INSIGHT by Amazon Watch

| Banks in Switzerland, France and the Netherlands facilitate trade from Amazon Sacred Headwaters region in Ecuador, where oil extraction contributes to spills, human rights abuses and climate destruction

| A new report released today by North America-based environmental organizations Stand.earth and Amazon Watch details how European banks are financing the trade of controversial oil from the Amazon Sacred Headwaters region in Ecuador to international destinations in the U.S. such as California. The report also examines how these banks are actively complicit in the impacts of the oil industry on the Amazon rainforest — including oil spills, harm to Indigenous peoples, and climate destruction — despite making previous climate and human rights commitments.

The release of the report comes just a week after the Indigenous Federation of United Communities of the Ecuadorian Amazon (FCUNAE), which represents the communities affected by a major oil spill in April — presented a series of lawsuits requesting precautionary measures to protect communities that are in danger from another possible oil spill due to regressive erosion of the Coca River and to guarantee rights protected by the constitution. A coalition of Indigenous and human rights organizations also recently launched an emergency global campaign demanding a moratorium on current crude oil production due to recorded contamination and the risk of future spills.

The top banks detailed in the report are ING Belgium, Credit Suisse, UBS, and BNP Paribas (Suisse) SA in Geneva, Switzerland; Natixis in Paris, France; and Rabobank in Utrecht, Netherlands. A total of 19 banks were assessed.

Since 2009, these banks and other private financial institutions have provided trade financing for approximately 155 million barrels of oil from Ecuador to refineries in the U.S. for a total of $10 billion USD. More than 40 percent of those exports go to refineries in California alone. This oil contained approximately 66 million metric tons of CO2, equivalent to the annual emissions from 17 coal-fired power plants.

Nearly all of the banks cited in the report have sustainability pledges or commitments to uphold Indigenous rights, as signatories of either the Equator Principles and/or the United Nations Environment Program Finance Initiative’s Principles for Responsible Banking. Several banks have policies specific to the Arctic, including Credit Suisse’s new sustainability initiative designed to “enhance consideration of biodiversity.” Yet the financing of the Amazon oil trade violates the spirit of those commitments.

“The financing from these banks perpetuates human rights abuses, worsens the climate crisis, and further tethers Ecuador’s economy to the boom-and-bust cycles of natural resource extraction. Given the recent oil spill and calls from Indigenous federations in Ecuador for a moratorium on oil extraction, any bank committed to protecting Indigenous rights and the climate should end financing the oil trade from the Amazon Sacred Headwaters until new safeguards and commitments for no expansion are put in place. It’s time for European banks to play a responsible and constructive role in advancing life over profits.” -Tyson Miller, Forest Program Director, Stand.earth

“The oil industry has a toxic legacy in the Amazon, further exacerbated by recent spills that have contaminated rivers and disrupted the health and food security of Indigenous communities. Even during the COVID-19 pandemic, oil companies continue to pursue expansion, putting Indigenous peoples at even greater risk. These banks cannot claim to uphold their own pledges on climate and human rights while they continue to finance the trade of Amazon oil.” -Moira Birss, Climate and Finance Director, Amazon Watch

| About The Amazon Sacred Headwaters

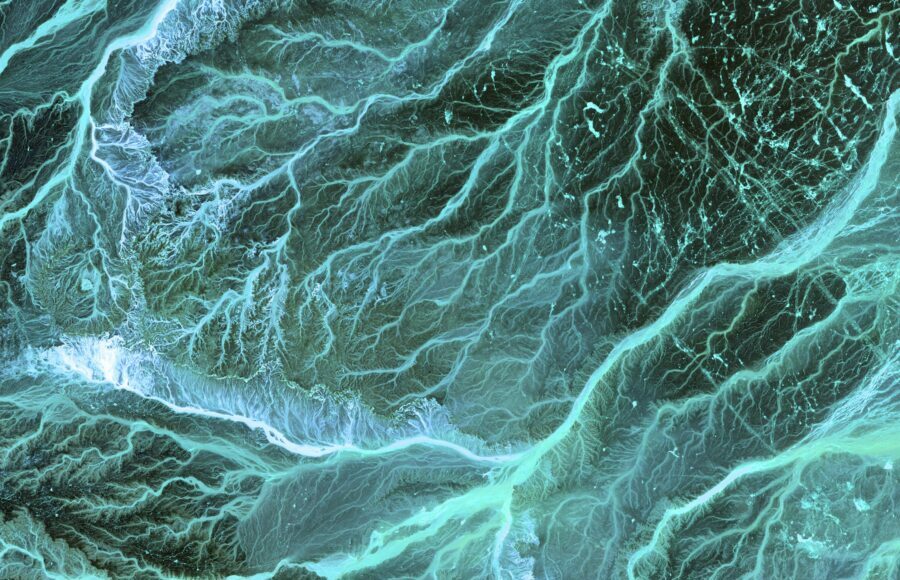

The Amazon Sacred Headwaters is one of the most biodiverse ecosystems on the planet and helps regulate essential planetary ecosystem services such as the hydrologic and carbon cycles. The region is home to more than 500,000 Indigenous peoples from over 20 nationalities, including peoples living in voluntary isolation on their ancestral lands. New and ongoing oil extraction in the region is a gateway to deforestation and contributes to violations of Indigenous peoples’ rights. Indigenous leaders in the region have repeatedly voiced their opposition to the expansion of the oil industry and other industrial activities in their territories.

The report outlines the following steps investment banks must take to assure consistency with the environmental and social commitments they have made:

〉Promote transparency of any trade financing and physical trade of commodities;

〉Ensure respect for Indigenous rights and compliance with free, prior and informed consent (FPIC) related to any project or trade financing as enshrined in the United Nations Declaration on the Rights of Indigenous Peoples and International Labor Organization Convention 169;

〉Stop financing Amazon oil-related activities, including trade, unless adequate remediation of contamination occurs, rights to health of local communities is guaranteed, safeguards are in place to prevent future spills, and governments in the region commit to no new expansion of oil development and a wind-down of existing wells in line with global climate goals and collective Indigenous visions for the region;

〉Focus investments on opportunities in Ecuador and other countries in the Amazon and world that truly meet responsible banking commitments and respect Indigenous rights; and

〉As debt for nature/climate funds develop, expand policies to exclude all Amazon-derived oil from project and trade financing until all Amazon basin countries commit to no new expansion of oil development and a wind down of existing wells in line with collective Indigenous visions for the region and global climate goals.

Companies and investors are becoming increasingly concerned about the significant financial risks stemming from biodiversity loss and the destruction of natural ecosystems.In July, the head of sustainable business development at Natixis was quoted in a story on how environmental, social, and governance (ESG) investors are waking up to biodiversity risk, and the same month, Credit Suisse announced it would earmark $300 billion for sustainable finance and give “enhanced consideration” to biodiversity.

| Banks Respond to Report

Several banks named in the report responded to Stand and Amazon Watch and expressed interest in addressing the issues raised in the report. To date, no banks have updated their policies.

Rabobank said it no longer finances trades from the Amazon Sacred Headwaters region, but it has not committed to updating its policy. Natixis pledged to engage with stakeholders like Stand.earth and Amazon Watch in order to update its policy. UBS and ING Belgium pledged to engage with stakeholders without committing to update their policies. Credit Suisse acknowledged the importance of the report’s findings but evaded responsibility by saying its policies only apply to project financing. BNP Paribas (Suisse) SA and Deutsche Bank did not respond.

| download here

| about

Stand.earth is an international nonprofit environmental organization with offices in Canada and the United States that is known for its groundbreaking research and successful corporate and citizens engagement campaigns to create new policies and industry standards in protecting forests, advocating the rights of Indigenous peoples, and protecting the climate.

Amazon Watch is a nonprofit organization founded in 1996 to protect the rainforest and advance the rights of indigenous peoples in the Amazon Basin. We partner with indigenous and environmental organizations in campaigns for human rights, corporate accountability and the preservation of the Amazon’s ecological systems. Amazon Watch is also a member of the Alliance of Organizations for Human Rights (Alianza de Organizaciones Por Los Derechos Humanos) a coalition of organizations working together to advocate for human rights in Ecuador and bring justice to the indigenous peoples and communities affected by the recent oil spill.

Stand.earth and Amazon Watch are members of the international Amazon Sacred Headwaters Initiative, working alongside allied organizations and Indigenous federations in Ecuador and Peru to draw global attention and support to halt industrial extractivism and protect the Amazon Sacred Headwaters region.

| All opinions expressed are those of the author. investESG.eu is an independent and neutral platform dedicated to generating debate around ESG investing topics.