INSIGHT by Robert Gardner, Co-Founder of Rebalance Earth

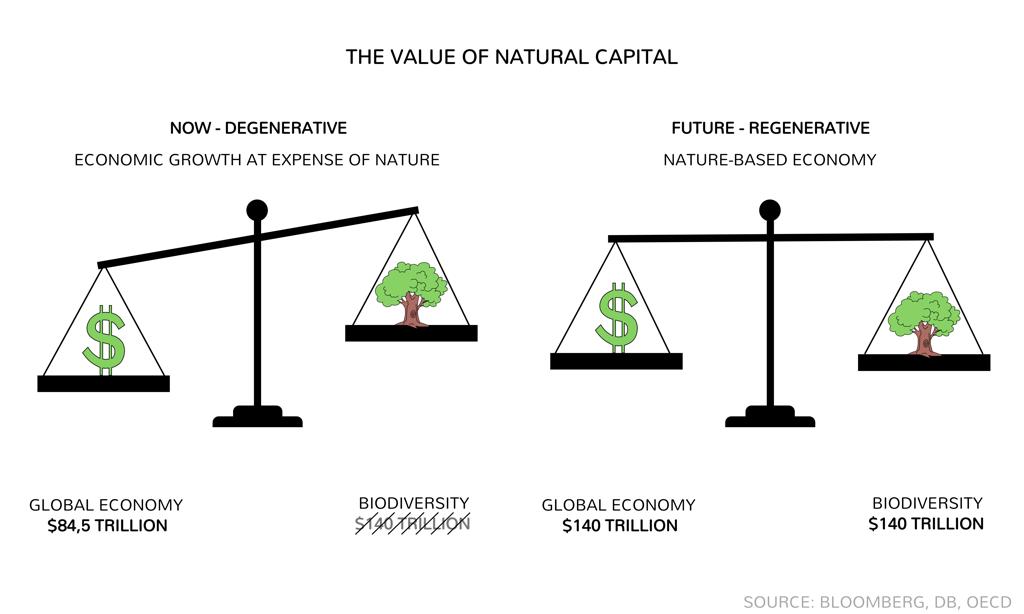

Have you ever wondered what the most valuable asset class in the world might be? Is it equities, or could it be real estate? You might be surprised to learn that it’s neither… What comes to mind when considering the value of Nature’s ecosystem services? These services — crop pollination, water purification, flood protection and carbon sequestration — are vital to our well-being. They also have an estimated value of $125-140 trillion annually, nearly one and a half times greater than the global economy.1

Nature represents the original asset—the foundation of our existence and society. From the food we eat to the water we drink and the air we breathe, our dependency on Nature is total.

While the past 50 years have witnessed significant economic growth, it has come at the expense of Nature. Our current economic model is extractive, fixated on short-term gain at the expense of long-term environmental impacts. This has led to the total exploitation of Nature. The decline has outpaced any other time in human history, accelerating species disappearance to 1,000 times faster than the natural extinction rate. We now face the prospect of the sixth great extinction, with up to 1 million species at risk.

| As investors, we face twin risks: Climate Change and Nature loss.

With increasing environmental degradation due to factors such as climate change, deforestation, habitat destruction, invasive species, overexploitation, and pollution, our economy’s foundation is being eroded.

Our economy’s reliance on Nature is evident: PWC’s research reveals that ‘55% of the world’s GDP is exposed to material Nature risks.’ Similarly, S&P Global notes that 85% of the largest companies significantly depend on Nature in their operations. The European Central Bank (ECB) estimates that 75% of bank loans to Eurozone companies rely heavily on ecosystem services provided by Nature.

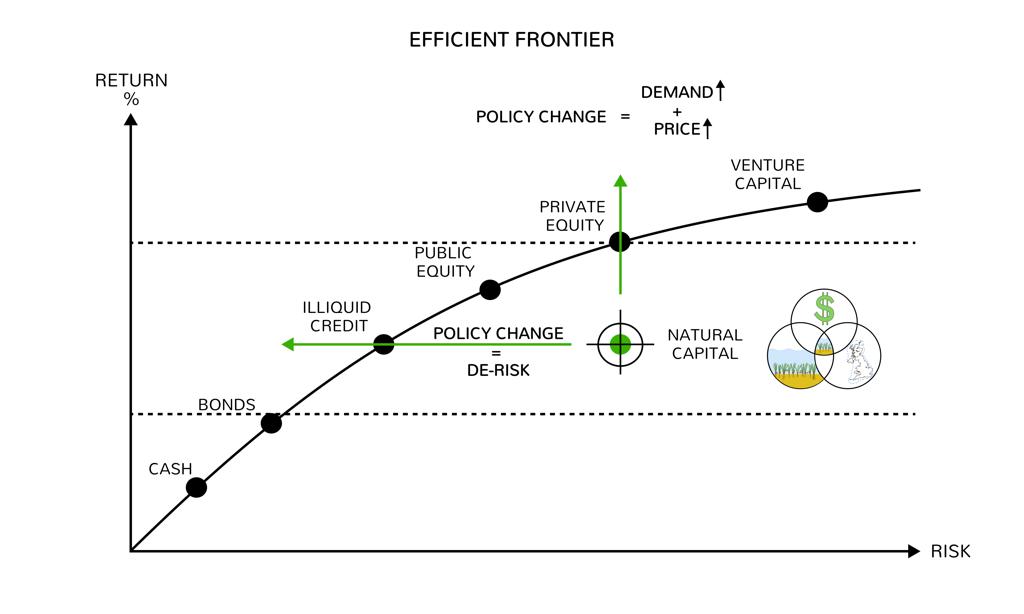

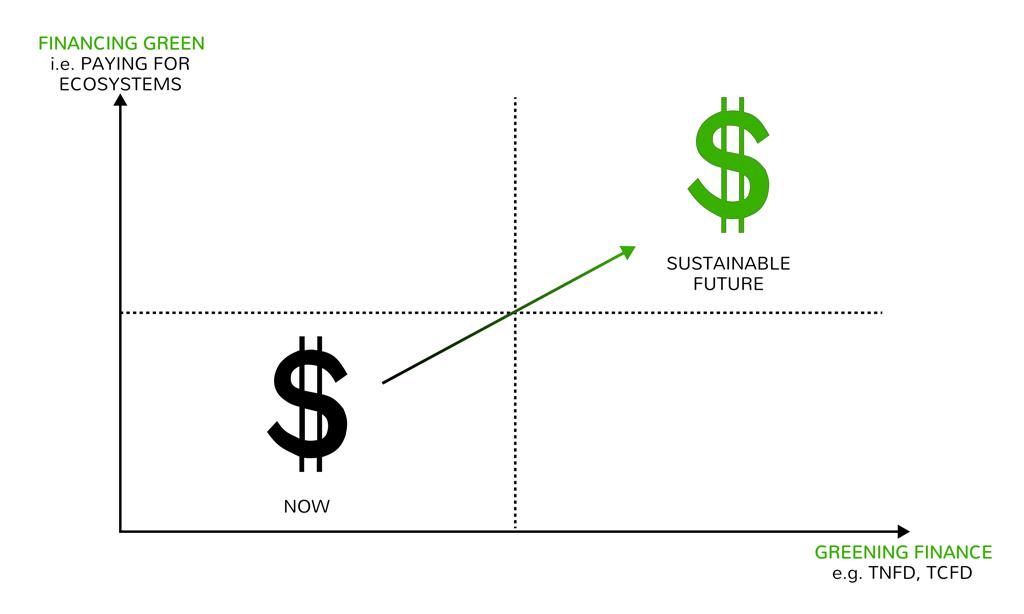

The issue is that the planet’s health is not on anyone’s balance sheet or profit and loss. Our current reporting system doesn’t factor in the negative externalities of CO2 emissions, habitat destruction or pollution, allowing companies to generate revenue and profits without acknowledging their Nature-related dependencies and risks. This demonstrates the significance of financial disclosure — the ‘F’ in both the Task Force on Climate-Related Financial Disclosures ‘TCFD’ and The Taskforce on Nature-related Financial Disclosures ‘TNFD’. As long-term asset owners and investors, we care because we know the world affects companies, and companies affect the world.

From the perspective of double materiality under TNFD, companies will internalise their negative externalities due to new financial disclosures, forcing recognition of their nature-related dependencies, impacts, risks, and opportunities. Investors will now see both the impact of companies on Nature and the impact of Nature on companies’ business models. Since the launch of TNFD in September 2023, companies have started to understand and report on their Biodiversity and Nature risks and opportunities. AXA, GSK, Iberdrola, and UBS have led with their reports.

| Without Nature, we possess nothing:

In the words of William Mitchell from Deloitte, “Unless we redirect the flows of finance, we risk funding our own demise, endorsing an extinction not just of species, but of economic viability and human potential.” The situation appears bleak. However, although our current way of life is unsustainable, opportunity remains. We must adopt a twofold approach— ‘Green Finance’ – integrating negative externalities into financial decisions – and ‘Financing Green’ – recognising the value in paying for Nature’s ecosystem services.

‘Green Finance’ is advancing, largely thanks to the International Sustainability Standards Board ‘ISSB’s sustainability disclosure standards integrating with TCFD and TNFD. These standards provide investors and financial institutions with dependable, consistent data on companies’ environmental impacts and climate risks. Standardised sustainability reporting gives greater confidence in pricing climate and nature-related risks and opportunities.

Consider the food and drink industry, which relies on abundant pollinators, healthy rivers and soils. Engaging with companies on resilient supply chains enables investors to back sustainably aligned businesses, creating a knock-on effect as businesses collaborate with suppliers to implement regenerative agriculture practices, restoring rivers and habitats whilst reducing their carbon footprint.

‘Financing Green’ involves paying for Nature’s invaluable ecosystem services. For example, if all pollinators in the UK were to vanish, replacing the work of one bumblebee nest would require approximately 20 farmers and cost over £1.8 billion annually when expanded across the whole UK sector.2

The key outcome of COP15 last year is a new Global Biodiversity Framework guiding global action to halt and reverse nature loss by 2030. This includes goals such as conserving 30% of lands and oceans, preventing extinctions, restoring ecosystems, reducing pollution, increasing financing, and ensuring the benefits of biodiversity to people.

Have you already read?

〉Four ways any company can become ‘nature positive’ and help transition to a world worth living in

Achieving this requires $700 billion of private sector money annually worldwide. That’s less than the United States military defence budget and its interest rate costs on its national debt. This means in the UK, our scaled-down financing gap is around $14 billion (£10 billion) annually. DEFRA has said the private sector needs to invest over £1 billion in restoring Nature by 2030. However, the current investment stands far below that at around £100 million. This means we need to increase funding here in the UK by a factor of 100.

The notion of Nature-as-a-Service ‘NaaS’ highlights the need to invest in conserving and regenerating Nature. For billions of years, we have used Nature’s ecosystem services at no cost, taking advantage of an apparently unlimited ‘Free Trial’ period. Now, we must ensure the continued provision of these services and upgrade to the ‘Nature Premium Plan’ by investing in conservation, restoration and regeneration at scale.

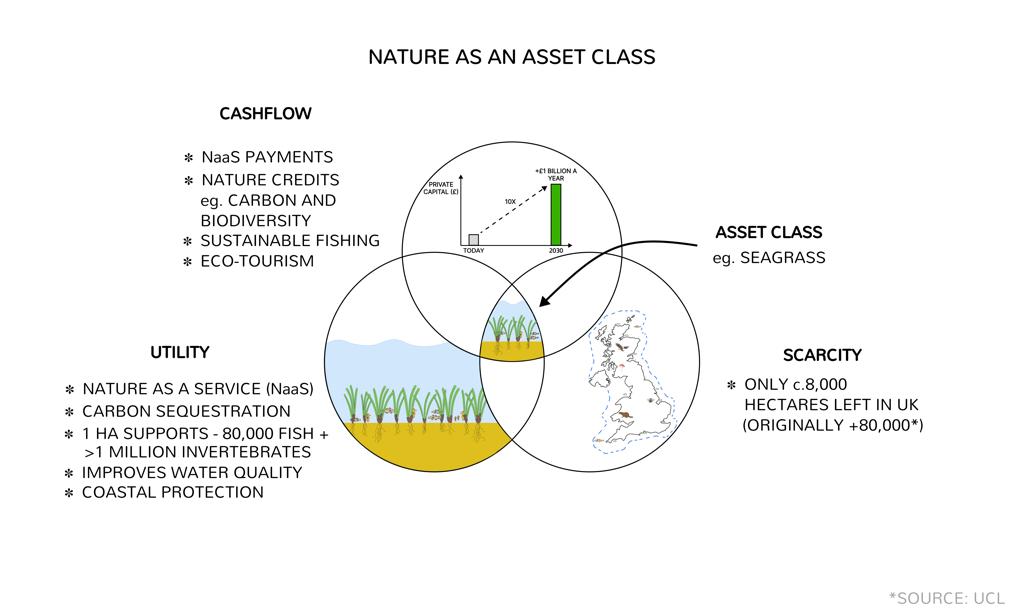

How? The finance industry needs to embrace Nature as an asset class, which can be done if you apply the three key attributes that define an asset – utility, scarcity, and cash flow.

Does Nature have utility value? Yes! Seagrass meadows have been offering free beneficial services throughout history. As a ‘NaaS’, seagrass shelters juvenile fish as a nursery habitat, boosting fisheries’ productivity and catch without expectation of payment. It filters water, improving quality and clarity at no cost to humans. By stabilising sediment and reducing the power of waves, seagrass also delivers a free premium service of shoreline storm and erosion protection. Whilst capturing and storing carbon dioxide, providing a free climate regulation service. This makes seagrass an invaluable factor in coastal infrastructure and worth investing in.

Does Nature have scarcity value? Yes! The global decline of seagrass due to human impacts threatens the existence of these free services. Once plentiful, seagrass meadows have shrunk by over 90% from around 80,000 to 8,000 hectares. As they disappear, their importance and scarcity surge in value. Yet more significant are the potential economic and environmental costs associated with its loss. We must invest at scale in the conservation and restoration of our seagrass meadows in the UK before it’s too late. The same applies to other natural habitats in the UK that provide valuable free services, such as salt marshes, wetlands, rivers, hedgerows, peatlands, and woodlands.

Does Nature have cash flow potential? Yes! Seagrass meadows have substantial cash flow potential for the local communities and businesses. They provide breeding and feeding grounds for juvenile fish species, including bass, plaice, and pollock, which have commercial value if fished sustainably. This supports the local fishing industry, creating jobs. Protecting and restoring seagrass and our marine environment will mean indicator species such as seahorses return, an excellent proxy for a healthy ecosystem.

This, in turn, enhances tourism, drawing in snorkelers, divers, and nature enthusiasts. A sustainable tourism industry generates income for coastal regions, further contributing to the cash flow associated with seagrass. In addition, Seagrass meadows are among the most efficient carbon sinks in the world. They account for 10% of the ocean’s carbon storage capacity despite occupying only 0.2% of the sea floor. They can capture carbon 35 times faster than tropical rainforests.3

A report by the Intergovernmental Panel on Climate Change (IPCC) found that mangroves, salt marshes and seagrass meadows can store up to 1,000 tonnes of carbon per hectare, much higher than most terrestrial ecosystems. Restoring half our lost seagrass could create over £1 billion in stored blue carbon. This illustrates the incredible environmental and social benefits and financial value-generation potential of large-scale investment into seagrass regeneration, providing sustainable fisheries, ecotourism, recreation, and coastal protection benefits whilst helping with climate change mitigation.

| Nature is, without a doubt, the most valuable asset class.

The current biodiversity and climate crises highlight the urgency of recognising Nature as a financial asset and investing in its protection and restoration. To affect change, we must ‘Green Finance’, holding companies accountable for their environmental impact and helping them transition to a significantly lower environmental impact. Simultaneously, we must embrace the concept of ‘Financing Green’, paying for the vital ecosystem services that Nature provides. Together, this dual approach enables the flow of capital to protect and restore Nature in the UK and worldwide, helping to create a world worth living in for many future generations.

| brief bio

Robert Gardner is a money expert, entrepreneur, and financial activist on a mission to make money a force for good for people and the planet to create ‘financial wellbeing in a world worth living in’.

As a father of two, Rob understands the importance of financial education and long-term financial freedom. His life’s work has been to make money relatable and easy to understand, helping empower financial literacy in everyone from primary school children to pensioners.

In 2012 Rob co-founded RedSTART, a financial education charity which aims to plant the seeds for the financial freedom of young people. In 2016 he wrote the children’s book Save Your Acorns to help make conversations about money an ongoing part of family life. In addition, he has delivered a TEDx talk on financial education among young people titled, ‘If You Leave Your Children One Thing, Make It This…’ He is regularly asked to speak about making money a force for good, having appeared on, or been invited to comment in, BBC Radio, Daily Mail, Daily Mirror, Good Housekeeping magazine, The FT, Sky News, The Times, etc.

In 2006, Rob shook up the UK’s pensions market with the launch of Redington. Now a leading investment consultancy whose mission is to create financial wellbeing for 100 million people in a way that protects the planet’s future. Having studied Geography at the University of Oxford, Rob’s love of glaciers and passion for the planet’s prosperity have heavily influenced his role in financial services. Responsible investment and using his position and expertise to drive better businesses for the earth and its people was a crucial part of his previous role as St. James’s Place’s (SJP) Director of Investments. In addition, Rob is a member of the World Economic Forum and sits on their retirement council.

Rob is now a co-founder of Rebalance Earth, whose goal is to make money a force for good to help reverse climate change and biodiversity loss. By creating high-integrity biodiversity credits. That puts a monetary value on nature based on its ability to absorb carbon, protect, and grow biodiversity, and support local communities that preserve it. Companies buy these credits as the most effective, quick, and verifiable way of being nature positive and achieving net zero.

(1) Tony Juniper, Natural England

(2) Tony Juniper, Natural England

(3) UNEP (2019) Seagrass—secret weapon in the fight against global heating.

| All opinions expressed are those of the author and/or quoted sources. investESG.eu is an independent and neutral platform dedicated to generating debate around ESG investing topics.