INSIGHT by Akanksha Khatri, Head, Nature and Biodiversity, the World Economic Forum. This article was originally published by the World Economic Forum.

〉The European Central Bank (ECB) has added its voice to the number of institutions sounding alarm bells on the economic and financial impact of nature loss.

〉A new ECB report found that nearly three-quarters of all bank loans in the euro area are to companies that are highly dependent on biodiversity.

〉An erosion of biodiversity will hamper companies’ abilities to trade and service their loans, which poses a major financial stability risk.

The European Central Bank (ECB) is the latest institution sounding alarm bells on the threat nature loss poses to the global economy and the financial system in particular.

Preliminary research from the ECB, which sets monetary policy and is tasked with safeguarding financial stability in the 20-nation euro currency area, warns that the risks from degrading nature and biodiversity “can spread to the financial system, potentially triggering instability”.

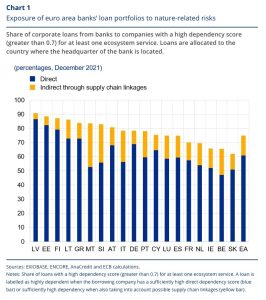

The ECB has started examining the dependence on nature of more than 4.2 million individual companies, representing over $4.58 trillion in corporate loans, and has so far discovered that “nearly 75% of all bank loans in the euro area are to companies that are highly dependent on at least one so-called ecosystem service”. This matters because the impact of continued nature loss will hamper companies’ ability to produce goods and services and they will struggle to service their bank loans – impacting banks’ credit portfolio, and risking the stability of the financial system.

An ecosystem service is defined as “various benefits that humanity obtains from nature”, such as food, drinking water and the storage of carbon by plants. About $44 trillion of economic value generation – over half the world’s total GDP – is potentially at risk as a result of the dependence of business on nature and its services, our New Nature Economy report found.

| Wake-up call for investors

Our natural resources are being degraded at an unprecedented rate, with nearly 1 million species facing extinction because of human activity such as intensive land use, pollution and overexploitation of resources. For example, global resource extraction has tripled during the past 50 years, from 27 billion tonnes in 1970 to 92 billion tonnes today.

The United Nations has calculated that the loss of healthy ecosystems around us could cause a decline in global gross domestic product of $2.7 trillion annually by 2030. That’s $338 for every person on the planet every year.

While much of the research and attention in recent decades has focused on the very direct existential impact on livelihoods, particularly in developing nations, data on the critical and intricate interplay between ecological destruction and the stability of the financial system are relatively recent. These will act as a wake-up call for investors.

| Trading natural capital assets

The ECB’s research complements other initiatives by international finance bodies.

Two years ago, the World Bank along with a number of multilateral development banks (MDBs) which aid economic development across the Americas, Europe, Middle East, Africa and Asia committed to supporting their members to define and enact sustainable strategies.

This includes what they call ‘’mainstreaming nature’’ into analysis investments and operations as well as fostering ‘’nature positive’’ investments which seek to reverse the drivers of nature loss and promote its protection and regeneration.

In 2021, the Inter-American Development Bank launched a new natural capital asset class on the New York Stock Exchange which will help countries to convert their natural assets into financial capital and trade their ecosystem services. Costa Rica was the first country to offer its natural assets to institutional investors.

| Global stocks depend on biodiversity

In April, a PwC analysis of 19 large stock exchanges globally showed that more than half the market value – nearly $45 trillion – of listed companies is subject to nature-related risk.

The ECB research has identified two main ways nature impacts companies and banks – physical risks and transition risks.

Physical risks include increasingly severe natural disasters or a decline in pollinating insects leading to falling crop yields, impacting the food, tourism and pharmaceutical industries to name but a few.

The transition risks for banks and their borrowers refer to the impact of government policies and measures to protect the environment which would limit the exploitation of natural resources. Technical innovation and changes in consumer and investor sentiment can push up risks and costs for companies being forced to adapt.

An ECB member, De Nederlandsche Bank, found that Dutch financial institutions have €510 billion in exposures to nature loss risk, while the Banque de France found that “42% of the value of securities portfolios held by French financial institutions consists of securities issued by companies dependent on at least one ecosystem service”.

| Sovereign credit downgrades already on the cards

Public finances are also under threat and, in the worst-case scenario, many developing nations could face bankruptcy, according to a study by the Bennett Institute for Public Policy at the University of Cambridge.

Researchers at the Institute developed the world’s first biodiversity-adjusted sovereign credit ratings for 26 nations and concluded that India and China are already on course to have their sovereign debt downgraded by one and two notches respectively as early as 2030 under a business-as-usual scenario.

Across the 26 countries, these downgrades would increase the annual interest payment on debt by up to $53 billion a year, “leaving many developing nations at significant risk of sovereign debt default”.

| Rallying to reverse nature and biodiversity loss

Last year, 195 nations and the European Union signed a landmark agreement – the Kunming-Montreal Global Biodiversity Framework – to halt the destruction of biodiversity and nature loss. They committed to protecting 30% of the Earth’s lands, oceans, coastal areas and inland waters by 2030; reducing harmful government subsidies by $500 billion annually and cutting food waste in half.

They also pledged to raise international financial flows from developed to developing countries, in particular least-developed countries, Small Island Developing States, and countries with economies in transition, to at least $30 billion per year to restore natural ecosystems.

The ECB has also vowed to play its part in ensuring the loss of nature will not lead to another great financial crisis. “Our economy relies on nature. Thus, destroying nature means destroying the economy,’’ it said. “We as ECB have to take nature-related risks into account in the pursuit of our mandate.’’

| The views expressed in this article are those of the author alone and not the World Economic Forum.

| All opinions expressed are those of the author and/or quoted sources. investESG.eu is an independent and neutral platform dedicated to generating debate around ESG investing topics.

>>click to zoom in

>>click to zoom in