INSIGHT by Martha Oberndorfer

| As of March 2021, the regulation on sustainability-related disclosures in the financial services sector is in place across the European Union. It requires disclosure at the level of asset management firms and at the product level. Disclosures at the product level of funds are dependent on the level of disclosures of investee companies. In this context, databases play a crucial role.

For fiscal 2021, taxonomy-related disclosure for turnover, operating expenses, capital expenditure will be required for exchange listed and other significant companies.

There are companies who publish a great amount of ESG indicators in their annual reports, although they are not yet legally obliged to do so. However, in the databases available to the financial community, the ESG data do not necessarily feed through nor show up in a comparable density.

Therefore, it is crucial for a company, who wants to attract money from the capital markets, to keep an eye on the way how its ESG-related figures appear in databases used by financial analysts, portfolio managers and the interested public. Some examples of widely used scores are presented in the following paragraphs.

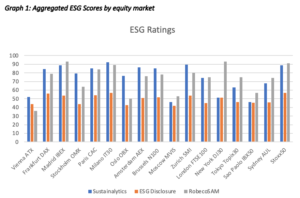

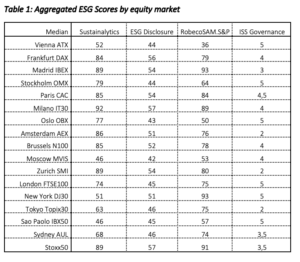

The ESG Disclosure score, ranking from 0,1 to 100, calculated by Bloomberg, indicates the amount of ESG data a company reports publicly, considering the importance relevant to different industry sectors, and does not measure the company’s performance on any data point. Among the markets studied, the highest scores for ESG disclosure were measured for the constituents of the DAX, the Milan IT 30, and the Stoxx 50, as shown in Graph 1. The lowest median scores appeared for the Moscow MVIS, the Vienna ATX, the London FTSE100, the OMX Stockholm, and OBX Oslo. It is expected that the EU taxonomy requirements and comparable global initiatives will push the level up from below 60 more towards 100 over the course of the next 3 years.

Both Sustainalytics and Robeco.SAM.S&P ESG-scores range from 0 to 100, and reflect percentiles relative to industry peers. The higher the score, the better the ESG performance among its peers. The figures in detail are shown in Table 1. The highest median scores by Sustainalytics are found across the Milan IT30, the Zurich SMI and the Stoxx 50; the lowest Sustainalytics median scores refer to the Sao Paolo IBX50, the Moscow MVIS, the Vienna ATX, and the Dow Jones Industrials. The highest scores of RobecoSAM, which recently teamed up with S&P, appear for the constituents of the Dow Jones, the Madrid IBEX, the Stoxx 50, and the Milan IT30. The lowest RobecoSAM scores apply fort he constituents of the Vienna ATX, the Oslo OBX, and the Sao Paolo IBX50.

The ISS Governance Quality Score assigned by Institutional Shareholder Services ranges from 1 for best to 10 for worst. It indicates a company’s overall governance practices.

Graph 2 depicts the results oft he markets studied: the best median levels – score 2 – were seen for Amsterdam AEX, Zurich SMI, and Tokyo Topix30. The worst level of the sample – score 5 – was encountered for Vienna ATX, Stockholm OMX, Oslo OBX, FTSE100, Dow Jones, and Sao Paolo IBX50. When looking at the constituents in detail, there are indeed some companies valued with the worst score of 10, and the best score of 1. Table 2 provides some details on top companies in this regard.

Table 2 includes several names of extractive industries. It seems that companies from this industrial sector make great efforts to achieve high governance scores, compensating for a potentially weaker basis situation in the environmental area.

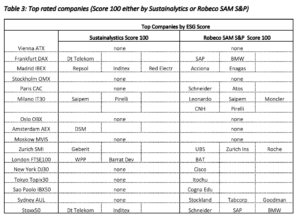

Sustainalytics and RobecoSAM hardly assign a score of 100. Table 3 shows index constituents with a top score of 100. In the FTSE100 Universe, the only company scoring 100 by Robeco SAM S&P is the British American Tobacco Group.

Presently, the European Commission is preparing for the development of ESAP – the European Single Access Point, striving to achieve a readily accessible set of financial and non-financial data of public companies. The European Securities and Markets Authority (ESMA) said it was ready to play a central role in setting up and running the ESAP. It will be interesting to experience how the private data providers and the official ones will complement each other.

In any case, it will remain particularly important for listed companies to carefully monitor their appearance in the relevant data bases. Some companies who decided to appoint a Chief Sustainability Officer, have this duty among other responsibilities assigned to this position.

Data as of March 10, 2021, Source: Bloomberg

| About the author

Martha Oberndorfer, CFA is an independent consultant for ESG and Sustainable Finance and Infrastructure Finance. She is a capital markets professional, with hands-on experience as analyst and manager of ESG funds, and as conductor of green bond issues. She advises industrial companies, asset management firms and public sector entities. She also serves as a member of the ESMA Securities and Markets Stakeholder Group, and serves on supervisory boards. www.marthaoberndorfer.at

| All opinions expressed are those of the author. investESG.eu is an independent and neutral platform dedicated to generating debate around ESG investing topics.