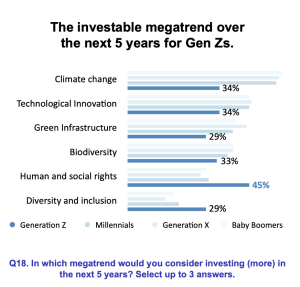

| 45% of Gen Zs selected human rights as the most investable megatrend over the next 5 years (only 34% chose climate change) based on a Nordea ESG Survey.

Nordea carried out an ESG Survey in 2021 to understand the sustainability-related goals, and the expectations of financial advisors’ clients across 5 European markets: Germany, Spain, Italy, France and Switzerland.

Gen Z sees human rights as megatrend

In Germany 47 % Gen Zs selected human rights as the most investable megatrend over the next 5 years. In Spain that number was 56 % and in Italy 36 %.

Climate change and global warming still in focus

To the question “what are the 3 top sustainability-related risks that concern you the most” more than six in 10 European investors (63%) point to global warming as the most concerning sustainability-related risk. They also raise concern regarding water and food scarcity (39%) and deforestation (39%). Millennials and Generation X investors exhibit the highest levels of anxiety related to global warming as more in both groups say this is a concern. Arguably, this may be because climate awareness began rising when members of Generation X were young and Millennials were, in turn, raised in an environment of heightened recognition of this issue.

This social dimension is clearly a priority for younger investors; Generation Z respondents view “S” investing as the next megatrend. More investors in this group consider human rights to be the most significant investment opportunity (45%). They also show a stronger interest in diversity and inclusion (29%).

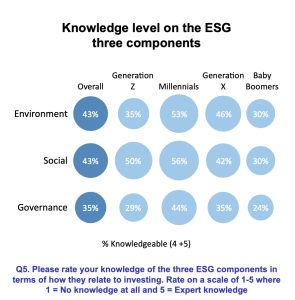

The authors of the report also state: “We have observed that investors who have tended to focus on the ‘E’ aspect of responsible investment are now shifting their attention to the ’S’. This observation is supported by the finding that investors feel they understand these two issues more than they comprehend the ‘G’ factor. 43% rate themselves as knowledgeable when it comes to the environmental and social dimensions of investing. This compares to 35% who feel the same way about governance concerns.”

Baby Boomers lack knowledge

Interesting to note also that Baby Boomers rank lowest in all categories.

> Refer to other articles on Human Rights and Human Rights Due Diligence on investESG.eu

Nordea’s message to financial advisors:

(1) The majority of clients trust their advisors and believe they know something about ESG.

(2) However, the clients still see great room for improvement and consider this to be the main barrier to investing more into ESG solutions.

(3) Advisors need to step up their game not only by improving their ESG know-how, but providing clients with simple messages and MiFID-eligible ESG solutions.

About the Survey

The Nordea ESG Survey 2021 gathered the views of 1,200 European individual investors on ESG and sustainable investing via an online survey conducted by CoreData Research between July and August 2021. Participants are classified into 4 different generations: Gen Z (age: 18-24), Millennials (25-40), Gen X (41-56), and Baby Boomers (57-75). They are also split into ESG users (currently investing in ESG, 43%) and ESG non-users (currently not investing in ESG, 57%). All individual investors interviewed currently use a financial adviser.

Link to the Report (Source: Nordea)

Additional note: Although the survey was conducted a few months ago most recent events and trends have supported a number of the findings of the report.

| investESG.eu is an independent and neutral platform dedicated to generating debate around ESG investing topics. All opinions expressed are those of the author or contributing source.