INSIGHT by Jolene Tan, Communications Lead, Trase

Forests are central to addressing the world’s climate and biodiversity crises. They capture and store carbon, play a critical role in the water cycle, and offer homes to countless species. For financial institutions pursuing net-zero and nature-positive portfolios, action on forests is a key priority.

Achieving this requires a close look at exposure to agribusiness and dependencies on soft commodity supply chains. Scientists estimate that agriculture drives over 90% of global tropical deforestation, and much of the produce – particularly of soy, beef, palm oil, cocoa and wood pulp – is internationally traded. Forests in South America, Southeast Asia and West and Central Africa are cleared and degraded to feed livestock and stock supermarkets across the world.

Growing recognition of these links has increasingly put transnational commodity supply chains on the regulatory agenda. The EU’s new Deforestation Regulation (EUDR) will require businesses to show that key commodities placed on the EU market or exported from the EU were not produced on recently deforested land or in breach of relevant environmental regulations in their countries of origin. Similar legislation is in the works in the UK and several US states. Public pressure is also mounting in a number of jurisdictions for mandatory due diligence on deforestation to extend to the finance sector.

While these developments have recently gained greater prominence, high quality data on supply chain deforestation has been available for some time. Trase was founded in 2015 by the Stockholm Environment Institute and Global Canopy to bring transparency to the international trade and financing of forest risk commodities. To date, Trase has mapped nearly 70% of global trade in forest risk commodities, making it the world’s most comprehensive open-access database on this trade.

Free online tools on the Trase platform cut through the complexity and opacity of supply chains, revealing how supply chain actors are linked to deforestation in specific producing areas. By presenting a high-resolution view of commodity flows from regions of production through to exporting and importing ports, Trase shows where deforestation linked to these flows is concentrated, and quantifies how specific importers and exporters are exposed to it.

Asset managers such as Storebrand Asset Management and First Sentier Investors have successfully used Trase data to tackle exposure to deforestation in their portfolios. Trase offers them a standardised and comparable basis for identifying and prioritising commodity trading companies exposed to deforestation. Detail on the regions and commodities of greatest interest for each company also supports more targeted and data-driven stewardship and company engagement. Geographic specificity is important, as commodity-driven deforestation can vary significantly between sourcing regions.

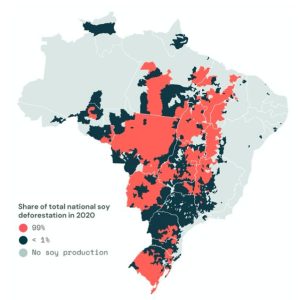

Of a total of around 2,400 soy-producing municipalities, only 569 together accounted for 99% of Brazil’s soy deforestation in 2020. Source: Trase

High-resolution supply chain data likewise fruitfully supports due diligence processes by lenders and investors. In April 2023, SEI, Global Canopy and Neural Alpha jointly published step-by-step guidance for financial institutions on how to implement due diligence processes to identify, prevent and mitigate the risks and impacts of deforestation, conversion and associated human rights abuses. This how-to guide puts into context how to understand and apply deforestation data, including from Trase.

Trase data will also be incorporated into Forest IQ, a new tool launching towards the end of 2023. Bringing together market-leading corporate deforestation data for the first time, Forest IQ is specifically designed to support financial institutions to confidently eliminate deforestation from their portfolios. Forest IQ will synthesise data from leading providers including Forest 500, Trase, ZSL Spott, RSPO and FAOSTAT, and assess the results against three core metrics to provide comparable data on exposure, materiality and performance of over 2,000 companies who produce, process, trade or use forest risk commodities.

The urgency of action on biodiversity and the climate has become clearer every day. The good news is that for financial institutions looking to achieve deforestation-free portfolios, there is now a wealth of data, tools and guidance tailored to support this journey. Effective action can start today.

| brief bio

Jolene is the Communications Lead for Trase. Before joining Trase in 2021, she worked for a decade on research and policy communications in Singapore, with a particular focus on equalities and human rights. A lawyer by training, with experience as a capital markets and financial regulation solicitor, she holds an LL.M. from Harvard Law School and a B.A. in Law from the University of Cambridge.

| about

Trase is a data-driven transparency initiative that is revolutionising our understanding of the trade and financing of commodities driving deforestation worldwide. Its unique supply chain mapping approach brings together disparate, publicly available data to connect consumer markets to deforestation and other impacts on the ground. Trase’s freely-available online tools and actionable intelligence enable companies, financial institutions, governments and civil society organisations to take practical steps to address deforestation.

| All opinions expressed are those of the author and/or quoted sources. investESG.eu is an independent and neutral platform dedicated to generating debate around ESG investing topics.