INSIGHT by Dr Nicola Ranger, Resilience and Development programme lead and Dorian van Raalte, Research Assistant, University of Oxford

Recent analysis by the UN Environment Programme found that investment in nature-based solutions must almost triple by 2030 to $542 billion if we are to meet global climate, land and biodiversity targets.

Several barriers have long held back the development of these markets for nature-based solutions (NbS), including the relatively long investment times and higher risks versus returns, the lack of a supportive policy environment and the need for specialist expertise. Consequently, investment levels have struggled to exceed $200 billion per year and much of this (eighty-two percent) comes from the public sector. To achieve our nature and climate goals requires a significant scale up in private sector investment in nature protection and recovery.

New research by the University of Oxford with the Global Center on Adaptation signals green shoots of optimism. The study analyses the structures of transactions in the market and develops a database of twenty-five of the largest emerging markets focused specialist nature funds to learn what works in delivering nature finance at scale. This complements work to develop new geospatial analytics and tools for data-driven investment in Bangladesh.

| Different shades of NbS investment

The study finds that many areas of investment in NbS do bring attractive returns today. Most existing nature-based investments are in established economic sectors that do deliver well understood and attractive commercial returns, including investments in sustainable or improved practices in agriculture and forestry. Moving at pace to accelerate investment in nature-positive value-chains in these sectors can bring major benefits both for the resilience of local communities and global supply chains, as well as biodiversity gains and commercial returns.

Investment in conservation projects and so-called green infrastructure like mangroves are still more challenging and offer less attractive returns, but there are growing opportunities like ecotourism. Biodiversity and carbon-related markets are growing but poorly designed schemes also bring risks both to investors and local communities. Difficulties in measuring and monetising the biodiversity and resilience gains (and losses) from NbS projects mean that investments can be skewed more toward activities that deliver a carbon benefit and may not lead to the best outcomes for people or the planet. To overcome this, public investment is needed in data, tools and market-based approaches to value the non-carbon benefits of projects robustly and consistently and engage local people.

Have you already read?

| Specialists acting as important trailblazers

The study points to the critical role played by blended finance and development finance institutions (DFIs) in de-risking transactions and the need to power-up these facilities. But it also reveals the important role being played by trailblazing specialist nature funds and investment managers, who bring deep knowledge of local contexts, and can connect global capital to high-impact local projects successfully. While these actors have struggled to raise significant levels of private sector capital on commercial terms and are modest in size, they are able to deliver outsized impact and complement other actors such as DFIs through structuring impactful transactions, executing blueprint transactions and contributing to a collective knowledge base. Growing this important ecosystem of actors is vital and a key recommendation of the research.

| Mainstream actors dipping their toes into nature finance

The growing demand from investors is also clear. We see institutional investors and larger asset managers beginning to enter the ecosystem bringing scale and speed to complement the skill and precision of the specialists, and several new partnerships forming, including from big players like HSBC, NATIX, Schroders and Lombard Odier, with assets under management ranging from $200 to 1200 billion. These actors are adept at raising private sector capital, and we are likely to see their strategies mobilise greater private sector capital than first-mover specialist nature funds which have relied heavily on less commercial pockets of capital.

| Data-driven investments for nature-based solutions

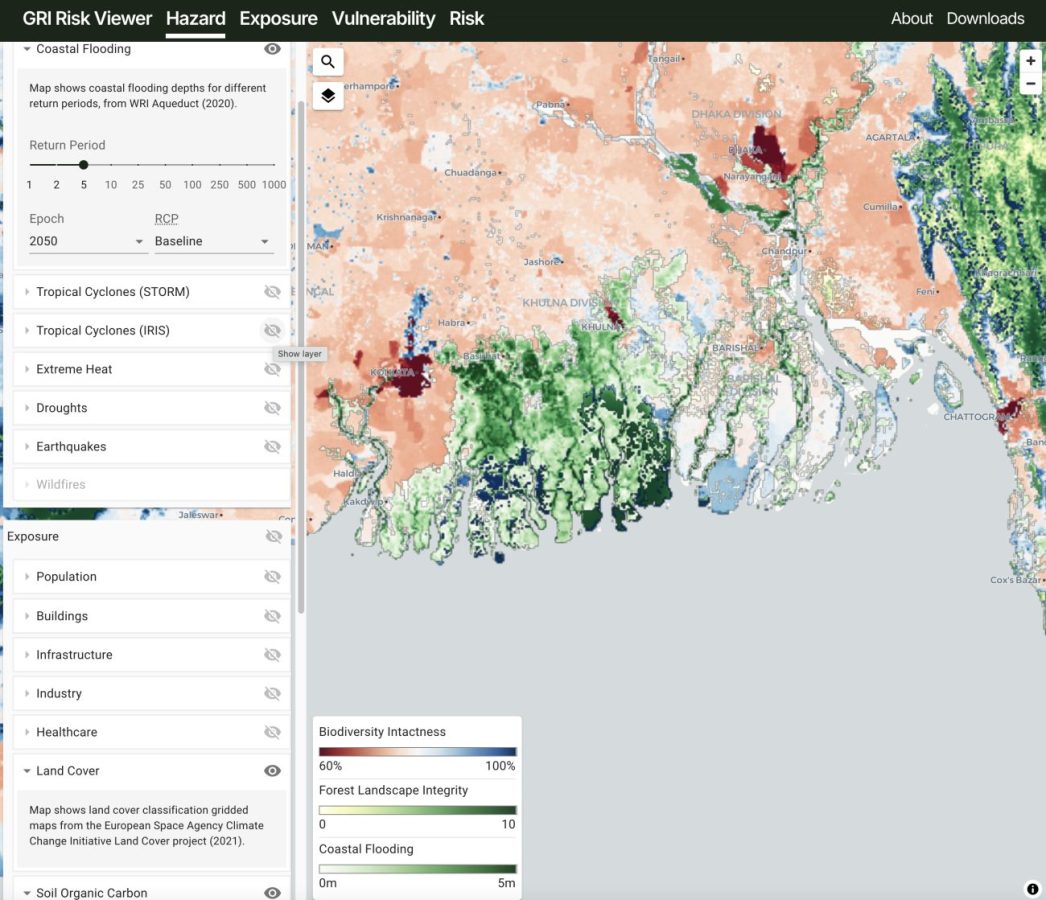

New technologies offer significant opportunities to more rapidly identify and assess viable nature-based investments and measure and monitor their outcomes for people and planet. Here, the University of Oxford is working with the Global Center on Adaptation in Bangladesh to pilot new approaches combining remote sensing, modelling and geospatial analysis to identify opportunities for investment in Mangroves and value their carbon, resilience and biodiversity benefits, making data available through the new Resilient Planet Data Hub.

Figure: Geospatial mapping of biodiversity intactness, forest integrity and coastal flood zones in Bangladesh.

Source: Resilient Planet Data Hub and Environmental Change Institute, University of Oxford

| Time for the public sector needs to step up

Finally, the study underlines the important role of government and regulators in enabling these markets, including through improving disclosures, encouraging the integration nature-related risks and opportunities into financial and corporate decision making and laying the groundwork of policies to build markets both globally and in recipient countries. In order to achieve scale, the public sector needs to step up and take a leading role in turbo-charging blended finance for nature, and setting the policy environment to align finance with biodiversity and climate goals.

The 25 Specialist Nature Funds and their Investment Managers studies are listed below:

| Fund Name | Investment Manager | HQ | Est. | Status | AUM $M |

|---|---|---|---|---|---|

| Climate Investor Two | Climate Fund Managers | NL | 2021 | Active | 855 |

| Eco. Business Fund | Finance in Motion | DE | 2014 | Active | 750 |

| Natural Capital & Nature Based Strategies | Climate Asset Management | UK | 2020 | Active | 750 |

| Natural Capital & Nature Based Strategies | Climate Asset Management | UK | 2020 | Active | 750 |

| Sustainable Water Impact Fund | RRG Capital Management | US | 2019 | Active | 710 |

| Aqua-Spark | Aqua-Spark Management | NL | 2013 | Active | 470 |

| &Green Fund | Sail Ventures | NL | 2017 | Active | 410 |

| Tropical Asia Forest Fund I & II | New Forests Asset Management | AU | 2008 | Active | 370 |

| African Forestry Impact Platform | New Forests Asset Management | AU | 2022 | Active | 300 |

| AgDevCo | AgDevCo | UK | 2008 | Active | 280 |

| Land Degradation Neutrality Fund | Mirova | FR | 2018 | Active | 210 |

| Global Fund for Coral Reefs | Pegasus Capital Advisors | US | 2020 | Active | 205 |

| Restore Fund I | Goldman Sachs Asset Management | US | 2021 | Active | 200 |

| Restore Fund II | Climate Asset Management | UK | 2023 | Active | 200 |

| Subnational Climate Fund | Pegasus Capital Advisors | US | 2020 | Active | 170 |

| Livelihoods Carbon Fund #3 | Livelihoods Venture | FR | 2021 | Active | 150 |

| Althelia Sustainable Ocean Fund | Mirova | FR | 2018 | Active | 130 |

| Althelia Climate Fund | Mirova | FR | 2013 | Active | 120 |

| EcoEnterprises Partners III | EcoEnterprises Management | US | 2018 | Active | 110 |

| Arbaro Fund | Finance in Motion | UNIQUE Group | DE | 2018 | Active | 110 |

| Latin American Green Bond Fund | Finance in Motion | DE | 2021 | Active | 100 |

| AGRI3 Fund | Cardano Development | FOUNT | NL | 2017 | Active | 95 |

| IDH Farmfit Fund | IDH Investment Management | NL | 2020 | Active | 90 |

| Livelihoods Fund for Family Farming | Livelihoods Venture | FR | 2015 | Active | 85 |

| The Livelihoods Carbon Fund #2 | Livelihoods Venture | FR | 2017 | Active | 65 |

This report is a first output from the project “Global Tools to Unlock Capital for Investments in Nature-Based Solutions” of the Global Center on Adaptation in partnership with the Environmental Change Institute (ECI) at the University of Oxford. This first output, completed by the Resilient Planet Finance Lab at the ECI and led by Dr Nicola Ranger, reviews the status of nature finance globally, to learn from the role played by nature-focussed funds and their investment managers, understand what works, and draw conclusions for how we might mobilise more financing for nature-based solutions for adaptation. This knowledge will inform a roadmap and toolkit for identifying viable investment modalities in Bangladesh. The Global Center on Adaptation (GCA) in partnership with the University of Oxford, under the leadership of Professor Jim Hall and Dr Ranger, is conducting research that supports the broad goal of scaling up investments in Nature-Based Solutions (NBS) as a key strategy for delivering resilient infrastructure systems and services. The research is supported by UK International Development under the Bangladesh Climate and Environment Program (BCEP). These recommendations outlined here will be deepened in the second phase of research due in 2024. See also our interactive case study.

Explore the report

| All opinions expressed are those of the author and/or quoted sources. investESG.eu is an independent and neutral platform dedicated to generating debate around ESG investing topics.