INSIGHT by Principles for Responsible (PRI)

The Inevitable Policy Response’s (IPR)[1] latest forecast of global climate policies, expected to be put in place in major economies[2] between now and 2050, concludes that the world will likely achieve the Paris Agreement goal of limiting temperature increase to ‘well below 2°C’ and continue to make efforts towards 1.5°C once temperatures peak. The forecast is informed by live tracking of over 300 climate policies over the past two years, as well as input from over 100 climate policy experts across 12 countries.

| What are the key findings?

〉Due to policy acceleration, ~90% of policies in Advanced Economies and ~40% in Emerging Markets and Developing Economies are in motion that support IPR forecasts.

〉In emission terms, over two-thirds of the global policy gap is concentrated in three areas: coal power in China, coal power in India, and overall policy in Russia.

〉Land will become the crucial residual emissions driver as fossil fuels peak this decade, consistent with the new IEA forecast, and electric vehicleswill reach ~90% of global sales by 2050. By 2050, +20% of GHG emissions will be linked to ruminant meat,[1] despite representing only ~10% of food[2] intake. Changing policy dynamics in Brazil and Indonesia are predicted to lead to an effective end to deforestation in both countries by 2030.

〉Social, just transition, geopolitical and nature guardrails will become a key part of the transition. As a result, while China will reach near zero coal power emissions by 2045, it will maintain 400 GW of coal power in strategic reserves. The deployment of bioenergy carbon capture and storage, (BECCS), prominently featured in other scenarios, will be limited to 1 GT of CO2 capture by 2050. BECCs does not appear as a significant long-term solution given the pressure around land use and more competitive alternatives across most sectors (excluding aviation and pulp and paper).

| How does the IPR 2023 Forecast Policy Scenario (FPS) align with the Paris Agreement?

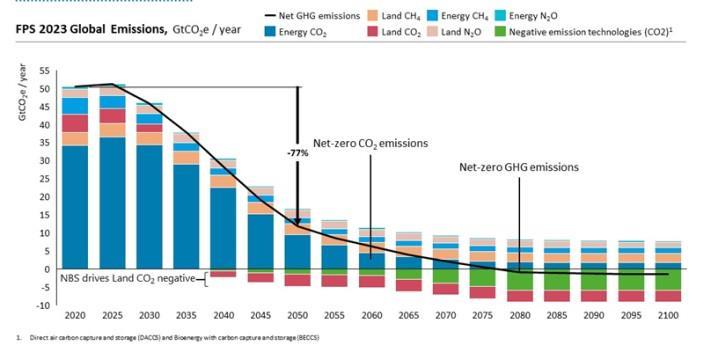

〉The FPS predicts concerted policy action in response to rising climate impacts, leading to net zero CO2 emissions by 2060 and net zero GHG emissions by 2080, which is consistent with Art. 4 of the Paris Agreement.

〉Temperatures are expected to peak between 1.7°C and 1.8°C, which is consistent with the “well below 2°C” objective of the Paris Agreement in Art. 2.1c.

〉IPR forecasts that average global temperatures will breach 1.5°C, the lower limit in the Paris Agreement, in the 2030s, leading to impacts on social and natural systems and increasing systemic risks for investors.

In light of these risks, policy efforts are forecast to continue “pursuing efforts” to achieve the lower temperature limit of the Paris Agreement, with the potential of achieving the 1.5°C goal by the 2120s through carbon removals.

IPR forecasts that policy will continue to accelerate, driven in part by the twin Paris Agreement Global Stocktake/Ratchet cycles between now and 2030.

However, the research finds that policy action is not in line with pathways that limit warming to the lower limit of 1.5°C in the Paris Agreement; only 3% of global policies (based on their relative importance to emissions) are currently moving towards the 1.5°C low overshoot target.

Land is a crucial component to achieving net zero. Ruminant meat (predominantly beef and lamb) will become critical to the transition, responsible for over 20% of GHG emissions by 2050, despite the fact that it represents only ~10% of our calorific food intake. Similarly, the forecast shows an effective end to deforestation by the 2030s and significant forest restoration in the context of the broader nature targets negotiated as part of the Post-2020 Global Biodiversity Framework. IPR has launched a dedicated bioenergy study to reflect this significant sector, which links the energy and land systems.

The forecast predicts that warming will breach 1.5°C by the 2030s, but peak below 1.8°C degrees higher than pre-industrial levels around 2050. This is a more optimistic future than many anticipate. Last year the UN synthesis report of government commitments, as part of the Global Stocktake (GST) process, stated that current pledges would lead to 2.5°C. As that report made clear, warming in excess of the 1.5°C lower limit of the Paris Agreement would increase systemic risks, including irreversible impacts on natural systems.

The IPR forecast emphasises that these impacts drive policymakers to invest heavily in negative emissions technologies. It forecasts that these could remove 5 Gt C02/year in the latter half of the century, reducing temperatures below 1.7°C by the end of the century, and that temperatures could return to below 1.5°C around the 2120s.

“While there is a long road to Paris, we are now well under way. The pessimism about missing 1.5°C no overshoot should not overshadow the fact that policy acceleration over the past 2 years increasingly highlights the central climate outcome is now 1.8°C warming. No time for complacency, but perhaps time for some optimism relative to previous temperature projections, despite the growing evidence of the systemic risk that comes with overshooting 1.5°C.”

-Jakob Thomä, Project Director, Inevitable Policy Response

“Climate-induced social tipping points and the Paris Stocktake-Ratchet cycles over this decade will accelerate pressure for policy makers to deliver a well below 2C outcome. This will have huge implications for investors and investment markets.”

-Mark Fulton, Founder, Inevitable Policy Response

“This new 2023 forecast from IPR demonstrates the economic transition to net zero is well underway. It offers clarity on where, when, and how policies are expected to accelerate in response to growing climate risks this decade and beyond. We encourage institutional investors to examine its findings carefully and consider the implications for their strategies.”

-Nathan Fabian, Chief Sustainable Systems Officer, PRI

| What makes the FPS distinct from other scenarios

IPR’s Forecast Policy Scenario is conceptually distinct from scenarios produced by the IEA or IPCC. Rather than working backwards from a hypothetical outcome (Net Zero by 2050 in the case of the IEA’s NZE scenario) or hypothetical level of climate action (continued fossil fuel-based development in the IPCC’s SSP5-8.5 scenario), the IPR forecast is constructed ‘bottom-up’, driven by a ‘high-conviction forecast’ of likely policy developments and their impact on GHG emissions and temperature.

In IPR, the net zero and temperature outcomes are the product of the forecast, not the other way around.

FPS 2023 was formally launched during Climate Week New York City on Thursday 21st September.

| Deep dive on key findings from the IPR 2023 Forecast Policy Scenario

1. Net Zero

〉Advanced economies reach near zero by 2050, while Emerging and Developing Economies (EMDEs) will continue to emit ~9 Gt GTCO2 in 2050, mainly from industry.

〉Turkey and Vietnam reach net zero by 2060 and South Africa beyond 2065 despite all having 2050 targets (each country contributes 1% of global CO2 emissions). India achieves net zero CO2 emissions by 2065, accelerating 5 years ahead of its existing target.

〉Following a mid-2020s plateau, all fossil fuel use declines, with coal, oil and gas demand falling by 66%, 62% and 52% respectively by 2050.

〉Renewables account for 85% of global electricity generation by the 2050s.

〉China acts on coal, retiring 60% (800GW) of its unabated coal fleet by 2045, fitting 100GW with CCS and keeping 400 GW in reserve.

〉Bio Energy Carbon Capture and Storage (BECCS) removes 1 Gt C02/year by 2050.

〉Direct Air Carbon Capture and Storage (DACCS) removes 0.6Gt C02/year by 2050 at a cost of $100bn and 5 Gt by 2080.

〉Nature based solutions capture ~3.8 GTCO2/yr by 2050.

2. Power

3. Negative Emissions Technologies (NETs) / Carbon Removals

4. Land use

〉Land protection reaches 30% of national land area by 2035 in North America and China, and by 2030 in Europe. Globally, an additional 980Mha of natural vegetation is protected by 2050, stabilising biodiversity intactness to 2020 levels.

〉Brazil and Indonesia end effective deforestation by 2030 (each country contributes 25% of C02emissions from land use change), with global deforestation ending by 2035.

〉Behavioural shifts and innovation drives consumers away from emission-intensive proteins, leading to a peak in global beef production by 2035.

5. Transport

〉Europe and China stop selling cars and vans with CO2 emissions by 2035; the US and India follow by 2040.

〉Shipping and aviation accounts for 70% of transport emissions by 2050 despite shifting to 50% zero carbon fuels.

6. Industry

〉Deep industrial decarbonisation at scale begins by the 2030s, driven by a shift toward clean hydrogen, industrial CCS and a variety of other recycled and bio-based materials.

7. Bioenergy

〉When considering sustainability guardrails, only 567 mha of land is available for bioenergy, of which only around 15% is used given economic and political constraints.

〉Bioenergy without CCS is likely to be outcompeted by lower carbon alternatives in most energy system applications. As a result, bioenergy use only grows modestly in the FPS, in contrast with other prominent transition outlooks, many of which expect a larger role for bioenergy.

〉Aviation and the pulp & paper industry are notable exceptions – a lack of cleaner alternatives and very inexpensive self-supply of waste and residues make unabated bioenergy cost competitive through to 2050.

| about

The IPR is a climate transition forecasting consortium that aims to prepare institutional investors for the portfolio risks and opportunities associated with a forecast acceleration of policy responses to climate change. To help prepare markets and investors IPR then models in detail the impact of the forecasted policies on the energy system, food & land use system, and real economy. More information is available here.

1] IPR was commissioned by the Principles for Responsible Investment (PRI)

[2]Accounting for 74% of global CO2 emissions across 21 major economies

[1] Predominantly beef and lamb

[2] Calorific

| All opinions expressed are those of the author and/or quoted sources. investESG.eu is an independent and neutral platform dedicated to generating debate around ESG investing topics.