NEWSLETTER by Alessia Falsarone. The author acknowledges the team at The University of Chicago Circular Economy and Sustainable Business Management Program and all participants of the innovation knowledge hub for their insights and collaboration.

Innovation investing plays a crucial role in advancing circular business models in both developed and developing economies. While innovation is often viewed as involving higher risk, circularity creates an economic framework where innovation becomes the norm. R&D clusters exemplify this trend by fostering collaborative networks that generate long-term benefits.

Would Warren Buffett, one of the most successful value-driven investors of all time, support a more circular economy? In discussing Berkshire Hathaway ‘s operating results, he consistently distinguishes between facts and fiction, highlighting the importance of assets that offer longevity and intrinsic value to a wide range of stakeholders.

It wouldn’t be surprising if circularity innovations start capturing the interest of the Oracle of Omaha.

| The Science of Impact

R&D clusters provide a compelling example of the implied upside in investing in collaboration networks to jumpstart the circular economy. Collaboration among diverse stakeholders, including public and private sectors and academia, to ensure different areas of expertise can help identify present and future challenges of a successful circular economy transition. This collaboration is also essential to ensure coherence and complementarity across government policies.

One such examples comes from Thailand where The Ministry of Energy has encouraged biogas production through coordinated policies involving various stakeholders, including the Ministry of Science and Technology (to support biogas research and development), the Board of Investment (to offer tax incentives to attract private investors), and public research centers and universities (to provide training programs to strengthen the domestic biogas market).

In Brazil, the municipality of São Paulo has launched Connect the Dots, an initiative supporting local farmers to transition to circular agricultural practices. The initiative fosters collaboration and synergies along the value chain, enabling better coordination between stakeholders. This facilitates understanding of production, distribution, and consumption processes, allowing the municipality to identify challenges and develop policies for a productive and regenerative agriculture value chain. Connect the Dots provides local farmers with technical assistance, training, equipment, and access to financial support. Moreover, the initiative promotes the transition to regenerative techniques by purchasing farmers’ produce at a 30% premium over the market price.

| Circularity Roadmaps Explained

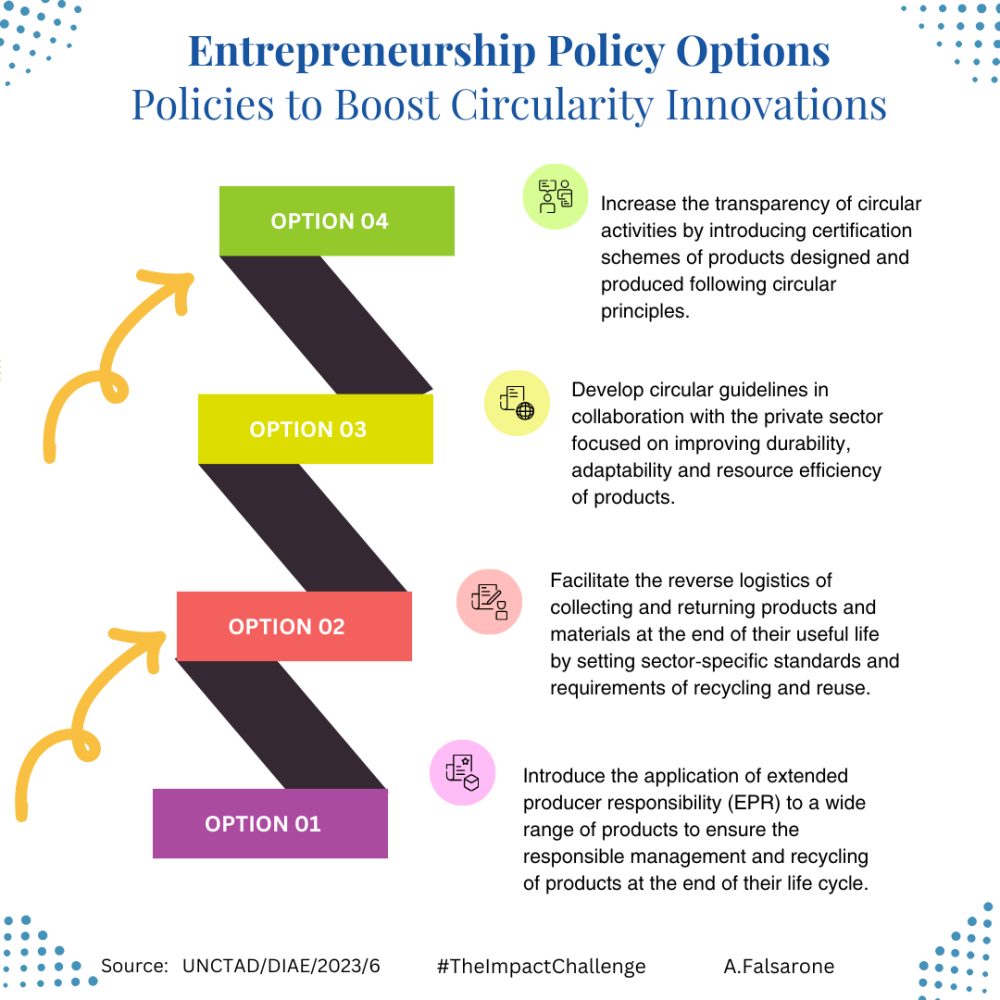

A variety of policy options have emerged to support a circularity ecosystem powered by R&D clusters in recent years. Entrepreneurship policy roadmaps can create lasting momentum for scaling up innovative business models that rely on the circular economy. While some policy options may initially only be feasible in more developed economies, sustaining their expansion in emerging markets will require policymakers to start designing strategy formulation processes earlier.

One early example concerns the need to adapt the regulatory environment in support of circular entrepreneurship.

eneurship and reduce investment risks, there is a need for public support. Increased public and private investment in these areas can align with ESG goals and promote sustainable growth. Public institutions can lead this shift by investing in key sectors, providing loans and grants, supporting R&D initiatives, and adjusting taxes and subsidies to encourage circular initiatives.

| Investing in the Circular Economy

Innovation financing and circularity investments go hand in hand. In The New Frontier in Entrepreneurship, the team at UNCTAD led by Arlette Verploegh zooms in what a transition propelled by entrepreneurial innovations may look like, and how facilitating the diffusion of new technologies and standardizing circularity principles can boost circular ecosystems and dramatically increase their investment backdrop.

In prior studies, UNCTAD provided an estimate of the economic value that the circular economy could add to India’s economy in the range of US$624* billion by 2050. The estimate for China’s public sector alone exceeds US$10* trillion by 2040 – nearly 16% of its GDP (*) in 2016-2018 dollar terms, respectively.

Navigating circular supply chains is crucial for innovation-oriented investors. Industry 4.0 technologies play a significant role in enhancing the sustainability of organizations in circular business models. Internet of Things (IoT) improves efficiency in the remanufacturing process, while AI and machine learning optimize real-time data for better connectivity across the supply chain. Furthermore, blockchain improves product traceability and streamlines coordination among suppliers.

Private market funding of circular innovations can enhance the accessibility and affordability of ICT and new technology diffusion. This funding is essential in building circularity literacy and skills while harnessing the economic benefits it brings.

| You don’t want to miss this week

From Brussels (Belgium) to the Nordics, this week offers new opportunities to connect with fellow circularity practitioners, and stir our world towards a more sustainable economic transition.

Discover, grow and leave your mark!

February 29th: HOOP Monthly Lunch Talks: Tools to empower financial investments (virtual)*. This month’s lunch series hosted by HOOP Project will feature Jorge Rodrigues de Almeida, the chairperson of the HOOP Circular Investors Board (CIB). The session will explore several tools to improve the maturity and bankability of circular bioeconomy investment projects which are essential to mobilize green funding in the sector.

Note (*): The lunch series is open to members of the HOOP Network of Cities and Regions, which you can explore joining here.

February 29th: Report Launch: Recycling of Critical Raw Materials in the Nordics (virtual)*. The Working Group for the Circular Economy of Nordisk Råd og Nordisk Ministerråd is hosting a report launch and webinar on the recycling of critical raw materials (CRMs) in the region. The report provides a comprehensive Nordic overview of measures for circular CRMs. Stian Bergeland, the coordinator for NCE, will give opening remarks on the strategic importance of CRMs for the Nordic region. Representatives from Volvo Cars –Owain Griffiths and Stena Recycling AB – Viktor Neiström Ortynski, PhD will discuss the roles and possibilities in waste and recycling sectors, circular innovation, and the evolution of logistics.

March 5th: State of play and possible future developments of the DPP (Brussels, Belgium)*. This CIRPASS – Digital Product Passport– an EU-funded project focusing on piloting and deploying DPP in the electronics, batteries, and textiles value chains – will host a final public event aiming to discuss the current state and future developments of Digital Product Passports (DPP). The event will provide an opportunity for projects to present results supporting the European Commission’s work. Attendees will be able to interact with EC personnel and DPP experts through discussion panels and Q&A sessions.

Off to another impactful week!