INSIGHT by Campbell Powers, Data Fellow , Salesforce; Claudia Ukonu, Growth Lead, Uplink, World Economic Forum. This article is part of the World Economic Forum Annual Meeting and was first published by the World Economic Forum.

〉The rapidly expanding impact investing world is turning to data as the lynchpin of decision-making.

〉Technology like AI and non-traditional data sources can contribute to a holistic approach on data.

〉Development of data-poor areas like the Global South is a prerequisite to an equitable investing ecosystem that focuses on social justice.

Since consumer choice drives many contemporary market forces, higher media consumption after 2020 has led to a growing focus among certain types of investors on the ethical, social, and environmental facets of the organizations to which they give their money. A critical mass has formed, loudly demanding transparency and responsibility.

As these sentiments ring across the boardroom of every industry, a re-evaluation of traditional norms – broadly encapsulated under the term “impact investing” – has received increased attention. Financial institutions, the catalyst for this change and the arbiter of the traditional, “best for the bottom line” mindset, face the challenge of aligning investment solutions with the evolving values of their clients who seek avenues that not only yield returns but also contribute positively to societies and the planet.

These institutions have turned to data to communicate the beneficial impact of their funds to investors. With the Global Impact Investing Network (GIIN) estimating the market size for impact investing reaching $1.164 trillion in 2022, with continued expansion in the future, the potential for enormous growth, and risk, demands a data-driven approach to ensure trust and transparency.

| Combatting scepticism with data

Yet, amid this transformative acceleration, scepticism persists. Doubt on the feasibility of attaining returns beyond market rates, particularly when funneling funds into early-stage ventures often branded as high-risk, haunts some impact-minded investors. However, defying these doubts, a 2022 report by Cambridge Associates noted that over 40% of the institutions surveyed anticipate embracing sustainable investing within two years. This signals a rapidly shifting landscape.

Mirroring the orthodox investment industry, this modern impact industry requires an underlying system of verifiable measurements. Digital systems are the core of such a system. With regard to this year’s GIIN Impact Measurement and Management (IMM) report, overcoming hurdles like global technological disparities and data reliability is critical to urgently integrate trust into impact investment strategies. Other challenges stubbornly remain, including standardizing measurements and creating incentives for widespread data sharing. An essential question arises: Can data quickly become the adhesive that holds a global, trans-industry, multistakeholder system together?

Have you already read?

Bridging the adaptation gap: can the circular economy help? | Ellen MacArthur Foundation

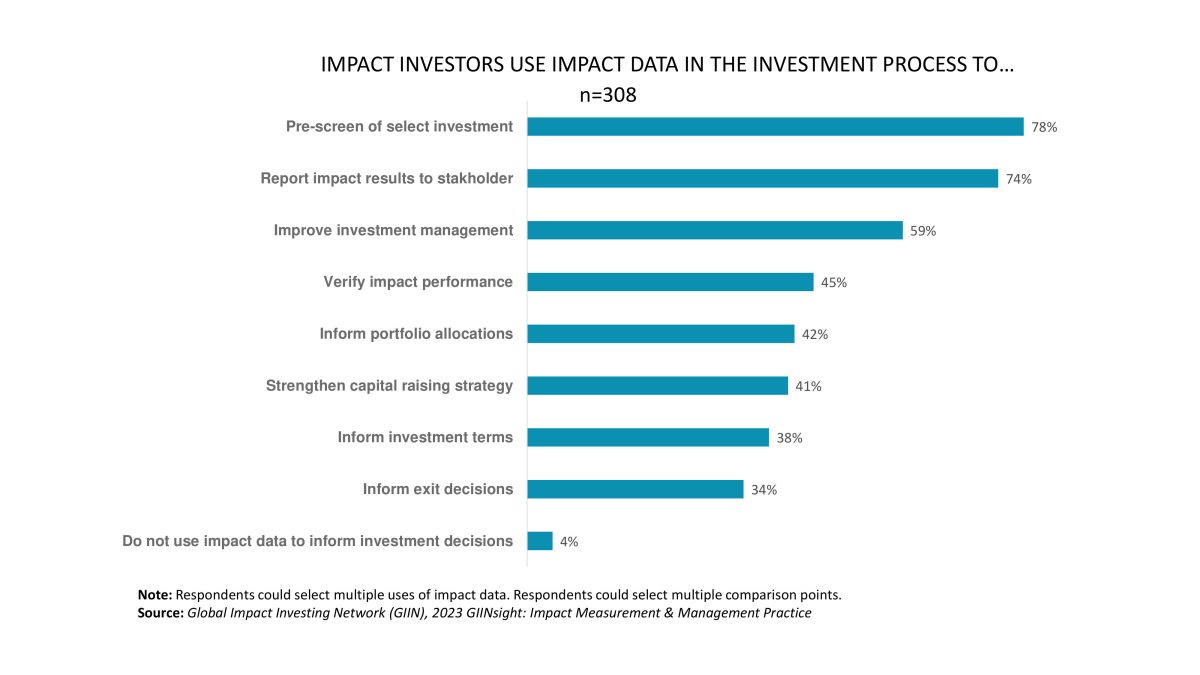

At its core, impact investing is about extending the traditional financial goal of market returns to societal and environmental objectives. As is already the case across the financial sector, data is the bedrock of impact decision-making, where 78% of investors employ impact performance data in their pre-screening and investment selection processes. Empowered by precise and holistic data, investors in any sector can meticulously evaluate the potential ramifications of their investments. Whether channelling funds into renewable energy, clean water initiatives, or supporting social enterprises fostering inclusive employment, data is the lynchpin to uncovering untapped opportunities to make social, environmental and financial gains.

| The synergy of investors, founders and data

The collaborative efforts of investors like Leandro Pisaroni, General Partner at Kalei Ventures and visionaries like UpLink Top Innovator Ady Beitler, Co-founder and CEO of Nilus, underscore the pivotal role of data in driving meaningful impact.

Leandro champions a holistic approach to data, advocating for the use of non-traditional sources to assess societal impact comprehensively. His insights reflect the symbiotic relationship between investors and founders, where data becomes the prerequisite for informed decision-making, fostering trust and transparency.

Ady’s narrative paints a vivid picture of Nilus’s mission – to alleviate the “poverty premium” by making healthy food more accessible. Their strategy, rooted in granular data insights, speaks to the collaborative spirit between investors and founders. Nilus’s seed round, led by Kalei Ventures, not only provided financial support, but played a hands-on advisory role, exemplifying the harmonious partnership necessary for impactful growth.

Nilus faces challenges, such as fluctuating prices in Argentina, but their commitment to being Latin America’s leading retailer remains unwavering. Ady emphasizes the continued reliance on data-driven strategies to refine their offerings. This success story echoes beyond Nilus – it’s a testament to the transformative potential when investors and founders align their goals, leveraging data as a driving force for impactful and sustainable ventures.

| Data: From theory to impact

The rise of artificial intelligence, machine learning and big data analytics opens new avenues for deeper insights and more sophisticated impact measurement. For instance, AI can analyze the interconnectedness of various social and environmental factors, providing a holistic understanding of the broader impact landscape.

The current focus on these technologies also provides an opportunity to apply the lessons of “bottom-line” investing while creating a more equitable system. Climate change will disproportionately affect countries in the Global South. Other solutions to social causes, such as poverty and education-access, will undoubtedly focus on similar geographies. These countries also have historically received less development support from global financial systems. Creating equitable financial systems requires equitable data systems, so digital development of data-poor areas is an antecedent to truly impactful investing.

To some, data isn’t just a tool; it’s a catalytic force in a traditional, bureaucratic system. Pekka Halla, Senior Associate at AlphaMundi Group, a Swiss impact fund manager, emphasizes: “The challenge lies in finding the right balance between standardized metrics that allow compatibility and accurate metrics tailored to capture the unique impact of each company or project.”

Embracing data-driven approaches is not just a choice but a necessity in our globally driven yet fragmented world. Halla underscores the importance of finding equilibrium between data reporting rules and innovative data methodologies. The answer to this bureaucratic question could ultimately unleash the benefits of these well-funded ventures.

| All opinions expressed are those of the author and/or quoted sources. investESG.eu is an independent and neutral platform dedicated to generating debate around ESG investing topics.