INSIGHT by IEEFA Asia

More financiers are committing to limiting capital for fossil fuel while their O&G-sector borrowers in the region, though reliant on equity, still approach new energy with a wait-and-see attitude.

The oil and gas (O&G) sector in the Asia-Pacific (APAC) region is likely to find fundraising trickier, particularly to support fresh capacity, according to a new report by the Institute for Energy Economics and Financial Analysis (IEEFA).

O&G company financing is subject to the practices of their financiers, underwriters and advisors. However, more financial institutions are joining a worldwide alliance that is committed to less funding of fossil fuel operations, which include making no new direct investments in upstream production.

“Lenders, bond investors and other finance facilitators need to change their policies significantly to fulfill net-zero commitments, at the same time aligning with the national net-zero targets of their home countries,” says Christina Ng, report co-author and IEEFA’s Research and Stakeholder Engagement Leader, Debt Markets.

“Capital support to the O&G sector in the coming years, particularly on expansion plans, could thus become more elusive.”

The global grouping that is attracting an increasing number of climate and environmental-oriented members is the Glasgow Financial Alliance for Net Zero (GFANZ), formed during the United Nations Climate Change Conference in 2021.

To date, it represents more than 550 organizations from sectors including banking, insurance, asset ownership and asset management. Many are O&G capital and financial services providers that recognize the need to limit fossil fuel financing by 2050 and to meet intermediate targets for 2030 or sooner. These aims to cover all of their operations, not just capital provision.

As GFANZ membership grows further and net-zero targets are strengthened in the near future, capital raising for new O&G production capacity could become harder.

As GFANZ membership grows further and net-zero targets are strengthened in the near future, capital raising for new O&G production capacity could become harder, says Ng and her co-authors, Gaurav Ahuja and Cameron Fairlie of global consultancy firm Arup.

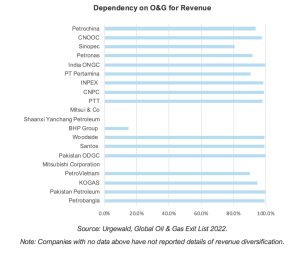

By contrast, O&G companies in APAC are falling behind because, compared to international peers, they rely more on fossil fuel revenue and have limited exposure to non-carbon assets, the authors have found in their research.

“Despite net-zero commitments, the top 20 regional O&G producers generate an average of 96% of their revenue directly from O&G production and related activities, and many still adopt a wait-and-see approach to new energy investments, lagging global peers,” says Ng.

In fact, planned O&G capacity expansion is not uncommon across APAC. Just 10 regional O&G firms with significant growth ambitions in APAC represent 14% of global future planned capacity, and half of them are based in China and Australia.

| Reliance on equity finance

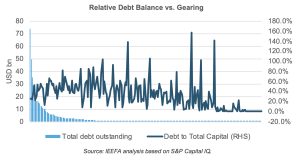

Based on IEEFA’s analysis, O&G companies in APAC are on average more reliant on equity than debt financing as a critical source of capital, with the aggregate debt-to-total capital ratio of 259 companies at roughly 32%.

Larger players exhibit high debt balances but more moderate gearing than their smaller peers, who are more highly geared, according to the research. As such, on a macro level, constraints on debt availability are unlikely to greatly affect production.

On the part of financiers, attempts to curb their funding of existing O&G operating assets may also run up against difficult choices, partly because pulling these funding lines too quickly risks affecting bank balance sheets and financial markets more widely, Ng adds.

In addition, many of the region’s largest O&G producers are state-owned, with O&G contributing significantly to national gross domestic product outcomes. Government-owned or controlled companies generate around 77% of O&G production across APAC.

“Their business models rely on O&G for revenue generation more so than their industrial peers, and this is likely one of the drivers of slower transition investment in APAC compared to other markets,” says Ng.

Even so, the low gearing among O&G companies in APAC suggests that shareholder requirements, rather than lenders’ policies, may drive changes in their attitudes to environmental, social and governance matters more effectively.

The report also identifies six regional companies under the combined criteria of high outstanding borrowings and significant investment plans for O&G production growth.

They are India’s Oil and Natural Gas Corporation, Santos Limited and the Woodside Energy Group of Australia, as well as China National Offshore Oil Corporation Limited, China Petroleum & Chemical Corporation and PetroChina Company Limited.

While these companies do not have high leverage levels, data shows an overwhelming use of bonds as a source of debt capital – the aggregate borrowing of the six companies is made up of 91% bond finance and 9% bank loans.

| Potential for regional GFANZ leadership

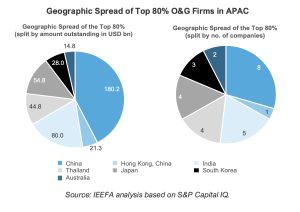

Just 27 of the 259 companies represent 80% of the O&G debt market in APAC, meaning debt capital is concentrated within a select few entities. China and India make up most of the borrowers, with around US$280 billion in O&G indebtedness between them.

To put it another way, lenders and bond investors in China and India account for about two-thirds of the debt capital utilized by the top 27 borrowers in APAC.

Currently, GFANZ’s APAC membership lacks representation from China and India, both of which have significant existing O&G operations and significant expansion plans in the region.

“The size, scale and profile of these two economies suggest a need for their active participation in the global move away from fossil fuels,” adds Ng.

Read the full report

Asia-Pacific lags global oil and gas industry in shift from carbon

| about

Christina Ng oversees a team of financial analysts that provide debt market analysis covering Asia Pacific. She also represents IEEFA at stakeholder forums. Her research of interest includes trends and issues in green and transition finance, policies and regulations, with a focus on the energy sector.

The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (www.ieefa.org)

| All opinions expressed are those of the author and/or quoted sources. investESG.eu is an independent and neutral platform dedicated to generating debate around ESG investing topics.

>>click to zoom in

>>click to zoom in >>click to zoom in

>>click to zoom in >>click to zoom in

>>click to zoom in