INSIGHT by Kiva Allgood Head, Centre for Advanced Manufacturing and Supply Chains, World Economic Forum; Na Na China Lead, Advanced Manufacturing and C4IR, World Economic Forum. This article was first published by the World Economic Forum and is part of the Centre for Advanced Manufacturing and Supply Chains.

〉The automotive industry must transition to the circular economy across its entire product life cycle in order to further reduce direct emissions.

〉The EU, China and the US are engaged in efforts to foster circularity, but a more systemic approach is needed.

〉The Circular Cars Initiative has crafted seven insight papers that aim to guide public policy interventions across the sector.

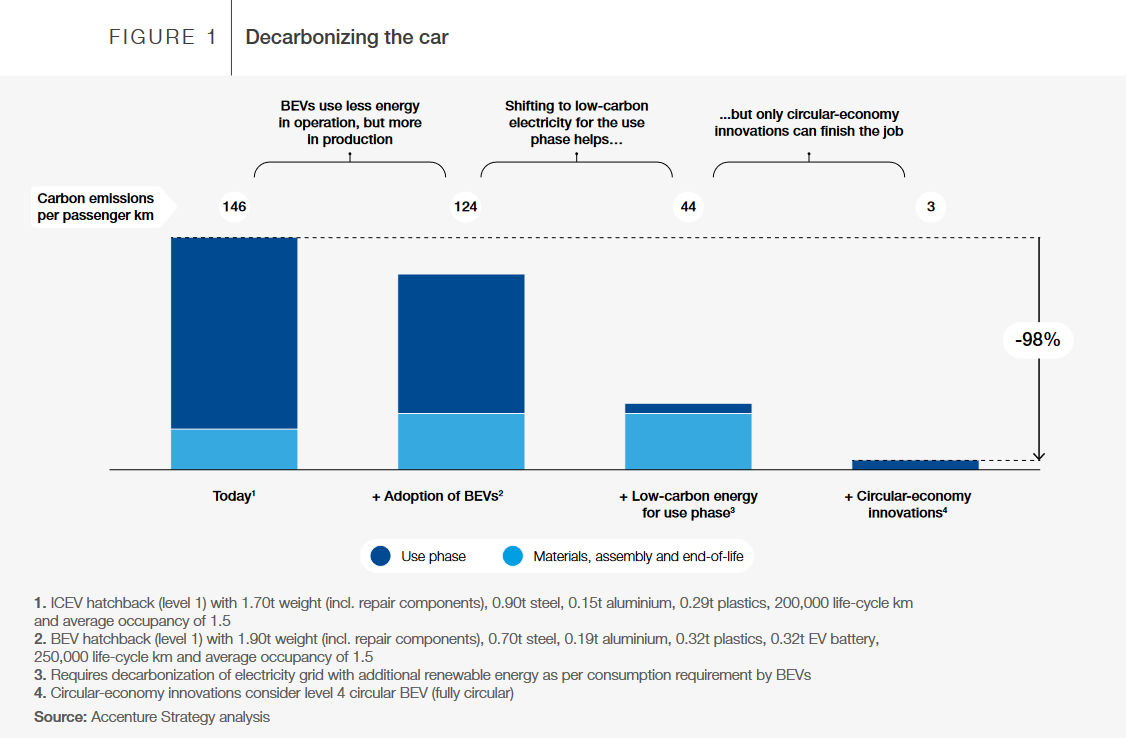

While the adoption of Battery Electric Vehicles (BEVs) represents a significant leap forward in reducing direct emissions from the transportation sector, it addresses only a fragment of its environmental impact. The production, usage and disposal of vehicles encapsulate a broader spectrum of carbon and resource footprints that BEVs alone cannot mitigate.

The circular economy offers a systemic solution by reimagining and restructuring the entire life cycle of automotive products. This approach emphasizes the importance of extending product lifespan through design for durability, reuse and remanufacturing, and prioritizes the recycling of materials to minimize waste.

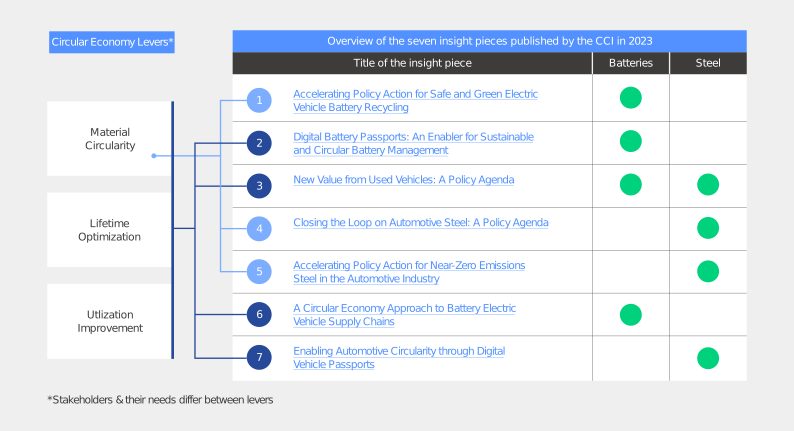

Despite ongoing efforts to foster a circular economy within the automotive sector in the European Union, China and the United States, such initiatives predominantly operate in silos. Recognizing the need to bridge knowledge disparities across these regions, the Circular Cars Initiative (CCI) has meticulously crafted seven insightful analyses, funded by the ClimateWorks Foundation and in collaboration with Systemiq, with key focuses on batteries and steel. These explorations not only scrutinize the current landscape, but also chart the trajectory of public policy interventions within these geographies.

The series of insight papers aims to offer actionable recommendations for policy-makers worldwide to enhance the circularity of the automotive industry. Automotive circularity is not just an environmental imperative but a strategic evolution. The insights reflect a deep understanding that the future of mobility lies in harmonizing innovation with sustainability across the European Union, China and the United States. These regions are leading the change, each with distinct strategies, challenges and milestones, weaving a rich tapestry of global efforts towards a circular automotive future.

| The European Union: a beacon of circular ambition

The European Union’s approach to embedding circularity within the automotive sector is marked by a series of forward-looking policies. At the heart of this strategy are the Digital Vehicle Passport and Digital Battery Passport, emblematic of the EU’s commitment to transparency and accountability. These digital tools are set to revolutionize the automotive life cycle, offering a granular view of a vehicle’s environmental footprint, from cradle to grave.

The EU’s battery recycling mandates exemplify a proactive stance on the burgeoning issue of EV battery disposal. By advocating for increased use of recycled materials and setting stringent targets, the EU is not only mitigating waste but also propelling the automotive industry towards innovative sustainable design and production methodologies.

The EU also employs economic incentives, such as the Carbon Border Adjustment Mechanism, to reduce carbon leakage by imposing fees on carbon-intensive imports, thereby encouraging investments in near-zero emissions steel manufacturing. This comprehensive approach reflected the EU’s holistic vision for a sustainable automotive ecosystem.

| China: navigating industrial growth and green innovation

China’s narrative in the realm of automotive circularity is one of balancing industrial ambition with ecological responsibility. The country’s pioneering efforts in establishing a robust battery recycling framework signal a commitment to addressing the environmental implications of its EV revolution.

China has made strides in battery recycling and transparency, establishing a traceability system and working towards a digital battery passport to facilitate trade and align with EU data transparency requirements. It has introduced comprehensive vehicle design and recycling requirements for end-of-life vehicles (ELV), aiming to increase the quantity and quality of materials used in vehicle components and improve the transparency of recycling processes.

Additionally, progress toward reducing emissions in steel production is being made, with plans to include the steel industry in its national emissions trading scheme. It has also established a significant fund to support the green transition of its steel industry, showcasing its commitment to environmental sustainability in automotive manufacturing.

| The United States: policy shifts to a circular path

Traditionally, the US has lagged behind the EU and China in circular economy policy-making for the automotive sector. However, recent legislative actions, such as the Inflation Reduction Act, reflect a growing emphasis on domestic recycling of battery materials. The act includes provisions for EV tax credits that require domestic production and recycling, though it does not specify targets for steel recycling from ELVs. Environmental protection regulations currently govern the recycling of ELVs without formal requirements for steel recycling.

As a global leader in production, consumption and exporter of remanufacturing goods, US has largely been market-driven. However, the government has also been supporting the development of this industry through demand-side public procurement policies. For example, under the Resource Conservation and Recovery Act, the government also encourages the public procurement of vehicles with remanufactured parts.

| A roadmap for policy-makers

Resetting the automotive industry on a path to circularity globally necessitates that policy-makers move beyond the status quo, acknowledging that current policies fall short in this evolving context. The policy recommendations outlined by the CCI in the seven insight papers not only highlight this inadequacy, but also chart a course towards meaningful transition.

To this end, five strategic recommendations emerge from the analysis, urging policy-makers to:

1. Scale digital battery and vehicle passports. Encourage global adoption of digital life cycle tracking for vehicles and batteries to support circularity, with emphasis on comprehensive coverage and compliance with international standards.

2. Close the loop on battery materials. Advocate for policies on battery recycled content and the development of new recycling technologies such as direct recycling, through R&D support or public-private partnership. Strategic utilization of subsidies is suggested to boost recycling economics.

3. Chart a path towards closed-loop automotive steel. Currently there is less of a focus on steel recycling-related policies. To promote closed-loop automotive steel recycling, policy-makers should aim to boost the supply of high-quality scrap, for instance, by setting recovery quality targets for steel recycling and providing financial support for the advancement of recycling technologies and infrastructure.

4. Incentivize delivery of ELVs to authorized treatment facilities. Propose incentives or penalties to ensure ELVs are responsibly processed. Better specified border controls, ideally mutually aligned with potential importing countries, would additionally help reduce illicit trade and leakage of vehicles to sub-optimal treatment destinations.

5. Prioritize reuse, repair and remanufacturing of batteries and vehicle components. Across all three geographies, there is insufficient support for lifetime optimization. Mandating suitability testing for reuse, repurposing or remanufacturing batteries before considering recycling is suggested. For other vehicle components, support could be enhanced by setting uniform definitions and standards, including quality benchmarks and transparency requirements, alongside economic incentives.

Embracing these recommendations will not only catalyze the progression towards automotive circularity, but also solidify a foundation for sustainable growth and innovation in the sector, aligning with global environmental and economic objectives.