NEWSLETTER by Alessia Falsarone. The author acknowledges the team at The University of Chicago Circular Economy and Sustainable Business Management Program and all participants of the innovation knowledge hub for their insights and collaboration.

Lunar New Year celebrations are underway in virtually all countries around the world that East and Southeast Asian communities call home. This year, under the auspices of the Wood Dragon, a combination of innovation, resilience and a drive for progress is poised to bring new opportunities for circularity professionals.

All opportunities start with learning and reflection. The team at Sapio Research calls our attention to the perceived role that resource scarcity may play in driving corporate investments in circularity to new highs.

| The Science of Impact

The increased business resilience of embracing circularity is not only evident in improved resource efficiency and reduced operational costs but also in the ability to navigate global challenges. However, organizations often fail to recognize the urgency of embracing circularity until these challenges directly impact them. Typically, attempts to measure and standardize practices come first, followed by team-based learning and, ultimately, broader organizational progress.

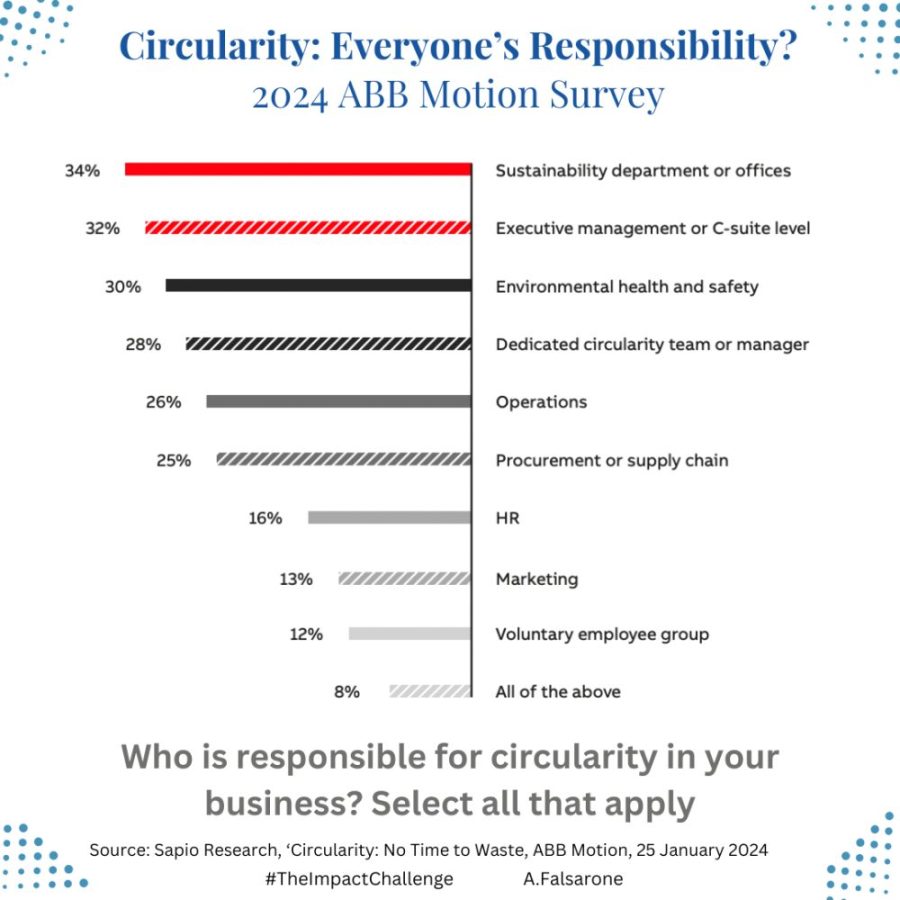

Recently, ABB Motion has conducted a survey of over 3,300 senior executives from diverse sectors and countries. The findings reveal that resource scarcity, particularly in raw materials (37%), energy (34%), and workforce (32%), directly affects more than 90% of industrial businesses. In addition, more than half of the surveyed businesses anticipate increasing their corporate spending on circularity initiatives within the next one to five years.

The survey highlights the importance of implementing a circular investment roadmap for businesses to effectively balance short-term and long-term investments and maintain competitiveness.

| Circularity Roadmaps Explained

The responsibility for circularity is still a matter of debate in many businesses. While it is common for industrial businesses to have designated roles for circularity, with 98% having at least one person responsible for this area, the lack of a standardized approach highlights the need for a more uniform profile for the role that would cater to all businesses.

As businesses continue to discuss the critical connection between sustainability, the green energy transition, and circularity, there will be a gradual increase in the adoption of circularity in the emission reduction plans of industrial players.

For instance, half of the Chinese respondents in the ABB survey identified the scarcity of raw materials as the main challenge to circularity adoption. Interestingly, the manufacturing market in China is expected to grow by around 4% between 2024 and 2028, with a market volume approaching US$6.0 trillion by 2028 (source: Statista). To sustain this growth, it is crucial to improve material efficiency, which can be achieved through enhanced circularity.

| Investing in the Circular Economy

Metals recycling continues to top the wish list of private investors seeking to allocate additional capital to circularity-oriented portfolios. This is especially relevant not only for sustainability-labeled fund investments, but more so to complement traditional Energy, Utilities and Natural Resources allocations. With circularity becoming a mainstream tool in the drive to reduce the environmental impact of traditional assets, access to renewable inputs, by-products and waste are raising to the top of circularity sourcing initiatives.

An example comes from Australia’s Sims Limited, a century-old metals recycling giant who is seeing its offering becoming a direct complement to iron and steel businesses. In the 2024 Global 100 ranking by Corporate Knights, the company scored top position along with Australia’s Brambles, a pioneer in the sharing economy, and another circular economy player.

As Neil O’Keeffe and his team at PwC in the Middle East point out, the metals and mining industry is particularly well suited to benefit from the circular economy. Metals have natural longevity, are infinitely recyclable and their high value acts as an incentive to reuse and recycle as far as possible.

Nevertheless, it’s important to address the alternative scenario for the industry. In the case of the EU, for example, researchers from University of Warsaw, discuss how the circular economy could significantly reduce the extraction of iron, aluminum, and nonferrous metals if implemented globally. However, the leakage effect may also cause some metal-intensive industries to relocate outside the EU, offsetting the circular economy efforts. The risk of a leakage effect emerging – the relocation of industries from developed to developing countries as a result of stringent environmental policies that increase prices in developed countries – is especially high for select metals such as copper.

| You don’t want to miss this month

From Maia (Portugal) to Turin (Italy), and Sydney (Australia), the second half of February offers new opportunities to connect with fellow circularity practitioners, and stir our world towards a more sustainable economic transition.

Discover, grow and leave your mark!

February 21st – 22nd: Circularity: Challenges, Tools and Case Studies. (Maia, Portugal)*. The Lipor Academy (Serviço Intermunicipalizado de Gestão de Resíduos do Grande Porto) in cooperation with the HOOP Project‘s Urban Circular Bioeconomy Hub, is organizing a training session on the theme of Circularity and its challenges and opportunities, analyze some circularity tools and case studies and promote the sharing of experiences among participants. Lipor manages, recycles and recovers 520,000 tonnes per year of municipal waste, produced by 1 million people in the 8 municipalities in the Greater Porto region. It aims to transform biowaste into innovative, circular and sustainable bio-based products. Registration is available here.

(*) Note: The training will be held in Portuguese.

February 21st – 23rd: Materials in a Changing World (Turin, Italy). IRTC, the “International Round Table on Materials Criticality” is a project established in 2018 and funded by EIT RawMaterials. IRTC consists of leading international experts in material criticality discussing different perspectives and requirements of criticality assessments, impacts of criticality, and ways to mitigate it. Now in its 2nd year, the IRTC will focus on new approaches to criticality to face the challenges of a changing geopolitical configuration and the material needs to combat the climate crisis – looking at emerging policies, new ideas for criticality mitigation, and novel forms of collaboration between sectors and countries to foster supply security and sustainability. Among others, Alessa Hool from the ESM Foundation, Luis A. Tercero Espinoza from Fraunhofer IIS, Dieuwertje Schrijvers from WeLOOP, and Nabeel Mancheri from REIA – The Global Rare Earth Industry Association are leading the coordination of this year’s IRTC.

February 28th – 29th: Circular Economy Summit 2024 (Sydney, Australia). Australia’s leading circularity summit will focus on three key themes this year: (1) Shaping the future through government policy; (2) Unlocking circularity with state and local governance; (3) Harnessing regional diversity to power the circular economy. Jillian Reid from Mercer’s Sustinable Investment team will lead the discussion on the investing landscape for circularity solutions in the region; followed by Eloise Lobsey (Hunter Joint Organisation) on using design to create tailored circularity outcomes. In the focused roundtables, Ryan Collins and Dr. Nicole Garofalo from Planet Ark Environmental Foundation will focus on customer engagement and measuring impact (KPIs and relevant metrics) for circularity success.

Off to another impactful week!

| brief bio

Alessia Falsarone is executive in residence, practitioner faculty at the University of Chicago, where she leads the Circular Economy and Sustainable Business program. The article is based on the author’s newsletter A Week of Circularity from the innovation knowledge hub.

| All opinions expressed are those of the author and/or quoted sources. investESG.eu is an independent and neutral platform dedicated to generating debate around ESG investing topics.