employment of over 100,000 jobs, of strategic relevance for the energy transition to both the Netherlands and Flanders.

*Note: the event is available only in Dutch.

〉May 17th: Circular Education Lab (Murcia, Spain). Launched as part of the HOOP Project portfolio, the aim of the Lab is to raise circular awareness among the inhabitants of Murcia. The city has developed a comprehensive Circular Economy Strategy, with the objective of becoming 100% circular by 2050. Most circular actions in Murcia are targeted at tourism, agriculture and trade, with a special focus on bio-waste. The Lab has become the flagship circular economy meeting point in the city.

〉May 16th – 17th: Rethinking Materials: Innovation and Investment Summit (London, UK). The theme of this year’s summit, Scaling Materials Innovation for Decarbonization and a Circular Economy, aims at reimagining how materials in consumer goods, packaging and textiles are produced, consumed, repurposed, and financed. Among others, expert talks by Mesbah Sabur, the founder of Circularise, Nick Thompson from DS Smith, Beth Murphy from PA Consulting, Marco Jansen from Braskem, and Garrett Quinn, Chief Sustainability Officer at Smurfit Kappa Ireland, will highlight the opportunities and challenges in building and adopting sustainable materials, and aid the race to decarbonize.

Off to another impactful week!

| about

Alessia Falsarone is executive in residence, practitioner faculty at the University of Chicago, where she leads the Circular Economy and Sustainable Business program. The article is based on the author’s newsletter A Week of Circularity from the innovation knowledge hub.

| All opinions expressed are those of the author and/or quoted sources. investESG.eu is an independent and neutral platform dedicated to generating debate around ESG investing topics.