INSIGHT by Kate Whiting, Senior Writer, Forum Agenda. This article was originally published on the World Economic Forum.

〉Ecuador has signed a landmark debt-for-nature swap agreement to raise funds to protect the Galapagos Islands.

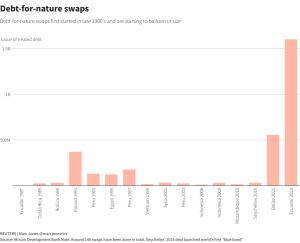

〉The financial instrument has been around since the 1980s, with 140 such deals made to date.

〉But what exactly are debt-for-nature and debt-for-climate swaps, and do they go far enough to help countries reduce their debt and take climate action?

The future looks more hopeful for the giant turtles of the Galapagos Islands thanks to Ecuador’s innovative “debt-for-nature” swap that raises money to protect the endangered ecosystem.

Millions will go towards conservation on the archipelago from the sale of a new “blue bond” that will mature in 2041, Reuters reports.

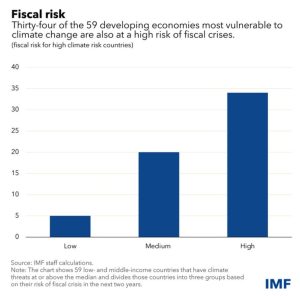

By 2050, it will cost between $3-6 trillion a year globally to mitigate climate change, according to the IMF. But while developed economies are better off, more able to afford the transition and invest in mitigation efforts, there are big funding gaps for emerging economies.

| Funding the green transition

Emerging markets require $95 trillion to transition, according to a 2022 report from Standard Chartered Bank. They’re the countries most vulnerable to climate change and with the most debt, meaning they’re at risk of fiscal crisis, says the IMF.

This is where innovative financing models like debt-for-nature or debt-for-climate swaps can help, as participants at the World Economic Forum’s Growth Summit 2023 agreed during a panel session on Squaring the Circle: Delivering on Growth, Jobs and Climate.

Rania Al-Mashat, Minister of International Cooperation, Ministry of International Cooperation of Egypt, which holds the Presidency of COP27 said: “Debt-for-nature swaps or debt-for-energy-transition swaps is where the world needs to push further.”

| What are debt-for-nature swaps?

Debt-for-nature swaps have been around for decades – as this 1990 paper from the World Bank shows. They were first envisioned by the WWF’s Thomas Lovejoy in a New York Times article back in 1982 that advocated conservation groups use debt-equity swaps to raise money locally.

In essence, they are a financial instrument that allows countries to free up fiscal resources to build resilience against the climate crisis, and take action to protect nature while still being able to focus on other development priorities without triggering a fiscal crisis.

As the IMF’s Managing Director, Kristalina Georgieva, explains: “Creditors provide debt relief in return for a government commitment to, say, decarbonize the economy, invest in climate-resilient infrastructure, or protect biodiverse forests or reefs.”

Debt-for-nature swaps are viewed by many as a win-win where the country reduces its external debt while benefiting nature and environmental groups involved in the deal, and banks profit from selling on the debt.

| Which countries have debt-for-nature swaps?

The first debt-for-nature agreement was signed between US-based environmental non-profit Conservation International and Bolivia in 1987. Since then, Costa Rica, the Philippines, Belize, Barbados and Seychelles, among others, have all entered into similar agreements – with around 140 swaps in total.

>> click to zoom in | Debt-for-nature swaps began in the 1980s and are growing in size. Image: Reuters

>> click to zoom in | Debt-for-nature swaps began in the 1980s and are growing in size. Image: Reuters

In the case of Ecuador, the world’s biggest debt-for-nature swap saw Credit Suisse help the government buy back around $1.6 billion of debt for $644 million, saving the country around a billion dollars in repayments over 17 years, Reuters reports.

In return, the government has committed to spending $18 million dollars annually for 20 years on conservation in the Galapagos, including protecting a marine reserve set up last year, which is used as a migratory corridor by sharks, whales, sea turtles and manta rays.

The old debt will be replaced with a cheaper-to-service $656 million “Galapagos Bond” maturing in 2041 and insured by the US International Development Finance Corporation.

Ecuador’s Foreign Minister Gustavo Manrique Miranda said biodiversity was now a valuable “currency”.

| Do swaps go far enough?

Al-Mashat told the Forum’s Growth Summit panel that the current global economic climate, with increased risk perception, has made concessional finance mechanisms more needed now than ever. But debt swaps at their current size aren’t enough to ensure a just transition.

“Debt-for-climate swaps are seen as a way to create more space for the transition in countries, but they are also done in very small amounts, not in amounts that are going to help,” she said.

Egypt has a debt swap with Germany under its NWFE platform, which funds renewable energy projects, but in terms of the total amount of investment needed for the transition, Al-Mashat said the swap was “symbolic”.

For swaps to really have an impact, “the number and size of transactions must be scaled up significantly”, the IMF’s Georgieva said.

“This means addressing barriers to scale and improving the financial terms under which swaps are conducted,” she added.

While they can take a long time to negotiate and come with their own risks, the recent Ecuador example shows such swaps are growing in size and could become increasingly beneficial to more countries in future.

| The views expressed in this article are those of the author alone and not the World Economic Forum.

| All opinions expressed are those of the author and/or quoted sources. investESG.eu is an independent and neutral platform dedicated to generating debate around ESG investing topics.

>>click to zoom in

>>click to zoom in